Last Update04 Aug 25Fair value Increased 9.26%

Despite a notable reduction in forecast revenue growth, improved net profit margins have supported an upward revision in Radico Khaitan's consensus analyst price target from ₹2807 to ₹2984.

What's in the News

- Launched The Spirit of Kashmyr, India's first homegrown luxury vodka, with a nationwide campaign and phased rollout across key states.

- Introduced Magic Moments Flavours of India, expanding the flavoured vodka range with Alphonso Mango and Thandaai, building on Magic Moments’ strong growth and market leadership.

- Announced Morpheus Super Premium Whisky, targeting the super premium segment and leveraging the success of Morpheus Brandy.

- Launched TRIKAL Indian Single Malt – Eternal Whisky, further expanding the luxury portfolio and emphasizing craftsmanship and Indian heritage.

- Declared an annual dividend of INR 4.00 per share; Board meeting scheduled to consider Q1 FY2026 results.

Valuation Changes

Summary of Valuation Changes for Radico Khaitan

- The Consensus Analyst Price Target has risen from ₹2807 to ₹2984.

- The Consensus Revenue Growth forecasts for Radico Khaitan has significantly fallen from 16.0% per annum to 14.1% per annum.

- The Net Profit Margin for Radico Khaitan has risen from 11.43% to 12.23%.

Key Takeaways

- Favorable regulatory shifts and capacity expansions are driving improved margins, increased operating leverage, and greater access to key markets.

- Strong growth in premium segments and dominant positioning in emerging categories support robust revenue gains and brand-driven profit expansion.

- Heavy reliance on the domestic market, volatile input costs, and concentrated brand portfolio expose the company to regulatory, margin, and growth risks.

Catalysts

About Radico Khaitan- Engages in the manufacture and trading of Indian made foreign liquor (IMFL) and country liquor in India, the United States, and internationally.

- The reduction in duty on bulk Scotch imports due to the U.K.-India FTA is set to significantly lower input costs over the next several years, leading to meaningful gross margin expansion and improved profitability.

- Rapid growth in the premium and luxury spirits segments, supported by new successful launches like Morpheus Super Premium Whisky, Royal Ranthambore, and The Spirit of Kashmyr, positions Radico Khaitan to capitalize on Indian consumers' increasing preference for premium branded beverages-driving higher revenue growth and sustained margin improvement.

- Structural modernization of state-level alcohol policies and improvements in distribution (especially in large markets like Andhra Pradesh and prospective openings in Bihar, Delhi, Tamil Nadu) are providing a friendlier regulatory environment and expanded addressable markets, setting the stage for outsized volume and earnings growth.

- Completion of major capacity expansions (Sitapur plant, increased single malt capacity) and efficiency initiatives are removing production constraints and increasing operating leverage, supporting both volume growth and net margin improvement as demand accelerates.

- The accelerating shift among younger Indian consumers toward aspirational, craft, and vodka categories-where Radico already has dominant market share-presents long-term opportunities for upscale product innovation and brand upgrades, which is likely to result in ongoing revenue and profit growth.

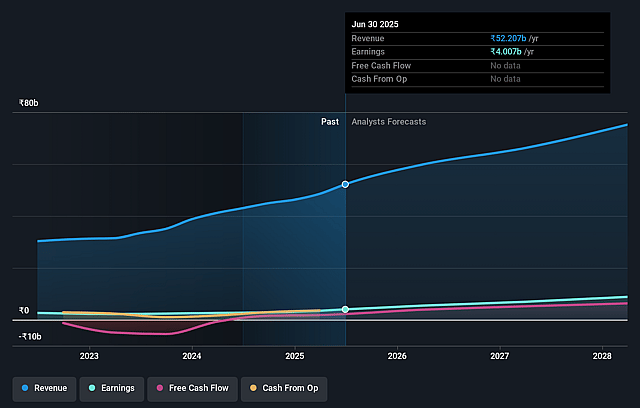

Radico Khaitan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Radico Khaitan's revenue will grow by 15.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.7% today to 11.7% in 3 years time.

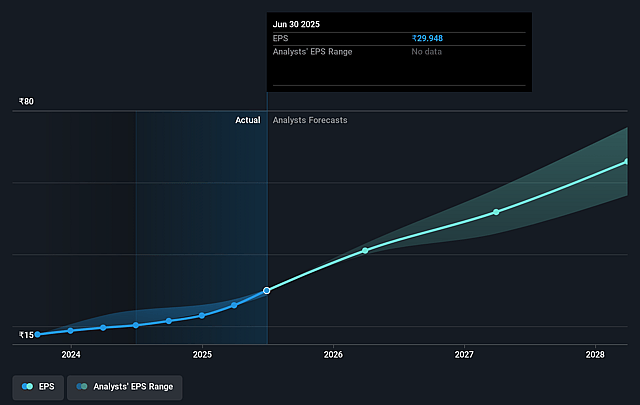

- Analysts expect earnings to reach ₹9.4 billion (and earnings per share of ₹62.32) by about August 2028, up from ₹4.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹7.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 62.6x on those 2028 earnings, down from 94.3x today. This future PE is greater than the current PE for the IN Beverage industry at 36.7x.

- Analysts expect the number of shares outstanding to grow by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Radico Khaitan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's high recent growth rates are partly attributable to base effects and state-specific regulatory changes (such as Andhra Pradesh reopening); once these normalize, organic growth could moderate, impacting future revenue and earnings momentum.

- Radico Khaitan's strategy remains highly concentrated in India with limited evidence of meaningful international expansion compared to larger global peers; this leaves earnings and revenue growth vulnerable to domestic regulatory shocks, market saturation, or economic downturns.

- Although management cites stable raw materials and input costs, the company remains structurally exposed to commodity volatility (such as grain prices); a reversal in the softening trend would erode gross and EBITDA margins, particularly given their ongoing commitments to marketing spend and premium brand launches.

- Reliance on a small handful of rapidly growing premium brands carries portfolio concentration risk; if consumer preferences shift or new entrants disrupt the market, Radico could experience both volume and margin headwinds, which would negatively affect top-line revenue and operating profit.

- Persistent regulatory unpredictability at the state level-including taxation changes in Maharashtra, potential future advertising bans, and overdue receivables from states such as Telangana-pose ongoing risks to cash flow, working capital management, and ultimately net margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹3066.538 for Radico Khaitan based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹3675.0, and the most bearish reporting a price target of just ₹2520.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹80.4 billion, earnings will come to ₹9.4 billion, and it would be trading on a PE ratio of 62.6x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹2823.9, the analyst price target of ₹3066.54 is 7.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.