Key Takeaways

- Expanded production, logistics, and product launches aim to capture new demand, enhance margins, and diversify earnings amid evolving consumer trends.

- Increased focus on modern retail, digital partnerships, and geographic expansion targets scalable growth and sustainable market share gains.

- Operational disruptions, limited product and regional diversification, and cost volatility are undermining Gopal Snacks' growth, margins, and ability to adapt to evolving consumer and channel trends.

Catalysts

About Gopal Snacks- Engages in the manufacture and market namkeen, gathiya, papad, and western snacks in India and internationally.

- Resolution of supply chain disruptions and commissioning of the new Modasa and Rajkot plants are expected to restore and expand production capacity, enabling Gopal Snacks to fully capture pent-up and future demand in both existing and new markets-directly supporting volume growth and topline revenue recovery.

- The company's increasing focus on modern retail and e-commerce partnerships, as well as brand-building initiatives, taps into India's digitally transforming retail landscape and growing demand for ready-to-eat foods, which should expand distribution channels and improve revenue scalability.

- Geographic expansion beyond core regions, supported by new distributor appointments and enhanced logistics, positions Gopal Snacks to benefit from rising consumption in urbanizing and non-Gujarat markets, driving sustainable long-term market share gains and revenue growth.

- Upcoming product launches, including recent entries into popcorn, wafer biscuits, and soon bakery items, show a shift towards higher-margin and health-oriented categories-a response that can improve blended gross margins and diversify earnings streams amid evolving consumer preferences.

- Investments in automation, supply chain efficiencies, and biweekly distributor servicing are set to structurally lower per-unit costs and improve service levels, supporting EBITDA margin recovery and net earnings as manufacturing operations normalize.

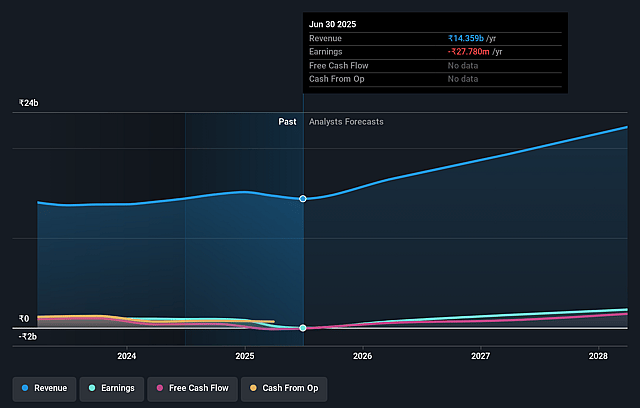

Gopal Snacks Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gopal Snacks's revenue will grow by 17.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.2% today to 11.5% in 3 years time.

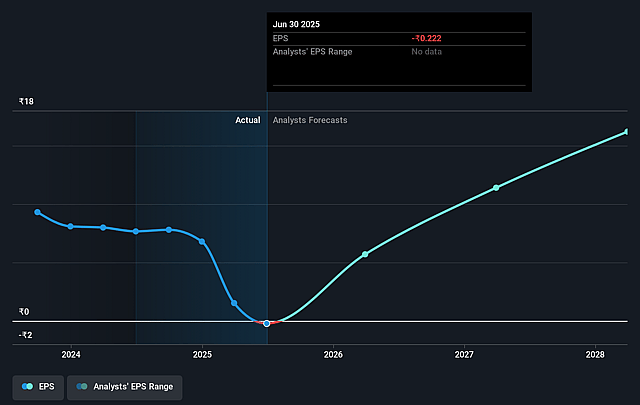

- Analysts expect earnings to reach ₹2.7 billion (and earnings per share of ₹14.99) by about September 2028, up from ₹-27.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.0x on those 2028 earnings, up from -1727.4x today. This future PE is greater than the current PE for the IN Food industry at 22.6x.

- Analysts expect the number of shares outstanding to grow by 1.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Gopal Snacks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing supply chain and plant disruption, including delayed commissioning of the Modasa and Rajkot facilities, has led to revenue shortfalls, reduced product availability, lost market share in key regions, and difficulty meeting prior growth guidance, all of which may suppress future revenue recovery and top-line growth.

- Gopal Snacks' profitability remains sensitive to raw material cost volatility (notably palm oil and packaging materials) and to regulatory actions such as new customs duties on palm oil, which have compressed gross margins and could continue to pressure net margins and earnings as these costs may not be fully passed to consumers.

- Heavy concentration of sales and operations in a few regions (notably Gujarat and select parts of central/western India), combined with execution challenges in new geographies (like Nagpur's underutilized facility and distributor attrition in MP/UP), increases vulnerability to regional economic slowdown and constrains diversified revenue growth.

- A limited and slow-to-diversify product portfolio (with some key products missing from production post-fire and delayed ramp-up of new introductions) exposes the company to risks from shifting consumer preferences towards healthier or innovative snacks, potentially weakening revenue growth and eroding pricing power.

- Despite growing digital and modern trade sales, challenges in adapting supply chains and order fulfillment to fragmented e-commerce and direct-to-consumer models, along with operational hiccups in scaling up new channels, may slow market share gains and constrain revenue and margin expansion in a rapidly evolving packaged food industry.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹550.0 for Gopal Snacks based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹23.3 billion, earnings will come to ₹2.7 billion, and it would be trading on a PE ratio of 38.0x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹385.05, the analyst price target of ₹550.0 is 30.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.