Last Update 06 Sep 25

Fair value Decreased 15%Expansion Into Exports And Quick Commerce Will Boost Future Prospects

The consensus analyst price target for Prataap Snacks has been revised downward to ₹960.00, primarily reflecting reduced expectations for both revenue growth and net profit margins.

What's in the News

- Declared a reduced annual dividend of INR 0.50 per equity share for FY ended March 31, 2025.

- Approved alterations to the Memorandum and Articles of Association, adopting a new set under the Companies Act, 2013.

- Scheduled a Board Meeting to consider unaudited financial results for the quarter ended June 30, 2025.

Valuation Changes

Summary of Valuation Changes for Prataap Snacks

- The Consensus Analyst Price Target has significantly fallen from ₹1135 to ₹960.00.

- The Consensus Revenue Growth forecasts for Prataap Snacks has significantly fallen from 10.2% per annum to 7.5% per annum.

- The Net Profit Margin for Prataap Snacks has significantly fallen from 6.28% to 5.35%.

Key Takeaways

- Strategic focus on premiumization, exports, and quick commerce channels aims to boost revenue and diversify growth avenues.

- Cost-reduction and operational efficiency measures target margin stabilization and earnings improvement.

- Inflation and input cost pressures, alongside strategic and structural changes, are challenging Prataap Snacks' financial stability and consistent growth prospects.

Catalysts

About Prataap Snacks- Engages in the manufacture and sale of packaged snacks in India and internationally.

- Prataap Snacks plans to shift towards higher price points by enhancing the contribution of large packs, focusing on premiumization and new product development. This strategic shift is expected to drive sustainable structural growth and impact revenue positively.

- The company is targeting exports as a growth avenue, having initiated shipments and participated in international trade fairs. This expansion into global markets is intended to enhance the revenue mix and boost earnings.

- Prataap Snacks has entered the quick commerce platform, observing positive initial sales and planning further expansion. This channel is aimed at increasing revenue by tapping into high-growth and modern trade sectors.

- The company is implementing cost-reduction measures such as process optimization and facility integration to offset input cost pressures. These efforts are expected to stabilize or improve net margins over time.

- Prataap Snacks is enhancing operational efficiencies through sales force automation and distribution network optimization. These initiatives are likely to decrease costs and potentially improve earnings.

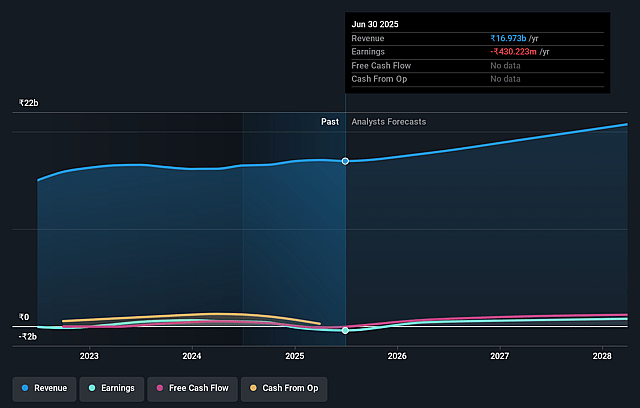

Prataap Snacks Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Prataap Snacks's revenue will grow by 10.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.5% today to 6.3% in 3 years time.

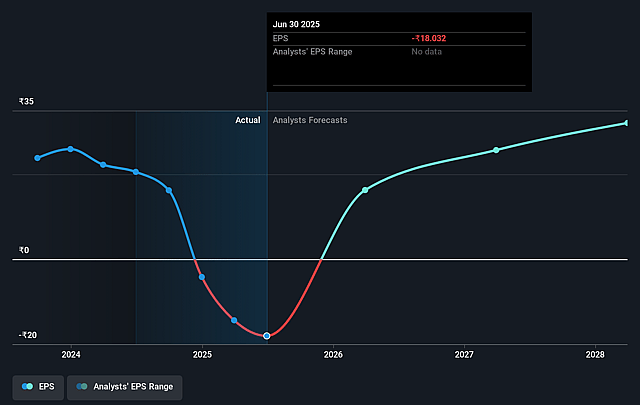

- Analysts expect earnings to reach ₹1.4 billion (and earnings per share of ₹32.41) by about September 2028, up from ₹-430.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.2x on those 2028 earnings, up from -54.8x today. This future PE is greater than the current PE for the IN Food industry at 22.1x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Prataap Snacks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's revenue growth is modest, with only a 2% year-on-year increase, potentially affected by inflationary pressures on ₹5 packs, which represent a significant portion of sales. [Revenue]

- Input cost pressures, especially from potatoes, wheat, gram, and the anticipated firming of palm oil prices, have led to significant reductions in EBITDA from ₹38 crores to ₹19.2 crores, negatively impacting EBITDA margin from 8.8% to 4.3%. [Net Margins]

- There are concerns about the cost benefits from shifting to a direct distribution model, as regional disruptions and adjustments in trade margins may impact revenue and market reach. [Revenue]

- Seasonality impacts, particularly during the potato offseason in Q3, could lead to fluctuations in sales performance, affecting consistent annual earnings. [Earnings]

- The exit of a key private equity partner and the introduction of new stakeholders may lead to strategic shifts that could delay or alter company growth initiatives, potentially affecting long-term financial stability. [Earnings]

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1135.0 for Prataap Snacks based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1310.0, and the most bearish reporting a price target of just ₹960.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹22.7 billion, earnings will come to ₹1.4 billion, and it would be trading on a PE ratio of 26.2x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹986.25, the analyst price target of ₹1135.0 is 13.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.