Key Takeaways

- Focus on premium and digital-first products, expanded distribution, and automation is set to drive efficient growth and capture evolving consumer trends.

- Diversifying beyond core segments and regions will stabilize revenue, reduce commodity dependence, and yield more consistent, higher-quality earnings.

- Margin and profit growth are threatened by volatile input costs, tough competition, shifting consumer trends, and persistent regulatory and international business risks.

Catalysts

About Marico- Manufactures and sells consumer products in India.

- Acceleration in premium Foods, Digital-first Personal Care, and value-added hair oils is expected to drive sustained double-digit revenue growth as consumer demand shifts toward health, nutrition, and natural/functional products; this aligns with structural trends like rising disposable incomes, increased wellness focus, and rapid e-commerce adoption in India and key international markets.

- Aggressive rural and urban direct distribution expansion (Project SETU) and increased penetration in under-indexed geographies are poised to boost volumes and support market share gains, especially as organized/branded goods replace local competitors—impacting future revenue growth positively.

- Rapid scale-up of digital channels (including quick commerce), digital-first brands, and supply chain automation are expected to enhance distribution efficiency, capture emerging demand in Tier-2/3 cities, and deliver ongoing improvements in operating margins and overall profitability.

- Sustained premiumization of the portfolio, margin expansion in Foods (gross margins up 1000 bps FY24–FY25), and focus on scale and profitability for Digital-first businesses will diversify earnings, reduce exposure to commodity price swings (e.g., copra), and systematically improve net margins.

- Robust international growth (double-digit constant currency performance), premium portfolio expansion in South Asia/MENA/Africa, and continued diversification away from the Parachute coconut oil segment are set to stabilize revenue streams and support higher-quality, less volatile earnings long-term.

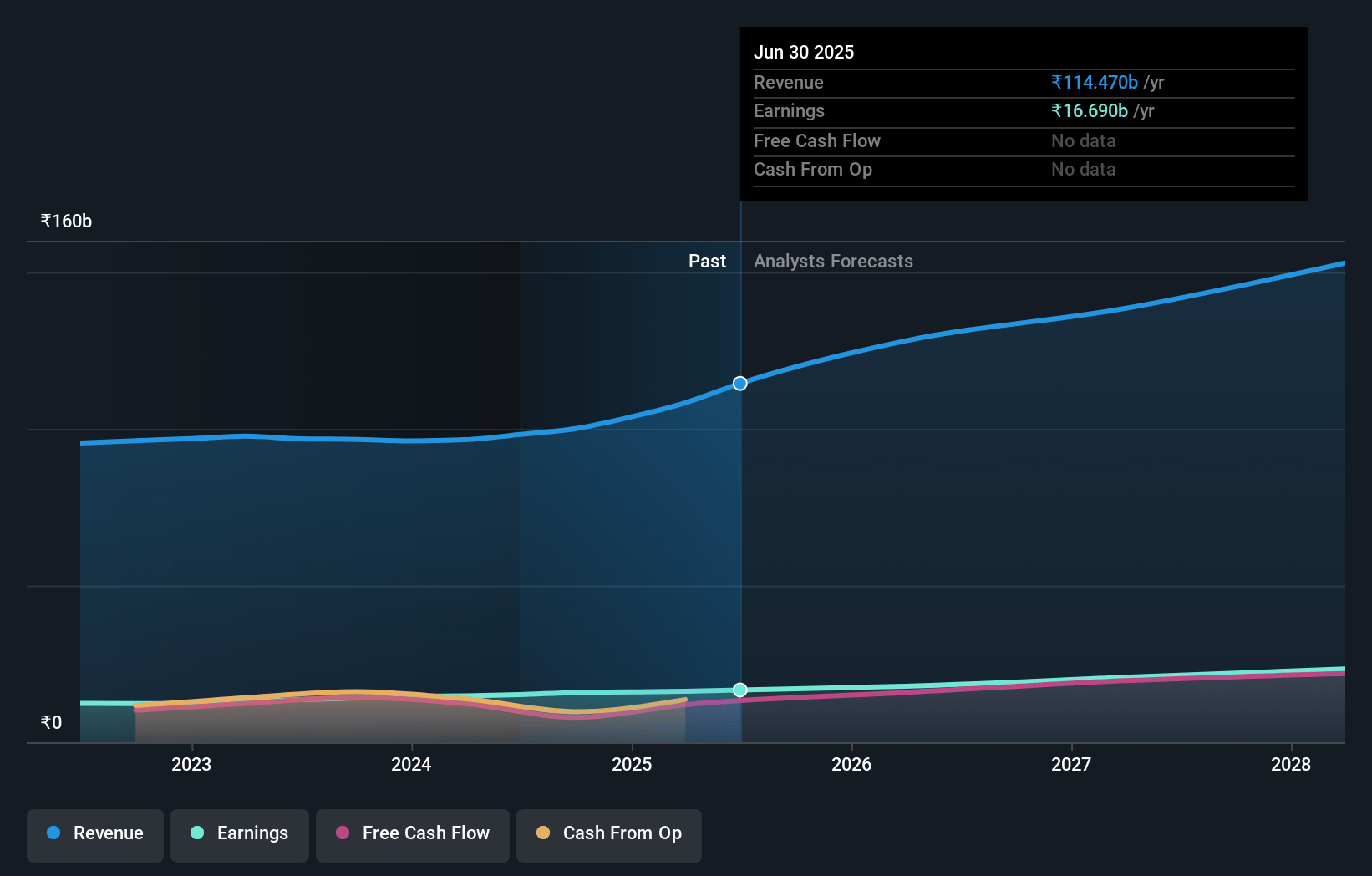

Marico Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Marico's revenue will grow by 10.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.0% today to 15.4% in 3 years time.

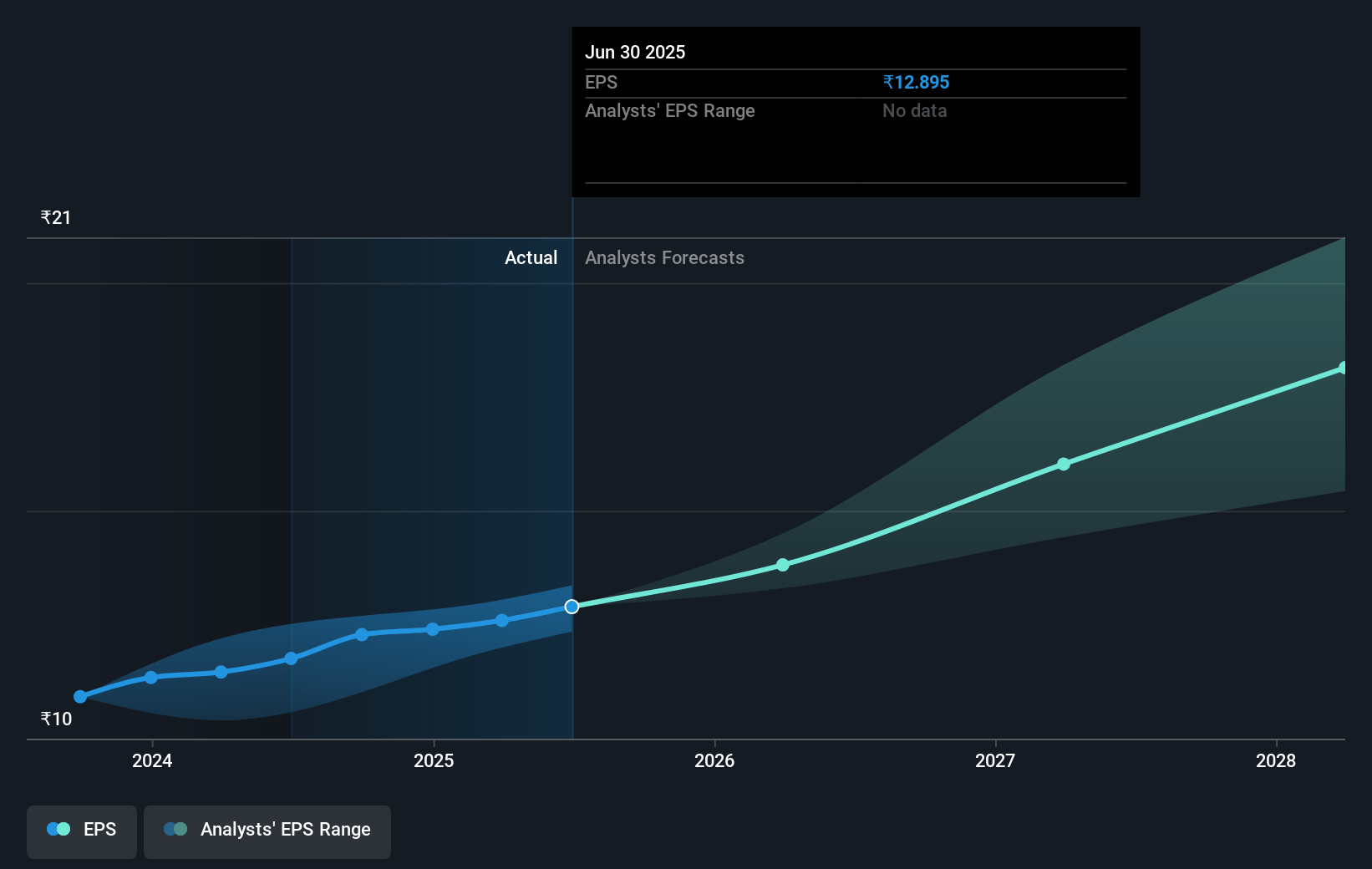

- Analysts expect earnings to reach ₹22.6 billion (and earnings per share of ₹17.58) by about July 2028, up from ₹16.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 63.4x on those 2028 earnings, up from 58.2x today. This future PE is greater than the current PE for the IN Food industry at 21.8x.

- Analysts expect the number of shares outstanding to grow by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.55%, as per the Simply Wall St company report.

Marico Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Marico’s core categories, notably Parachute coconut oil and Saffola edible oil, remain exposed to prolonged commodity price volatility (e.g., copra and edible oils), which could compress gross margins and destabilize earnings if cost inflation continues or price hikes eventually suppress demand, impacting margin resilience and long-term profit growth.

- The company's increasing reliance on new and premium product segments (such as Digital-first brands, Foods, and premium personal care) faces the risk that growth may moderate once low-hanging distribution or innovation-driven gains are exhausted, while persistent high A&P spend required to scale these categories may weigh on net margins if profitable scale fails to materialize as planned.

- Intensifying competition from unorganized, regional, and D2C brands in India—along with evolving consumer preferences toward minimally processed or local/home-made products—could erode Marico’s volume growth and market share in key categories, especially if its innovations or distribution upgrades lag, impacting sustainable top-line expansion.

- International business diversification, while currently driving growth, remains vulnerable to macroeconomic and currency shocks in key markets like Bangladesh, MENA, and Vietnam; underperformance or growth stagnation in these regions could stall consolidated revenue growth and reduce the anticipated earnings contribution from overseas operations.

- Despite management’s focus on supply chain optimization and premiumization, long-term risks from regulatory changes (in food safety, labeling, packaging, and ESG compliance) persist and could result in higher compliance costs, potential product reformulation expenses, or reputational risks, thereby constraining future net margins and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹767.513 for Marico based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹850.0, and the most bearish reporting a price target of just ₹505.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹146.6 billion, earnings will come to ₹22.6 billion, and it would be trading on a PE ratio of 63.4x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹731.35, the analyst price target of ₹767.51 is 4.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.