Narratives are currently in beta

Key Takeaways

- Completion of refinery upgrades and new capacity projects is set to enhance refining margins and revenue through higher distillate yields and petrochemical products.

- Strategic expansion into energy diversification and value optimization in lubricants could boost future net income and margins significantly.

- Suppressed marketing margins, inventory losses, increased debt, and project delays challenge Hindustan Petroleum's profitability, financial resources, and future revenue growth.

Catalysts

About Hindustan Petroleum- Engages in the refining and marketing of petroleum products in India and internationally.

- The commissioning of HPCL's Vizag Refinery modernization unit, including the Residue Upgradation Facility, is expected by Q4 FY 2024. This will result in higher distillate yields, improving refining margins and enhancing revenue and net income in future quarters.

- The construction of the Rajasthan Refinery is progressing well, with key units nearing completion. Once operational, the refinery will significantly increase throughput capacity, contributing to revenue growth and potentially improving overall earnings by tapping into higher-value petrochemical products.

- HPCL is actively pursuing value unlocking in its lubricant business by enhancing supply chain efficiencies, cost optimization, and customer engagement. This could improve net margins and earnings, especially once the planned carve-out is executed, subject to government approval.

- The establishment of the Chhara LNG Terminal and plans for enhanced LNG marketing through HP's gas distribution networks will bolster HPCL's energy portfolio, potentially increasing revenue streams and contributing positively to net margins through diversified energy offerings.

- The development of green energy initiatives, including the commissioning of a green hydrogen plant and new renewable energy projects, positions HPCL to benefit from government-green energy incentives and to diversify future revenue streams, positively impacting net income and margins in the long term.

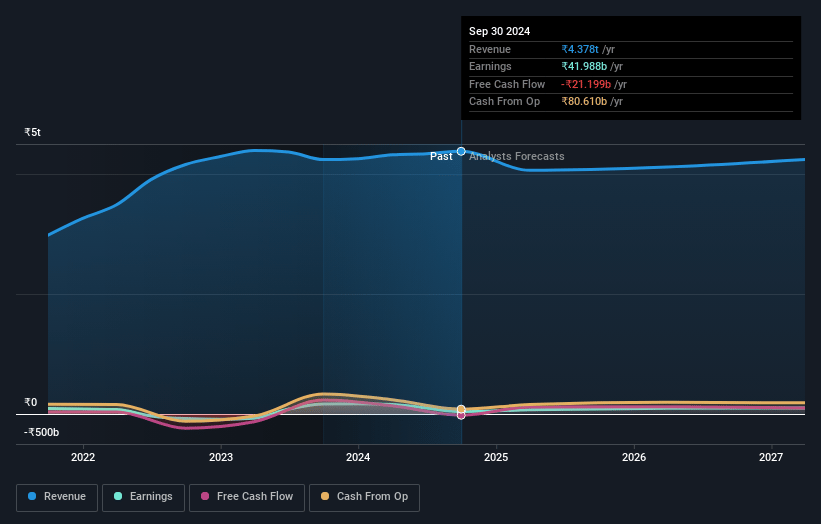

Hindustan Petroleum Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hindustan Petroleum's revenue will decrease by -1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.0% today to 3.1% in 3 years time.

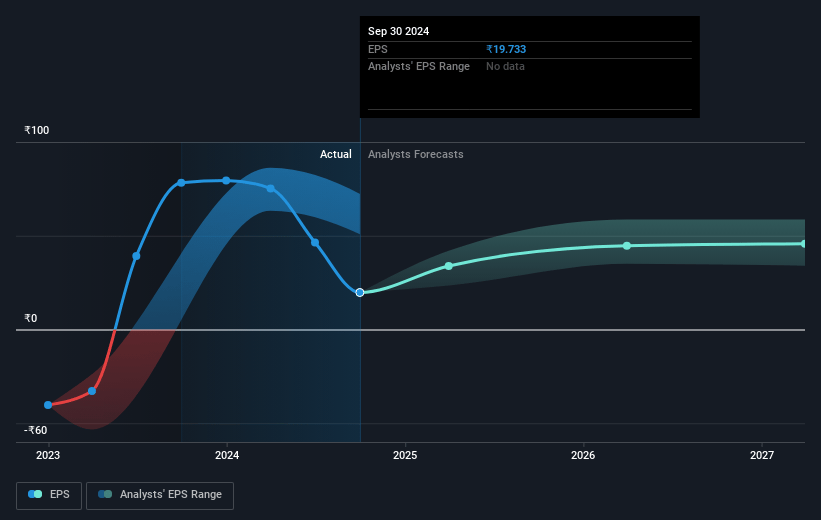

- Analysts expect earnings to reach ₹127.8 billion (and earnings per share of ₹45.78) by about January 2028, up from ₹42.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹72.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.5x on those 2028 earnings, down from 20.9x today. This future PE is greater than the current PE for the IN Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to grow by 9.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.5%, as per the Simply Wall St company report.

Hindustan Petroleum Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces suppressed marketing margins on select petroleum products and significant under-recoveries, particularly with LPG, leading to notable impacts on profit after tax (PAT) and the company’s financial standing.

- Reduced refining margins due to lower benchmark product cracks and decreasing international crude prices have been affecting Hindustan Petroleum’s gross refining margin (GRM), thereby impacting its profitability.

- Inventory losses resulting from declining crude prices have contributed to substantial financial hits, decreasing the company's earnings from both refining and marketing divisions.

- Increased net debt due to factors like high subsidies receivable and inventory spikes pressures the company's financial resources and could affect future net margins and capital utilization.

- Delays in major project completions such as the Rajasthan refinery and cost escalations present execution risks, potentially affecting future revenue growth and earnings stabilization.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹390.2 for Hindustan Petroleum based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹558.0, and the most bearish reporting a price target of just ₹196.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹4144.9 billion, earnings will come to ₹127.8 billion, and it would be trading on a PE ratio of 13.5x, assuming you use a discount rate of 16.5%.

- Given the current share price of ₹412.35, the analyst's price target of ₹390.2 is 5.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives