Key Takeaways

- Strategic fleet management and potential in-chartering could enhance margins without significant capital expenditures amidst tight market conditions.

- Favorable asset pricing and fleet expansion strategy position the company for future revenue and profitability growth during market upturns.

- Declines in asset values and subdued market demand pose significant risks to Great Eastern Shipping's profitability and revenue growth across key sectors.

Catalysts

About Great Eastern Shipping- Through its subsidiaries, engages in the shipping and offshore businesses in India and internationally.

- The large upcoming order book set for 2027 suggests that fleet expansion will not significantly impact supply in 2025 and 2026, potentially leading to tighter market conditions if vehicle demand increases. This could improve freight rates and revenue during this period.

- Current asset values remain high, potentially indicating that if asset prices correct further, Great Eastern Shipping could expand its fleet at more favorable prices, setting the stage for future earnings growth once market conditions improve.

- Due to the tight market environment, there is potential for increased in-charter activity, allowing Great Eastern Shipping to optimize its fleet management without significant capital expenditures, potentially impacting margins positively in the short term.

- Ongoing sanctions and geopolitical uncertainties could lead to tighter supply of shipping vessels, positively affecting freight rates and net margins as market dynamics leverage Great Eastern's operational capacity and strategic positioning.

- The company's focus on asset valuation and strategic fleet expansion during periods of lower asset prices positions it for enhanced revenue and profitability during subsequent market upturns, utilizing its net cash position and financial flexibility to make timely acquisitions.

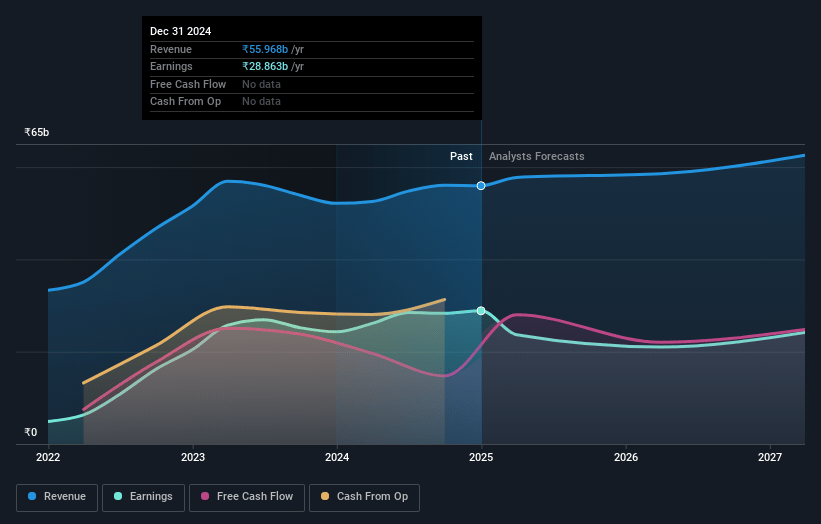

Great Eastern Shipping Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Great Eastern Shipping's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 51.6% today to 34.0% in 3 years time.

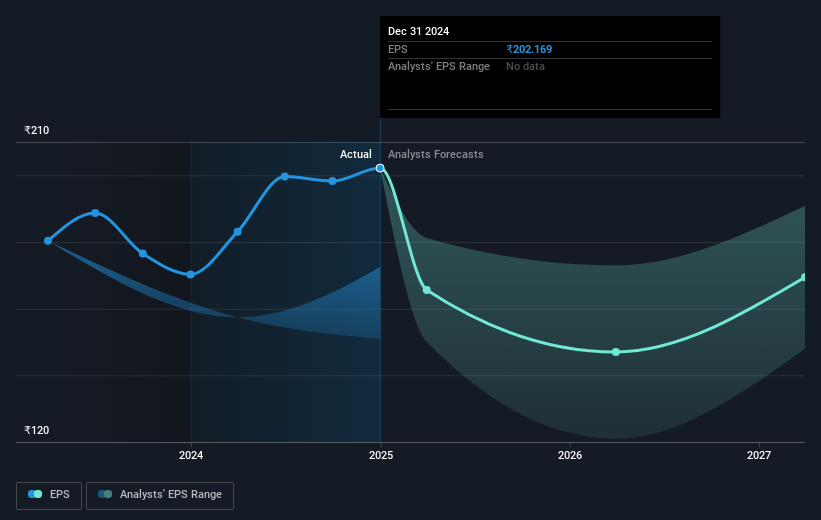

- Analysts expect earnings to reach ₹21.9 billion (and earnings per share of ₹153.28) by about February 2028, down from ₹28.9 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹27.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, up from 4.4x today. This future PE is lower than the current PE for the IN Oil and Gas industry at 20.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.51%, as per the Simply Wall St company report.

Great Eastern Shipping Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The drop in fleet value, with a reported decline of $150 million, could indicate challenges in maintaining asset values and impact net asset value and future earnings.

- Asset prices, particularly for product tankers, have dropped significantly, which could affect profitability if the decline persists, impacting earnings and net margins.

- The tanker markets were disappointing and subdued over the winter, with weak oil demand and lower refinery throughputs, potentially reducing revenue from shipping operations.

- The aging fleet and minimal scrapping contribute to an oversupply risk, potentially pressuring future freight rates and leading to lower revenue and profit margins.

- The lack of growth in sectors such as iron ore and coal trades due to low demand, alongside challenges in the Chinese market, could negatively impact revenue from dry bulk shipping.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1477.5 for Great Eastern Shipping based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹64.3 billion, earnings will come to ₹21.9 billion, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 14.5%.

- Given the current share price of ₹883.4, the analyst price target of ₹1477.5 is 40.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives