Narratives are currently in beta

Key Takeaways

- Resolving stressed assets and securing international financing position Power Finance for improved net margins and global revenue growth.

- New subsidiary operations and transformation strategy enhance growth opportunities, boosting potential earnings and optimizing business processes.

- Heavy reliance on state sectors and fixed-rate liabilities poses risks to cash flow, asset quality, and margins, while cautious expansion may hinder growth.

Catalysts

About Power Finance- A non-banking finance company, engages in the provision of financial products and related advisory, and other services to the power, logistics, and infrastructure sectors in India.

- The company has made significant progress in resolving stressed assets, reducing the gross NPA ratio to below 3%, and maintaining strong provisioning on Stage 3 assets, indicating potential future improvement in net margins and profitability.

- The successful execution of a landmark USD 1.265 billion foreign currency term loan deal showcases the company's ability to secure large-scale international financing, positioning it for future revenue growth through expanded global operations and lower cost of funds.

- The establishment and operational commencement of the subsidiary PFC Infra Finance IFSC Limited in GIFT City, Gujarat, provides new opportunities for growth by offering foreign currency loans, benefiting from tax incentives, and potentially enhancing net earnings.

- The implementation of a BCG-recommended transformation strategy for improving business processes is expected to optimize operations, facilitating higher future disbursements and subsequently increasing revenue and earnings.

- Continued recovery and resolution of large-scale projects like Lanco Amarkantak and upcoming resolution of projects like KSK Mahanadi, wherein the company expects to achieve substantial recoveries, are poised to have positive impacts on their balance sheet, possibly boosting EPS and net margins through write-backs.

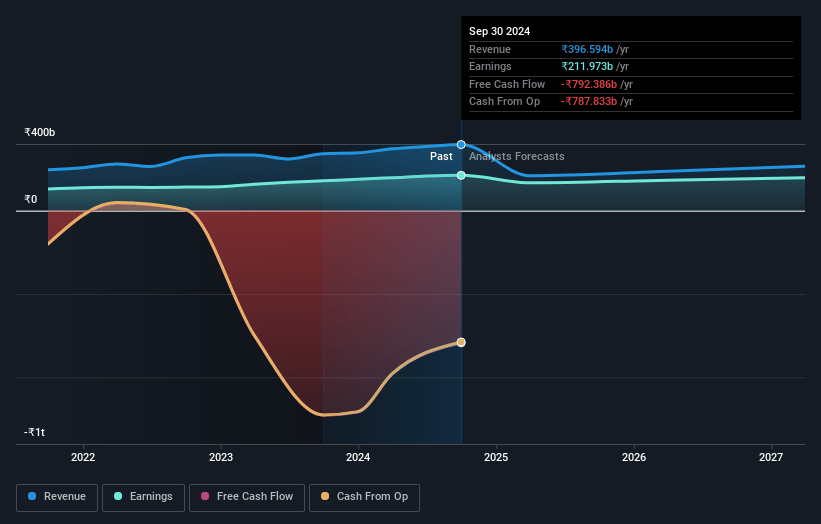

Power Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Power Finance's revenue will decrease by -17.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 53.4% today to 86.3% in 3 years time.

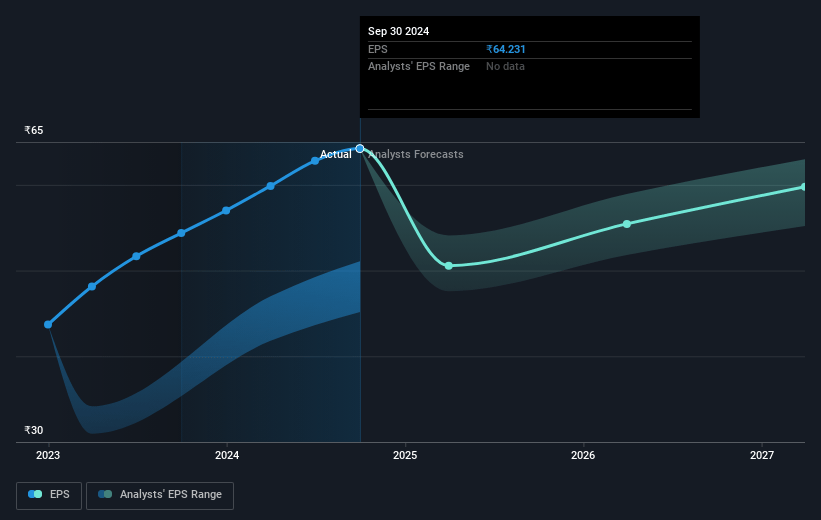

- Analysts expect earnings to reach ₹192.3 billion (and earnings per share of ₹59.83) by about January 2028, down from ₹212.0 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹214.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.1x on those 2028 earnings, up from 6.2x today. This future PE is lower than the current PE for the IN Diversified Financial industry at 25.2x.

- Analysts expect the number of shares outstanding to decline by 0.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.95%, as per the Simply Wall St company report.

Power Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on state sectors, which constitutes about 80% of PFC's book, poses a risk in asset quality as delays in state payments, although usually resolved, could impact cash flow consistency and revenue projections.

- The cautious approach in expanding into the infrastructure sector, potentially due to lack of experience, may slow down diversification and hamper revenue growth if not navigated efficiently.

- The current capital adequacy is influenced by lower risk weight assignments due to guaranteed loans; with expected higher risk-weight assets in the future, there could be capital strain potentially affecting future earnings and business expansion.

- Uncertainty around NCLT approvals for asset resolutions, despite high provisioning, can create unpredictability in financial recoveries impacting perceived asset quality and profit margins.

- Heavy reliance on fixed-rate liabilities (about 73% of borrowing) against predominantly floating-rate assets (95%), in a declining interest rate environment, may compress net interest margins and reduce future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹609.09 for Power Finance based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹680.0, and the most bearish reporting a price target of just ₹550.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹222.9 billion, earnings will come to ₹192.3 billion, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 13.9%.

- Given the current share price of ₹399.1, the analyst's price target of ₹609.09 is 34.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives