Last Update01 May 25Fair value Increased 0.12%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Government initiatives and new affordable housing products are expected to boost demand and growth, positively affecting revenue and margins.

- Efforts to improve asset quality and planned forays into affordable housing should lead to lower credit costs and diversified long-term AUM growth.

- Slowing growth and increased costs could challenge revenue expansion, while operational challenges and competitive pressures may impact margins and loan book stability.

Catalysts

About LIC Housing Finance- A housing finance company, provides loans for the purchase, construction, repair, and renovation of houses/buildings in India.

- The ongoing government initiatives such as tax reliefs and liquidity easing measures by the RBI are expected to improve purchasing power for the middle class, which could significantly boost the demand for housing finance, positively impacting revenue growth.

- The launch of a new affordable housing finance product priced 250-300 basis points higher than traditional mortgages is anticipated to drive growth and improve margins due to its higher pricing structure.

- The resolution of external issues impacting major centers like Bangalore and Hyderabad, which are significant contributors to the loan book, is expected to lead to a backlog clearance and increased disbursements in the upcoming quarters. This would positively influence earnings growth.

- The company’s efforts to improve asset quality, demonstrated by a decrease in Stage 3 exposure from 4.26% to 2.75%, and anticipation of further reductions, should lead to lower credit costs and improve net margins.

- Planned forays into affordable housing, supported by existing extensive branch infrastructure and brand strength, are expected to contribute to long-term AUM growth and diversify revenue streams, potentially improving margins due to competitive interest rates in this segment.

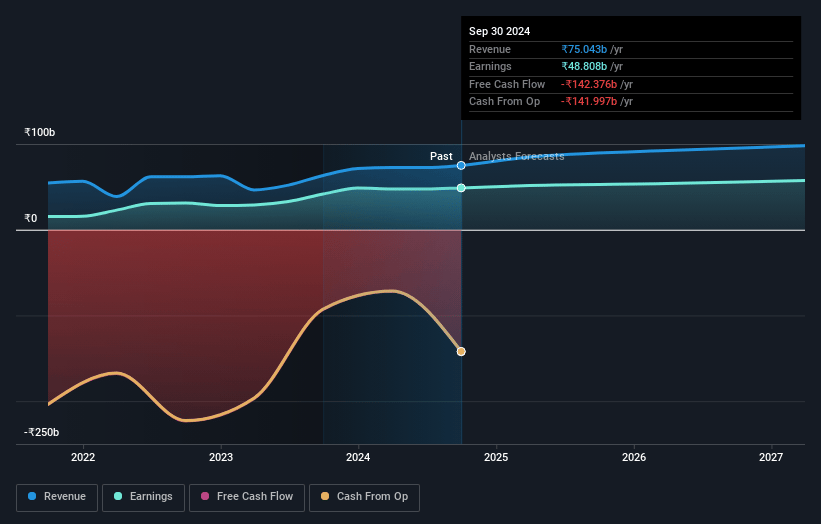

LIC Housing Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LIC Housing Finance's revenue will grow by 6.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 64.8% today to 57.5% in 3 years time.

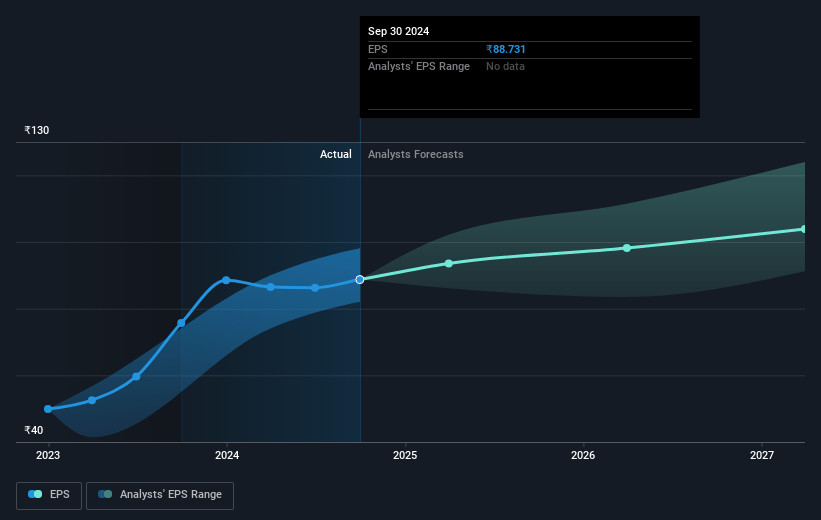

- Analysts expect earnings to reach ₹55.9 billion (and earnings per share of ₹100.12) by about May 2028, up from ₹51.5 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹66.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, up from 6.4x today. This future PE is lower than the current PE for the IN Diversified Financial industry at 26.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.09%, as per the Simply Wall St company report.

LIC Housing Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Concerns over slowing growth are evident, given the 6% AUM growth year-on-year, which is below the initial 10% expectation. This could signal challenges in revenue expansion.

- There is an increase in the cost of funds due to tight liquidity and rising benchmark rates, which could impact net interest margins if not managed through proper repricing.

- Disbursements were affected in key centers like Bangalore and Hyderabad due to external regulatory and technical issues, which delayed expected revenue from these regions.

- The entry into the affordable housing market is expected to be operationally intensive and may lead to increased costs, impacting operating expenses and potentially squeezing net margins initially.

- Despite volatile interest rate environments, existing loan repricing could lag due to internal cost metrics, raising the risk of balance transfers to competitors and impacting loan book stability and revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹684.107 for LIC Housing Finance based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹940.0, and the most bearish reporting a price target of just ₹435.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹97.2 billion, earnings will come to ₹55.9 billion, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₹600.95, the analyst price target of ₹684.11 is 12.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.