Last Update 05 Sep 25

With both the Future P/E and Discount Rate remaining effectively unchanged, the consensus analyst price target for India Shelter Finance was maintained at ₹1072.

What's in the News

- Board meeting scheduled to consider and approve unaudited financial results for the quarter ended June 30, 2025, along with the Limited Review Report.

- Board will discuss and potentially approve raising funds via issuance of Non-Convertible Debentures, in one or more tranches/issues/series, as required for business needs.

Valuation Changes

Summary of Valuation Changes for India Shelter Finance

- The Consensus Analyst Price Target remained effectively unchanged, at ₹1072.

- The Future P/E for India Shelter Finance remained effectively unchanged, moving only marginally from 23.29x to 23.04x.

- The Discount Rate for India Shelter Finance remained effectively unchanged, moving only marginally from 14.42% to 14.36%.

Key Takeaways

- Expansion into underserved regions and technology adoption are expected to drive sustained loan growth, revenue, and improved cost efficiencies.

- Strong government support and prudent risk management should result in stable growth, lower credit costs, and resilience in earnings.

- Rising asset quality concerns, macroeconomic headwinds, competitive pressure, and higher costs threaten India Shelter Finance's long-term growth, profitability, and margin expansion.

Catalysts

About India Shelter Finance- Operates as a housing finance company in India.

- The ongoing expansion of India Shelter Finance into new geographies, especially underserved Tier II/III/IV cities through aggressive branch additions (24 branches in Q1, targeting 40-45 for FY26), is likely to drive robust loan growth and higher revenue over the next several years as urbanization and formal housing demand rise.

- The company's acceleration of technology initiatives-such as Aadhaar-based digital KYC, machine learning-driven underwriting, and strengthened digital collections-should structurally lower customer acquisition and servicing costs while improving risk assessment, thereby supporting improved net margins and long-term operating leverage.

- Easing inflation and a supportive monetary policy environment (as reflected by declining cost of funds with an expected further 20bps reduction), combined with a high proportion of fixed/semi-fixed rate assets, should help maintain or slightly expand lending spreads and protect NIMs in the near-to-medium term.

- Continued strong government tailwinds through policies like PMAY-CLSS and targeted affordable housing subsidies are rapidly increasing eligibility and uptake among India Shelter's targeted customer base, which points to an ongoing upward trajectory in disbursements and long-term revenue growth.

- The company's focus on self-employed, lower

- and middle-income housing finance with conservative LTVs and strong collateral, alongside improved data-driven risk controls, positions the portfolio for structurally lower long-term credit costs and more stable earnings growth, despite short-term upticks in delinquencies.

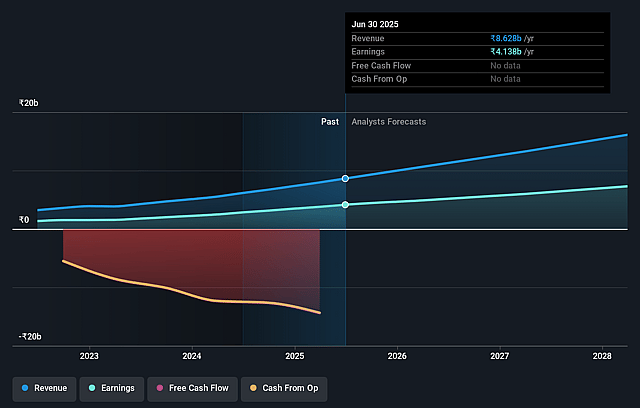

India Shelter Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming India Shelter Finance's revenue will grow by 25.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 48.0% today to 44.5% in 3 years time.

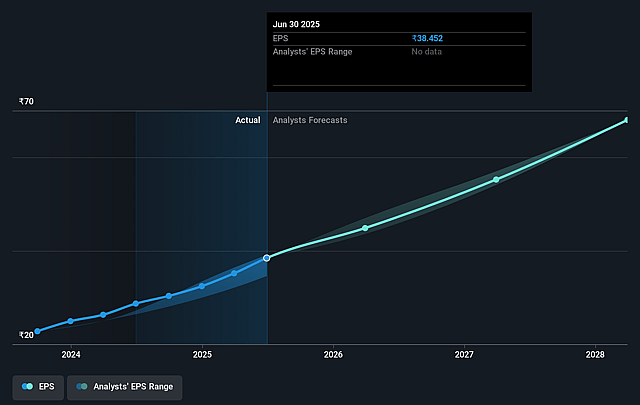

- Analysts expect earnings to reach ₹7.6 billion (and earnings per share of ₹64.79) by about September 2028, up from ₹4.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.3x on those 2028 earnings, down from 23.6x today. This future PE is lower than the current PE for the IN Diversified Financial industry at 23.5x.

- Analysts expect the number of shares outstanding to grow by 0.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.42%, as per the Simply Wall St company report.

India Shelter Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rise in early delinquencies (30+ DPD bucket increasing to ~4.5% from 2.5% over three years), along with persistent asset quality stress in key geographies like MP and Karnataka, suggests underlying borrower fragility in the affordable housing and LAP segments, which could lead to higher credit costs and negatively impact long-term earnings.

- Macro headwinds-including soft consumer demand, subdued wage growth in urban areas, and slow recovery in urban consumption-create risks of slower loan growth, weaker borrower profiles, and potential downward pressure on AUM and revenue growth.

- High exposure to self-employed, MSME, and LAP borrowers with multiple loans-segments highly sensitive to economic downturns-raises the risk of elevated defaults during adverse cycles, resulting in potential net margin compression and volatility in profitability.

- There are signs of intensifying competition and elevated attrition in frontline sales, as well as commentary around potential deterioration in industry-wide underwriting standards; these factors may force India Shelter Finance to either accept higher risk to maintain growth or compress NIMs to defend market share, putting long-term revenue and margin expansion at risk.

- Despite increased technology-driven processes, India Shelter's cost-to-assets ratio remains higher than peers, and while operational leverage is improving, the slower pace of cost reduction could limit further ROE expansion and constrain net profitability improvement over the medium-to-long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1072.2 for India Shelter Finance based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹17.1 billion, earnings will come to ₹7.6 billion, and it would be trading on a PE ratio of 23.3x, assuming you use a discount rate of 14.4%.

- Given the current share price of ₹900.95, the analyst price target of ₹1072.2 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.