Key Takeaways

- Bond market expansion and regulatory changes are set to boost ICRA's revenue stability and broaden its market opportunities.

- Investments in technology, partnerships, and specialized ratings strengthen ICRA's operational efficiency and position it for high-margin, data-driven growth.

- Narrow growth paths, client concentration, and structural threats from automation and pricing pressures could constrain ICRA's revenue diversification, profitability, and long-term earnings growth.

Catalysts

About ICRA- Operates as an independent and professional investment information, and credit rating agency in India and internationally.

- The expected acceleration in India's financial inclusion and formalization, combined with increased regulatory emphasis on credit transparency (SEBI/RBI mandates and risk assessment standards), is likely to expand ICRA's ratings volume and ensure more stable, recurring revenues as the diversity of rated borrowers increases.

- The long-term expansion of India's bond and debt markets, supported by ongoing infrastructure funding and regulatory nudges for large corporates to raise a higher share of their funding from debt capital markets, is set to increase ICRA's addressable market, benefitting revenue and potential market share gains.

- Sustained investments in technology, analytics, and automation are starting to enhance operational efficiency, lower unit costs, and allow ICRA to maintain high profitability even amidst margin pressures, pointing to further margin expansion driven by operating leverage.

- Product innovation and strategic alliances (such as partnerships with BitSight for cyber risk and FTSE-Russell for index solutions) are broadening ICRA's analytics and research offerings, positioning the company to benefit from secular shifts toward digitized, data-driven financial services and bespoke risk solutions, which could support higher-margin revenue growth.

- The creation and licensing of ICRA ESG, as well as increased demand for specialized ratings (ESG, structured finance, stress testing), indicate a forward opportunity to capture new, higher-value fee streams amid rising global investor and regulatory demand for advanced and niche risk assessments, positively impacting topline growth and earnings quality.

ICRA Future Earnings and Revenue Growth

Assumptions

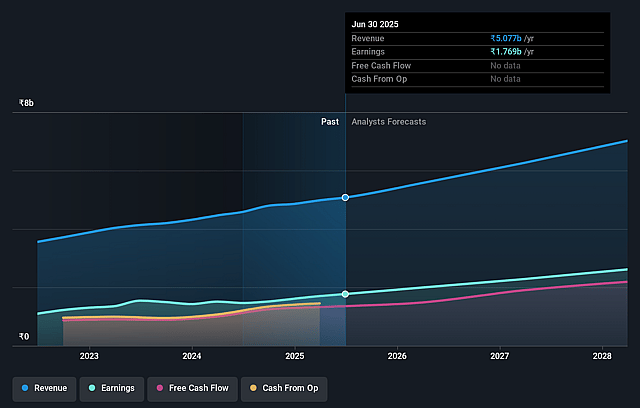

How have these above catalysts been quantified?- Analysts are assuming ICRA's revenue will grow by 12.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 34.8% today to 37.5% in 3 years time.

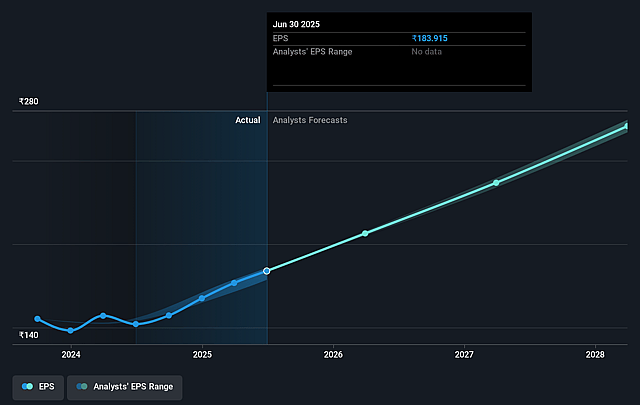

- Analysts expect earnings to reach ₹2.7 billion (and earnings per share of ₹262.2) by about September 2028, up from ₹1.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.1x on those 2028 earnings, up from 34.5x today. This future PE is greater than the current PE for the IN Capital Markets industry at 22.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.66%, as per the Simply Wall St company report.

ICRA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's non-ratings (Research and Analytics/Knowledge Services) business has experienced plateauing growth and was negatively impacted by the planned discontinuation of ESG-related offerings, revealing ongoing vulnerability to client concentration (notably Moody's) and a relatively narrow growth path, which could affect revenue diversification and future topline growth.

- Despite management's optimism about regulatory "push" in India, macro commentary highlighted that credit and bond market growth slowed in FY'25 versus previous years, with government stimulus and rate cut expectations providing only partial mitigation, suggesting that a weaker credit environment or policy reversal could decrease ratings volume and suppress revenue growth and operating margins.

- ICRA's margin improvements in Ratings are driven by operating leverage and selective pricing, but persistent or intensifying competitive pressures (including competitors willing to undercut prices or greater client negotiation power) could erode pricing power, impacting future net margins and sustaining earnings expansion.

- The global knowledge services business faces structural risks from automation and digital transformation (including increased use of AI by clients, particularly Moody's), which could reduce project volumes and pressure margins over time if ICRA does not stay ahead in digital offerings, posing long-term risks to earnings and profitability.

- Accumulating large cash reserves on the balance sheet, in the absence of clear strategic deployment or high-yield opportunities, may signal a lack of attractive organic or inorganic growth avenues, limiting future return on equity and potentially pressuring overall earnings growth if cash continues to earn low post-tax yields.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹7178.5 for ICRA based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹7.2 billion, earnings will come to ₹2.7 billion, and it would be trading on a PE ratio of 36.1x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹6353.0, the analyst price target of ₹7178.5 is 11.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ICRA?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.