Key Takeaways

- Expansion into global markets, new product lines, and regulatory trends are driving sustained revenue growth and long-term earnings stability.

- Automation and AI adoption are improving operational efficiency, supporting margin expansion and a premium revenue mix.

- Expansion into new products and markets, alongside rising competition and persistent investment in emerging verticals, poses risks to profitability and future earnings growth.

Catalysts

About CARE Ratings- A credit rating agency, provides various rating and related services in India and internationally.

- India's ongoing move towards greater formalization and transparency, alongside regulatory reforms (e.g., mandatory ratings by IFSCA-registered agencies), is expected to structurally increase demand for credit ratings; this should result in sustained top-line growth as more entities access capital markets and require ratings.

- CARE Ratings' expansion into global sovereign and ESG ratings, as well as its first-mover advantage in the IFSCA/GIFT City domain, directly increases its addressable market and diversifies revenue streams, supporting both revenue growth and more resilient earnings.

- Investments in automation, digitization, and AI across rating processes are driving operating efficiencies, enabling the company to process more cases with stable team size-this is expected to support operating margin expansion over time.

- Strategic international forays (South Africa, Nepal, Mauritius, and GIFT City) and product innovation (Analytics, Advisory, ESG, specialized bond ratings) establish multiple new growth vectors and reduce dependency on Indian economic cycles, enhancing long-term earnings stability.

- Rising investor sophistication and deepening of the Indian bond/securitization market (shift from bank loans to bonds, greater institutional investor activity) are creating higher-value rating assignments for CARE, supporting premium pricing, improved revenue mix, and potential for higher net margins.

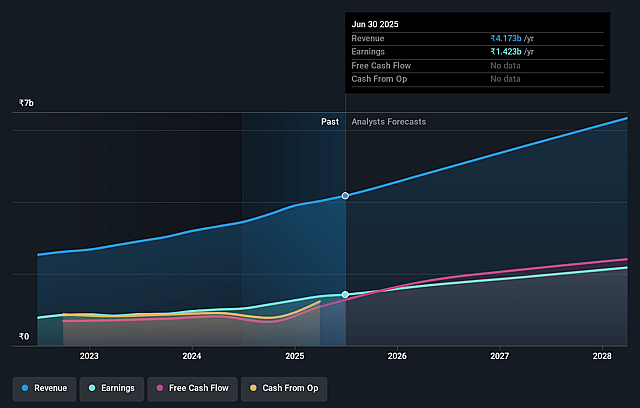

CARE Ratings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CARE Ratings's revenue will grow by 16.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 34.1% today to 34.4% in 3 years time.

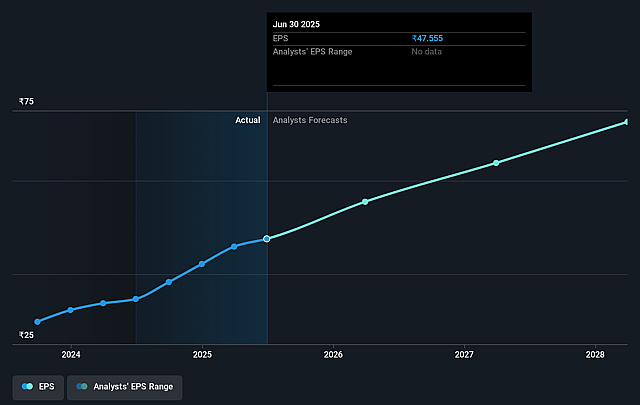

- Analysts expect earnings to reach ₹2.3 billion (and earnings per share of ₹70.39) by about September 2028, up from ₹1.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.7x on those 2028 earnings, up from 32.2x today. This future PE is greater than the current PE for the IN Capital Markets industry at 22.9x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.66%, as per the Simply Wall St company report.

CARE Ratings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's rapid international and product expansion (including into ESG, global ratings, and analytics) is reliant on significant upfront investments in new lines of business and overseas markets whose regulatory and economic environments are still evolving; if these markets do not scale as expected or regulatory dynamics shift, investment losses and subdued revenue from these ventures could adversely affect group profitability.

- The current high growth rates in ratings revenue are partly tied to a favorable mix shift toward bond and securitization market share; if industry-wide bond issuance moderates, private sector capex remains subdued, or India's credit cycle turns, the core ratings business's revenue trajectory could slow, leading to lower topline growth and constraining operating leverage.

- Increased focus and patient investment in ESG and analytics divisions is expected to drive future diversification, but management guidance suggests these verticals may remain lossmaking in the medium term with expenses outpacing revenue, which could dampen consolidated net margins until these units scale meaningfully.

- While tech-led operational efficiency improvements have supported current margin expansion, management signaled that pre-2018 margin levels (50–55%+) are unlikely to return due to talent investments and industry structure; if pace of technology adoption stalls or competitive wage pressures intensify, margins could plateau or contract, impacting future earnings growth.

- The sustainability of CARE's outperformance is heavily reliant on continued market share gains and successful brand positioning amid growing competition from domestic peers and potential global entrants; if CARE fails to continuously outpace the industry or loses pricing power, revenue and profit growth will revert to industry norms, limiting future upside in share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1996.0 for CARE Ratings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹6.6 billion, earnings will come to ₹2.3 billion, and it would be trading on a PE ratio of 39.7x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹1525.3, the analyst price target of ₹1996.0 is 23.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on CARE Ratings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.