Key Takeaways

- Regulatory changes and potential valuation concerns may negatively impact BSE's equity derivatives market revenue and overall earnings.

- Technology uptake challenges and necessary infrastructure investments could affect BSE's future customer acquisition, trading volume growth, and profitability.

- BSE's robust revenue growth, strong operational efficiency, and continuous tech investment indicate a secure financial outlook and potential market leadership.

Catalysts

About BSE- Provides a platform for trading in equity, currencies, debt instruments, derivatives, mutual funds, and other securities in India and internationally.

- BSE's stock may be overvalued due to concerns about upcoming regulatory changes in the equity derivatives market, which could negatively impact volumes and revenue from this segment, affecting overall earnings.

- Market expectations of reduced traction in index options due to regulatory reforms could decrease transaction volumes and revenues, impacting net margins and earnings.

- There may be uncertainty regarding the sustainability of high revenue growth from derivatives, especially given potential shifts towards monthly expiry contracts that could initially lower trading volumes, influencing future revenue streams.

- Challenges in technological uptake among brokers and limited access to BSE's derivative products, like individual stock options, may slow down new customer acquisition and expansion in trading volumes, impacting future growth in revenues.

- Potential costs associated with necessary technology upgrades and infrastructure investments for handling increasing trading volumes could compress net margins, affecting future profitability.

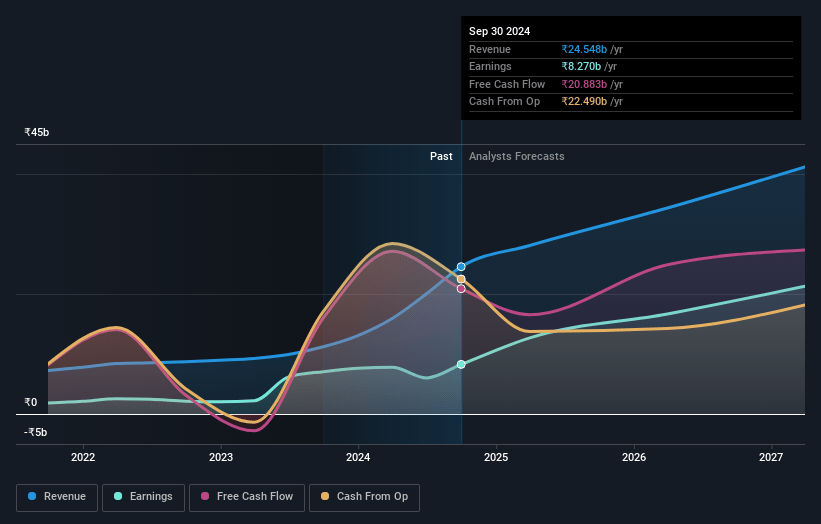

BSE Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BSE's revenue will grow by 22.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 33.7% today to 55.7% in 3 years time.

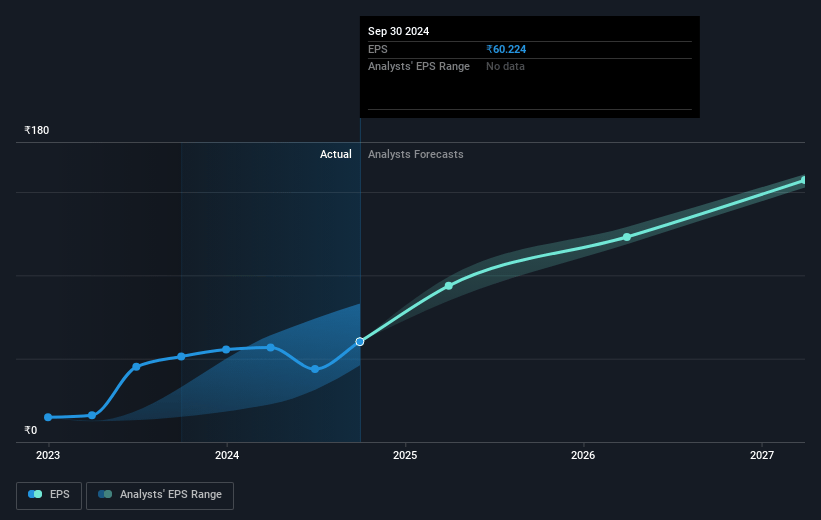

- Analysts expect earnings to reach ₹25.4 billion (and earnings per share of ₹157.04) by about December 2027, up from ₹8.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.3x on those 2027 earnings, down from 93.5x today. This future PE is greater than the current PE for the IN Capital Markets industry at 23.4x.

- Analysts expect the number of shares outstanding to grow by 5.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.6%, as per the Simply Wall St company report.

BSE Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- BSE's strong increase in operating revenues, with a reported 137% growth, suggests that the company is effectively generating significant income from its operations, which could provide stable earnings and counter any expected share price decline.

- The BSE listing platform continues to attract substantial capital, evidenced by the record-breaking IPO by Hyundai Motor India, indicating robust revenue potential from listing fees, which could support long-term revenue stability.

- The consistent growth in transaction-related income, especially in derivatives and mutual funds, has led to BSE recording its highest-ever quarterly revenues, which could help maintain or improve net margins.

- BSE's significant accomplishment of surpassing a 50% operating EBITDA margin, reaching 52%, indicates improved operational efficiency, bolstering earnings and supporting a positive outlook on its financial performance.

- Continuous investments in technology and infrastructure, such as the state-of-the-art data center, suggest BSE is committed to maintaining its competitive edge, potentially enhancing its market share and revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹4870.6 for BSE based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹6500.0, and the most bearish reporting a price target of just ₹3500.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be ₹45.6 billion, earnings will come to ₹25.4 billion, and it would be trading on a PE ratio of 45.3x, assuming you use a discount rate of 13.6%.

- Given the current share price of ₹5632.45, the analyst's price target of ₹4870.6 is 15.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives