Last Update01 May 25Fair value Decreased 2.32%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Infibeam Avenues is positioned to capitalize on India's digital payments growth, leveraging AI and new revenue streams to boost future earnings.

- International expansion and strategic acquisitions are set to enhance cross-selling opportunities and diversify revenue, strengthening Infibeam's financial position.

- Intensifying competition in digital payments and investments in AI and data centers could pressure margins and impact Infibeam Avenues' profitability and growth.

Catalysts

About Infibeam Avenues- Operates as a digital payment and e-commerce technology company that engages in the provision of digital payment solutions, data center infrastructure, and software platforms for businesses and governments to execute e-commerce transactions.

- Infibeam Avenues' strategic focus on digital payments and AI-driven solutions positions it well to capitalize on the rapidly growing digital payments market in India, potentially boosting future revenue growth.

- The acquisition of a controlling stake in Rediff provides Infibeam Avenues with direct access to over 65 million monthly visitors, opening up substantial opportunities for cross-selling and scaling financial products, which could significantly impact earnings.

- The company's plan to launch UPI services under the RediffPay brand and integrate bill payments through Bharat Bill Payment operating unit license is expected to create new revenue streams and enhance net margins.

- Investment in AI through Phronetic AI and development of an AI Facility Manager solution targets sectors like healthcare and retail gas distributions, with potential to contribute 5% to 10% of net revenue within 2 to 3 years, thus supporting future earnings growth.

- Expansion into the GCC market, particularly in Saudi Arabia, and successful partnerships with key players indicate potential for international revenue growth and diversification, positively impacting net revenues.

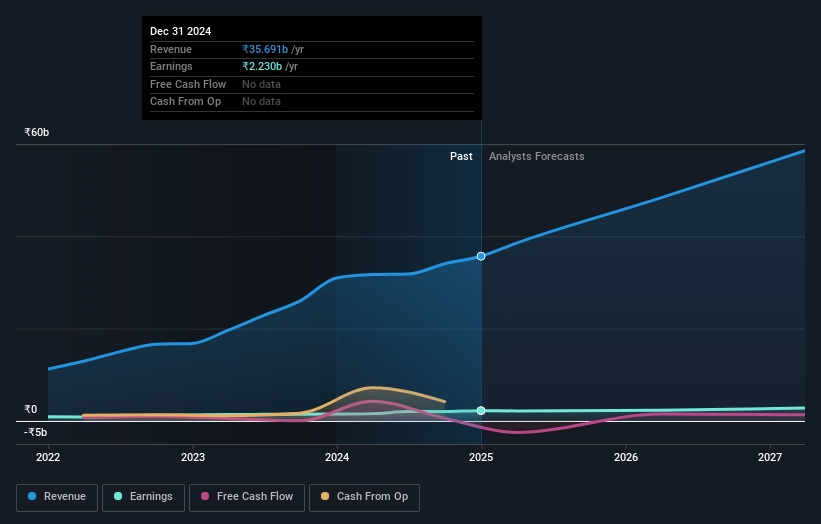

Infibeam Avenues Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Infibeam Avenues's revenue will grow by 24.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.2% today to 4.3% in 3 years time.

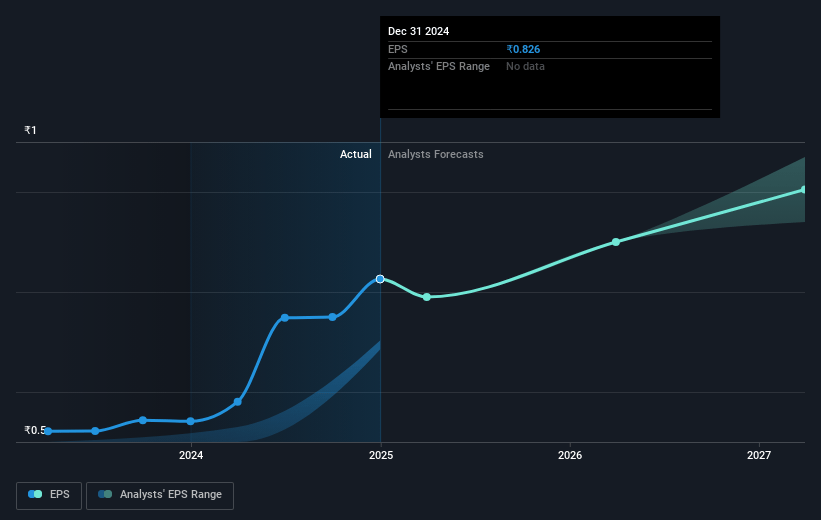

- Analysts expect earnings to reach ₹3.0 billion (and earnings per share of ₹1.07) by about May 2028, up from ₹2.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹2.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.3x on those 2028 earnings, up from 21.2x today. This future PE is greater than the current PE for the IN Diversified Financial industry at 26.2x.

- Analysts expect the number of shares outstanding to decline by 2.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.64%, as per the Simply Wall St company report.

Infibeam Avenues Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The competitive landscape in digital payments is intensifying, which could drive downward pressure on margins and impact net profits as the company may need to invest more in customer acquisition and retention.

- The success of Rediff as a platform for consumer payments and financial services is uncertain, and there is execution risk in converting its large but potentially non-tech-savvy user base into active financial service customers, potentially impacting revenue growth.

- The company is making significant investments in AI and data centers, which carry inherent risks; if these initiatives do not generate the anticipated returns, it could affect the company's profitability and return on capital.

- Regulation and market practices introduce risk, such as the requirement for UPI market share caps and no MDR on UPI transactions, potentially limiting revenue from this channel.

- The company faces challenges in maintaining or growing its transaction processing volumes (TPV), particularly in a highly competitive market where larger rivals like Razorpay and Paytm continue to expand, which may affect overall revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹27.4 for Infibeam Avenues based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹68.5 billion, earnings will come to ₹3.0 billion, and it would be trading on a PE ratio of 35.3x, assuming you use a discount rate of 13.6%.

- Given the current share price of ₹17.03, the analyst price target of ₹27.4 is 37.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.