Key Takeaways

- Expansion into international markets and government-driven digital payment adoption broaden Infibeam's addressable market and diversify revenue streams.

- Shift to high-margin, SaaS, and AI-driven solutions increases cross-selling opportunities, operational leverage, and long-term profitability.

- Elevated spending on growth initiatives and exposure to low-margin segments may suppress profitability, while expansion and integration risks could drive earnings volatility and operational complexity.

Catalysts

About Infibeam Avenues- Operates as a digital payment and e-commerce technology company that engages in the provision of digital payment solutions, data center infrastructure, and software platforms for businesses and governments to execute e-commerce transactions.

- The accelerating adoption of digital payments-propelled by government initiatives for a cashless economy, ongoing UPI proliferation, and rising e-commerce among SMEs-is expanding Infibeam's addressable market for payment processing and integrated commerce solutions, providing a long-term driver for revenue growth.

- Strategic international expansion, particularly into the Middle East and Africa, combined with investments in data localization and compliance (e.g., setting up localized infrastructure in Saudi Arabia and Oman), is positioned to significantly increase transaction volumes and diversify revenue streams, supporting both top-line growth and improved earnings quality.

- The migration to a focused, high-margin SaaS-based model-exemplified by the convergence of payments (CCAvenue) and advanced AI infrastructure (Phronetic.AI) and by the transfer of e-commerce platform business to Rediff-enables greater cross-selling, higher client stickiness, and operational leverage, which are likely to enhance net margins and profitability over time.

- The scaling of AI-driven value-added services (e.g., fraud detection, intelligent routing, orchestration layers, agentic developer platforms) positions Infibeam for higher-margin, fee-based income, supporting blended margins and providing a structural advantage as enterprise adoption increases and new verticals are penetrated.

- Strong partnerships and embedded relationships with banks, government agencies, and large enterprise clients (including in segments like BFSI and energy) ensure recurring revenue streams and reinforce Infibeam's competitive moat, supporting stable earnings even as competition and pricing pressures increase across the digital payments sector.

Infibeam Avenues Future Earnings and Revenue Growth

Assumptions

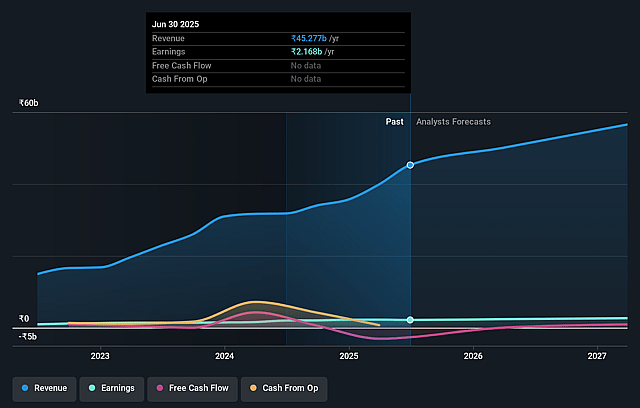

How have these above catalysts been quantified?- Analysts are assuming Infibeam Avenues's revenue will grow by 16.8% annually over the next 3 years.

- Analysts are assuming Infibeam Avenues's profit margins will remain the same at 4.8% over the next 3 years.

- Analysts expect earnings to reach ₹3.4 billion (and earnings per share of ₹0.95) by about September 2028, up from ₹2.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.7x on those 2028 earnings, up from 20.7x today. This future PE is greater than the current PE for the IN Diversified Financial industry at 23.5x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.94%, as per the Simply Wall St company report.

Infibeam Avenues Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's guidance for FY '26 profitability (PAT) implies only 5-15% growth year-on-year despite optimistic revenue growth forecasts, indicating significant planned increases in marketing, branding, and customer acquisition expenses that may suppress net margins and earnings in the near-to-medium term.

- Infibeam's AI and data center strategy requires high up-front and ongoing capital expenditure, with management projecting an 18-36 month ROI per site; delays in client ramp-up or industry shifts in AI technology could result in underutilization and lower-than-anticipated returns, impacting earnings and return on equity.

- There is ongoing exposure to low-margin, highly competitive payment processing services, including pressure from UPI (zero MDR regime) and commoditization trends, which may continue to constrain overall net margins and revenue growth, particularly if alternative payment technologies or government-backed infrastructure become more dominant.

- Execution risk is elevated in the international expansion, particularly into the Middle East and Africa, which require heavy investment in data localization and regulatory compliance; failure to achieve targeted revenue contribution (12-15% by FY '28) or slow merchant/user adoption could stagnate international revenues and increase operating costs.

- The company's financial performance is subject to volatility from large one-time items (e.g., goodwill, mark-to-market adjustments), and the reorganization involving Rediff introduces risks of integration complexity, client migration, and potential dilution from capital raises at Rediff, which could affect consolidated revenues, earnings, and control over key assets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹19.5 for Infibeam Avenues based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹72.2 billion, earnings will come to ₹3.4 billion, and it would be trading on a PE ratio of 23.7x, assuming you use a discount rate of 13.9%.

- Given the current share price of ₹16.14, the analyst price target of ₹19.5 is 17.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.