Key Takeaways

- Long-term growth is supported by rising domestic demand, digital customer acquisition, and capital-light expansion strategies to boost both recurring revenues and profitability.

- Focus on sustainability, quality upgrades, and curated experiences is expected to improve customer retention and increase member lifetime value, enhancing margins.

- Shifting industry trends, operational complexities, and external risks threaten long-term profitability, revenue stability, and growth of the traditional timeshare and resort model.

Catalysts

About Mahindra Holidays & Resorts India- Operates in the leisure hospitality sector in India, Finland, Sweden, Spain, Dubai, Thailand, and Malaysia.

- The expansion of the Indian middle class, rising disposable incomes, and strong government investment in domestic tourism infrastructure support a multi-year increase in leisure travel demand and vacation ownership, providing a long runway for sustained membership growth and future recurring revenues.

- Adoption of digital platforms for member acquisition and engagement (now at 65% via digital and referrals) is leading to lower customer acquisition costs, tighter sales/marketing spend, and improved operating leverage, supporting margin expansion and long-term earnings growth.

- The company is targeting 1,000 new rooms by March 2026 and 10,000 rooms by FY30, with 65-70% of future pipeline already identified. Capital-light expansions through leases and partnerships are expected to boost return on capital, accelerate asset turnover, and drive both top-line growth and profitability.

- Enhanced focus on curated experiences, sustainability, and quality upgrades at resorts (e.g. winning Traveller's Choice awards, increased solar installation) aims to improve customer retention, drive cross-sell opportunities, and increase lifetime value per member, translating into higher net margins over time.

- Operational recovery in Europe from macro/geopolitical headwinds, combined with the company's efforts to stabilize overseas operations, represents potential upside to consolidated earnings if economic and travel conditions normalize, given past high-margin performance from the HCRO business.

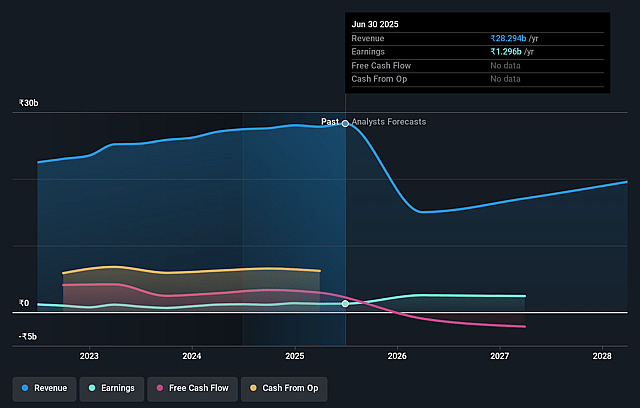

Mahindra Holidays & Resorts India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mahindra Holidays & Resorts India's revenue will decrease by 10.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.6% today to 20.7% in 3 years time.

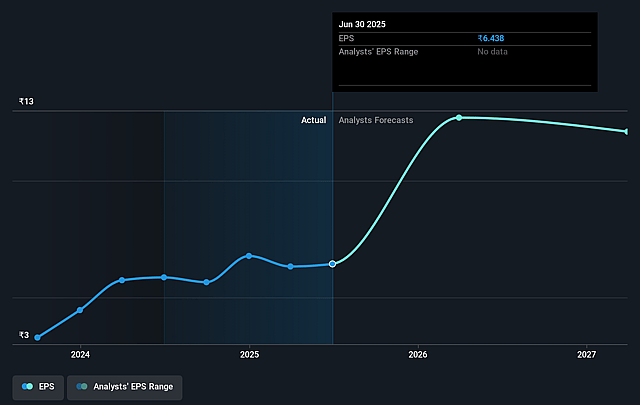

- Analysts expect earnings to reach ₹4.2 billion (and earnings per share of ₹20.92) by about September 2028, up from ₹1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.5x on those 2028 earnings, down from 55.7x today. This future PE is greater than the current PE for the IN Hospitality industry at 37.7x.

- Analysts expect the number of shares outstanding to decline by 0.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.13%, as per the Simply Wall St company report.

Mahindra Holidays & Resorts India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued losses and muted performance from the European Holiday Club Resorts Oy (HCRO) business due to geopolitical risks (Russia-Ukraine conflict) and a sluggish Finnish economy, with uncertain timelines for recovery and no immediate plans for divestment, could pressure consolidated profits and cash flows over the long term.

- Ongoing industry-wide trends toward asset-light, digital-first vacation models (such as OTAs and vacation rentals like Airbnb) pose a competitive threat to the traditional timeshare membership model, potentially capping membership growth and compressing revenue as consumer preferences evolve.

- Increasing churn in resort inventory, driven by quality concerns, customer feedback, and non-renewal of leases, may lead to periodic dips in available room inventory and could constrain top-line growth and recurring income, particularly if high-quality replacements are not secured at scale.

- The company's reliance on expansion through leased and partner-built properties, while targeting a capital-light model, could introduce operational complexity and regional risk concentration, impacting long-term asset utilization rates and return on capital, especially if market conditions or demand shift in specific geographies.

- Management's drive to shift towards shorter tenure membership products (such as 5-year versus 25-year plans) may increase revenue cyclicality, elevate churn and retiral rates, and reduce the long-term predictability of cash flows and margins associated with the classic timeshare business.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹510.0 for Mahindra Holidays & Resorts India based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹20.4 billion, earnings will come to ₹4.2 billion, and it would be trading on a PE ratio of 38.5x, assuming you use a discount rate of 17.1%.

- Given the current share price of ₹357.6, the analyst price target of ₹510.0 is 29.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.