Catalysts

About Le Travenues Technology

Le Travenues Technology, which operates the ixigo brand, provides AI-led online travel booking services across trains, flights, buses and hotels for Indian travelers.

What are the underlying business or industry changes driving this perspective?

- Although the company is leveraging rising digital adoption in Tier 2 and Tier 3 cities to onboard first-time flyers and online bus users, dependence on constrained airline and rail capacity could cap ticketing volume growth and limit operating leverage on revenue.

- While AI-first customer support and value-added peace of mind products are improving cross-sell and service efficiency, rapid shifts in regulatory requirements such as Aadhaar-based authentication and changing rail policies may force continuous re-engineering of algorithms and compress net margins.

- Although the hotel OTA opportunity remains underpenetrated as midrange and budget properties move online with PMS and channel managers, intense competition for differentiated supply and brand recall in cities beyond metros can push up acquisition costs and weigh on earnings.

- While the fresh capital infusion and a disciplined M&A track record broaden options to deepen presence across buses, flights and hotels, any misstep in integrating new assets or scaling AI-native NewCo initiatives could delay synergy realization and depress near-term profitability.

- Although increasing use of conversational, hyper-personalized and agentic interfaces can unlock new demand pools and ancillary revenue streams, the heavy upfront investment needed to stay at the frontier of AI infrastructure and talent risks outpacing near-term monetization and pressuring free cash flow growth.

Assumptions

This narrative explores a more pessimistic perspective on Le Travenues Technology compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

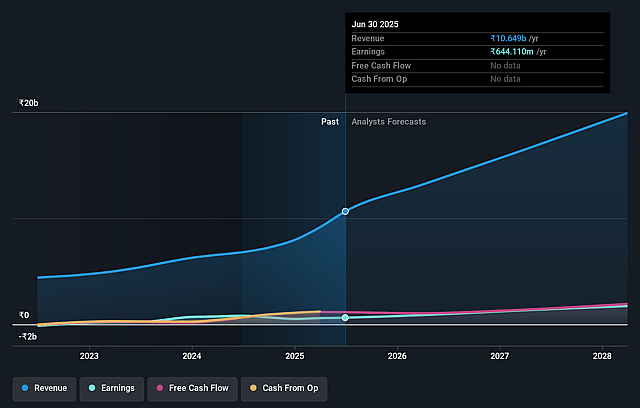

- The bearish analysts are assuming Le Travenues Technology's revenue will grow by 24.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.3% today to 13.1% in 3 years time.

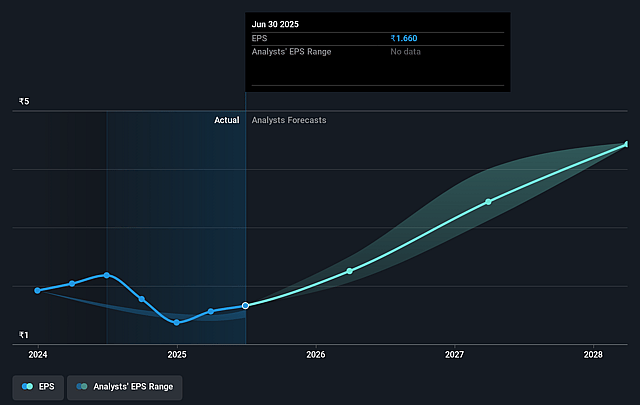

- The bearish analysts expect earnings to reach ₹2.8 billion (and earnings per share of ₹6.48) by about December 2028, up from ₹481.5 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹3.3 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 69.0x on those 2028 earnings, down from 232.2x today. This future PE is greater than the current PE for the IN Hospitality industry at 31.9x.

- The bearish analysts expect the number of shares outstanding to grow by 2.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.9%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Structural capacity constraints or slower than expected supply additions in domestic aviation and rail, despite some near term green shoots, could keep overall traffic growth muted and cap ixigo's ability to outgrow the market on volumes, limiting long term revenue and earnings expansion.

- Regulatory tightening around rail bookings, Aadhaar-based authentication and other ecosystem rule changes may become more frequent over time, forcing constant re-engineering of algorithms and risk models for products like alternate travel plans, which could structurally compress contribution margins and net margins.

- Heavy upfront investment in AI-native NewCo initiatives, agentic platforms and hotel OTA expansion, funded by the large equity raise, may take longer than management expects to monetize at scale, leading to a prolonged period of elevated operating expenses that dampens free cash flow and earnings growth.

- Rising competitive intensity in underpenetrated segments such as buses and budget and midrange hotels, where access to inventory is increasingly commoditized, could trigger higher marketing and brand spends to maintain share beyond Tier 2 and Tier 3 cities, weighing on contribution margins and net margins over the long run.

- If macro or geopolitical shocks periodically disrupt travel demand while the company has scaled fixed cost bases in tech, AI infrastructure and brand, the expected operating leverage may not fully materialize, leading to more volatile and potentially lower than anticipated revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Le Travenues Technology is ₹300.0, which represents up to two standard deviations below the consensus price target of ₹340.0. This valuation is based on what can be assumed as the expectations of Le Travenues Technology's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹400.0, and the most bearish reporting a price target of just ₹300.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be ₹21.4 billion, earnings will come to ₹2.8 billion, and it would be trading on a PE ratio of 69.0x, assuming you use a discount rate of 14.9%.

- Given the current share price of ₹256.05, the analyst price target of ₹300.0 is 14.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Le Travenues Technology?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.