Key Takeaways

- Growth may slow as offline users are fully acquired, while heavy domestic focus heightens vulnerability to regulatory shifts and economic shifts in India.

- Prioritizing investment in new services and technology limits near-term profit gains, as competition and evolving digital trends threaten pricing power and market share.

- A strong market position, technology-driven efficiency, and expansion into underdigitized segments position Le Travenues Technology for sustainable growth and improved profitability.

Catalysts

About Le Travenues Technology- Operates online travel aggregator (OTA) platforms in India.

- The market may be overestimating the durability of Le Travenues Technology's growth trajectory given India's rising internet and smartphone penetration, as a large part of the offline population is yet to shift online; once this segment is fully tapped, growth rates could significantly decelerate, which would impact future revenue expansion.

- Elevated investments in branding, AI initiatives, and new verticals (e.g., Hotels, food delivery, new ancillary services) are being prioritized over margin expansion, potentially constraining operating leverage and delaying meaningful improvement in EBITDA and net margins in coming years.

- Heightened competition from both incumbent OTAs and emerging "super-app" ecosystems or direct booking tools (enabled by rising digital payments adoption) could erode pricing power, compress commission/take rates, and pressure long-term earnings growth.

- The company's heavy concentration in the domestic Indian market leaves it exposed to macroeconomic volatility, regulatory changes (such as railway booking policy adjustments or data privacy norms), and digital infrastructure challenges, potentially introducing unpredictability and periodic shocks to revenue and profit growth.

- The growing adoption of AI-driven, decentralized travel planning and booking via social or peer-to-peer platforms could gradually reduce Le Travenues Technology's aggregate market share and user relevance, directly dampening transaction volumes and margin progression over the long term.

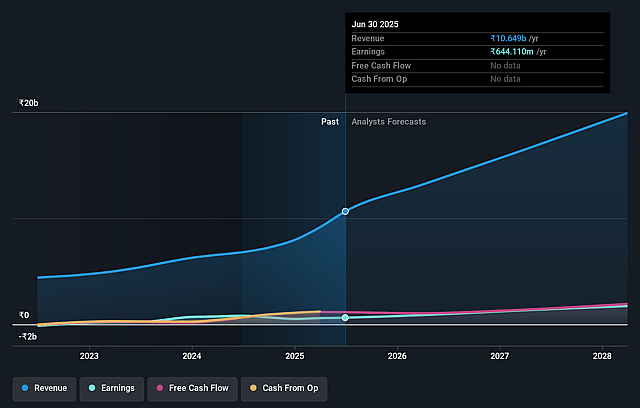

Le Travenues Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Le Travenues Technology's revenue will grow by 25.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.0% today to 9.6% in 3 years time.

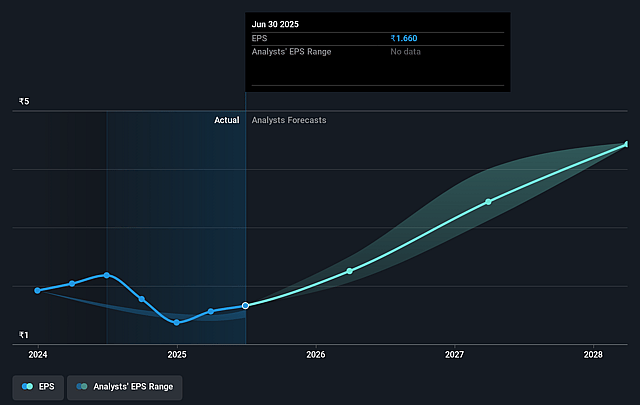

- Analysts expect earnings to reach ₹2.0 billion (and earnings per share of ₹4.29) by about September 2028, up from ₹644.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 65.9x on those 2028 earnings, down from 172.5x today. This future PE is greater than the current PE for the IN Hospitality industry at 37.7x.

- Analysts expect the number of shares outstanding to grow by 1.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.3%, as per the Simply Wall St company report.

Le Travenues Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rapid growth in India's air, rail, and bus travel sectors driven by infrastructure upgrades, expanding airport/road networks, and rising middle-class discretionary spending provides a long-term structural tailwind for Le Travenues Technology's customer volumes, which is likely to support revenue and gross transaction value growth.

- Continued market share gains in trains (now over 60% OTA share), aggressive expansion in buses and flights, and highly rated, widely used consumer-facing apps suggest durable user loyalty and an entrenched market position, pointing to robust future earnings potential.

- Leveraging AI for customer support, product innovation, pricing, and marketing is driving significant internal productivity gains and product differentiation, which can lead to improved operating margins and competitive advantage in the medium to long term.

- The company's asset-light, organic, product-led growth strategy reduces reliance on heavy marketing spend and inorganic acquisitions, supporting sustainable net margin improvement and increased resilience to competitive pricing pressures.

- Underdigitized categories (bus, budget hotels, food on trains) represent large, untapped growth opportunities; early traction and cross-sell progress, coupled with a strong existing user funnel, increase the likelihood of future revenue streams and long-term EBITDA leverage.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹212.5 for Le Travenues Technology based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹230.0, and the most bearish reporting a price target of just ₹180.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹20.9 billion, earnings will come to ₹2.0 billion, and it would be trading on a PE ratio of 65.9x, assuming you use a discount rate of 15.3%.

- Given the current share price of ₹284.85, the analyst price target of ₹212.5 is 34.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.