Key Takeaways

- Aggressive expansion and franchise conversions are expected to drive revenue growth and improve margins by reducing capital expenditure.

- Targeted debt reduction and strong same-store sales growth enhance financial performance and brand presence.

- Reduction in customs duty and franchise growth may negatively impact margins, with international expansion and local competition posing risks to future revenue growth.

Catalysts

About Kalyan Jewellers India- Manufactures and retails various gold and precious stone studded jewelry products.

- Kalyan Jewellers is on track to open 80 Kalyan showrooms and 50 Candere showrooms, with international expansion in the U.S. planned. This aggressive expansion is expected to drive revenue growth and tap into new markets.

- The company is converting more existing stores to franchisee models, which reduces capital expenditure and enhances operating leverage, potentially leading to improved net margins.

- There is a targeted debt reduction plan of ₹300 crores for the current fiscal year and a further ₹350-400 crores planned for next year, which should reduce interest costs and improve net earnings.

- The growing studded jewelry segment, with better margins than gold jewelry, is witnessing robust demand, particularly in non-southern Indian markets, which could enhance gross margins over time.

- Kalyan Jewellers is experiencing strong same-store sales growth, particularly during festive periods, indicating a strong brand presence and customer loyalty, contributing positively to revenue growth.

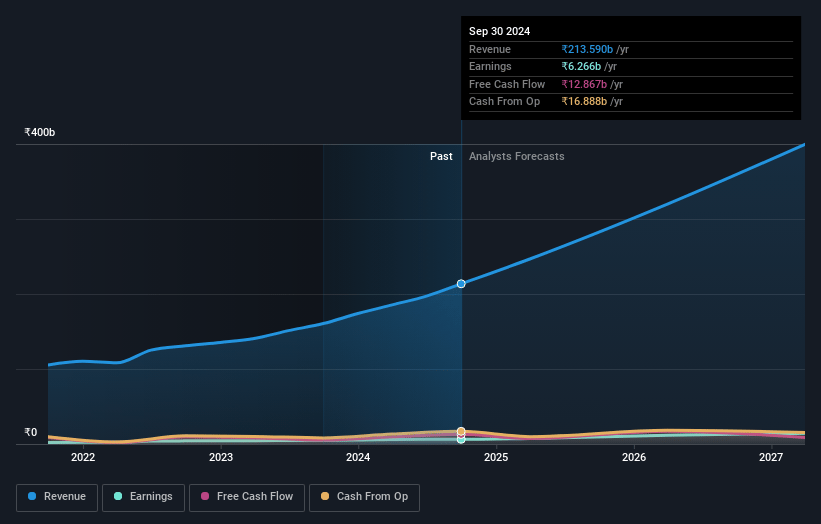

Kalyan Jewellers India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kalyan Jewellers India's revenue will grow by 28.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 3.9% in 3 years time.

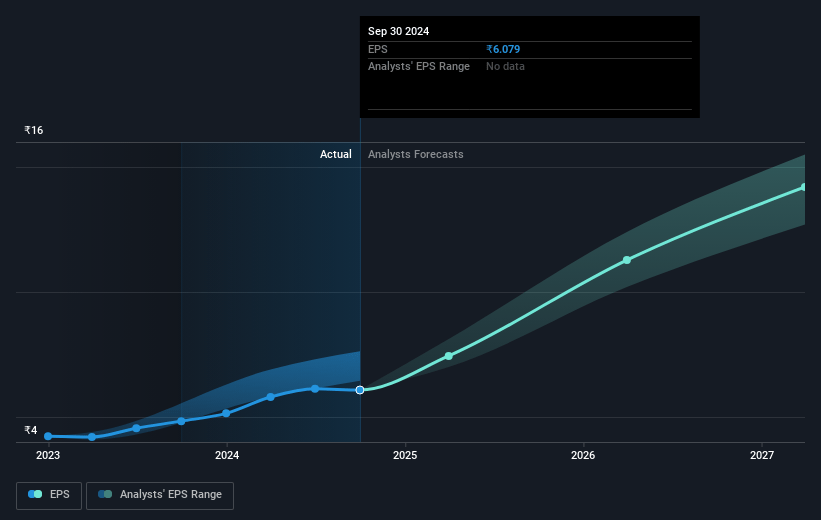

- Analysts expect earnings to reach ₹17.7 billion (and earnings per share of ₹14.37) by about January 2028, up from ₹6.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 79.4x on those 2028 earnings, up from 73.9x today. This future PE is greater than the current PE for the IN Luxury industry at 27.1x.

- Analysts expect the number of shares outstanding to grow by 6.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.49%, as per the Simply Wall St company report.

Kalyan Jewellers India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reduction in customs duty resulted in a one-time inventory write-off of ₹70 crores this quarter, with an additional ₹50 crores expected in the next quarter, impacting net margins negatively.

- International expansion, including launches in the U.S. and other regions, faces delays and geopolitical risks, which could affect future revenue growth and add to operational costs.

- Franchise model growth in India, while reducing capital expenditure, may dilute gross margins due to the lower margin structure (8% for franchisee stores compared to 15.5%-16% for owned stores), impacting earnings.

- Competitive pressures, especially from local players, and the lack of demand for lab-grown diamonds may hinder the company's ability to capture additional market share, impacting revenue growth.

- Fluctuating gold prices create market volatility, and a consequent impact on consumer demand and inventory valuation, which could affect both revenues and net profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹760.5 for Kalyan Jewellers India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹875.0, and the most bearish reporting a price target of just ₹624.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹451.6 billion, earnings will come to ₹17.7 billion, and it would be trading on a PE ratio of 79.4x, assuming you use a discount rate of 14.5%.

- Given the current share price of ₹448.7, the analyst's price target of ₹760.5 is 41.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives