Last Update23 Aug 25Fair value Decreased 6.31%

The downward revision in IFB Industries’ price target reflects reduced analyst expectations, as both net profit margin and revenue growth forecasts have declined, prompting the consensus target to be lowered from ₹1548 to ₹1450.

What's in the News

- The Board of IFB Industries will meet on July 29 to consider unaudited financial results for the quarter ended June 30, 2025, among other matters.

Valuation Changes

Summary of Valuation Changes for IFB Industries

- The Consensus Analyst Price Target has fallen from ₹1548 to ₹1450.

- The Net Profit Margin for IFB Industries has fallen from 4.66% to 4.21%.

- The Consensus Revenue Growth forecasts for IFB Industries has fallen from 11.3% per annum to 10.6% per annum.

Key Takeaways

- Aggressive cost-cutting and manufacturing efficiency measures are set to strengthen margins, with further gains expected from localizing supply and consolidating group operations.

- Investments in after-sales service, product upgrades, and premium category expansion aim to drive brand loyalty, higher revenues, and improved profit potential.

- Persistent cost pressures, weak pricing power, and structural inefficiencies threaten profitability and earnings growth, while supply chain dependencies and organizational complexity add risk to margins.

Catalysts

About IFB Industries- Manufactures and trades in home appliances in India and internationally.

- IFB is undertaking material cost optimization and fixed-cost reduction initiatives (in partnership with Alvarez & Marsal), targeting ₹200 crores in recurring cost savings over the next few years, much of which will flow through to net margins and EBITDA as these savings ramp up in FY26 and FY27.

- The company is leveraging high domestic manufacturing utilization rates in core categories (washing machines, air conditioners), with significant headroom in newer lines (refrigerators at 50-65% utilization), creating operating leverage potential and revenue acceleration as market demand for appliances rises with urbanization and income growth.

- IFB is expanding after-sales service infrastructure, now at over 1,500 franchisees with ambitious targets for rapid service delivery, which should boost brand stickiness and support higher repeat purchases, impacting both topline and customer lifetime value.

- Strong focus on product upgrades (e.g., switch to BLDC motors, new product launches in higher-end refrigerators) and new category entries (modular kitchens, air conditioners) position IFB to capitalize on consumer shifts towards premium, energy-efficient, and smart appliances, likely to support higher average selling prices and margin expansion.

- Ongoing consolidation and potential future integration of group companies (like IFB Refrigeration), along with efforts to increase localization and reduce import dependence, could further enhance EBITDA margins and reduce earnings volatility due to currency or supply chain risks.

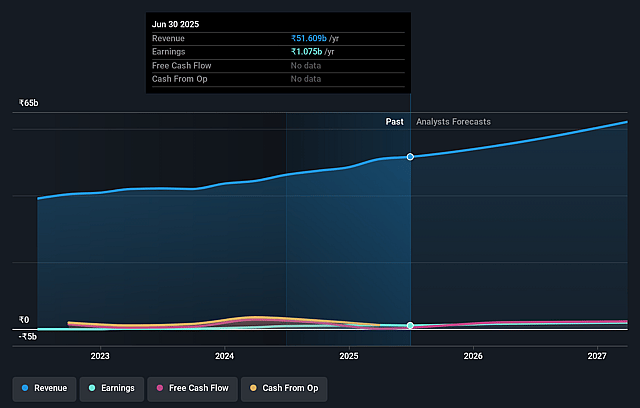

IFB Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IFB Industries's revenue will grow by 10.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.1% today to 4.2% in 3 years time.

- Analysts expect earnings to reach ₹2.9 billion (and earnings per share of ₹62.36) by about September 2028, up from ₹1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.1x on those 2028 earnings, down from 58.7x today. This future PE is lower than the current PE for the IN Consumer Durables industry at 41.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.02%, as per the Simply Wall St company report.

IFB Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained margin pressure due to rising commodity and input costs

- the company admitted that previous cost optimization measures were insufficient to offset these increases, and slow execution on both cost controls and commodity price management could continue to erode net margins and earnings if not resolved promptly.

- Weak pricing power and subscale market share in most product segments (outside washers and a few niches) could hinder sustainable margin improvement, especially against deep-pocketed global competitors; this structural issue may cap the company's ability to grow gross revenues and maintain profitability.

- Elevated fixed and operating costs, stemming from increased headcount (e.g., sales representatives), higher professional fees, and other overheads, outpaced revenue growth this quarter

- persistent cost overruns without corresponding revenue increases can suppress net margins and earnings growth over the long term.

- The complex organizational structure (notably in the refrigeration business) and unclear revenue and profit attribution between IFB Industries and IFB Refrigeration could obscure consolidated financial performance, potentially leading to inefficiencies or unoptimized allocation of resources, impacting earnings visibility.

- Dependency on global supply chains (notably compressors and imported components), as well as ongoing rupee depreciation and exposure to input price volatility, present continued risks to gross margins, especially if localization and cost control initiatives are delayed or under-executed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1450.0 for IFB Industries based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹69.8 billion, earnings will come to ₹2.9 billion, and it would be trading on a PE ratio of 30.1x, assuming you use a discount rate of 15.0%.

- Given the current share price of ₹1556.8, the analyst price target of ₹1450.0 is 7.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.