Last Update01 May 25Fair value Decreased 5.31%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Focus on advanced motor technology, premiumization, and new segments drives revenue diversification, margin improvement, and positions Crompton for long-term growth in energy-efficient appliances.

- Brand strength, expanded distribution, and new manufacturing capability enable Crompton to capitalize on regulatory shifts and rising demand, enhancing pricing power and recurring earnings.

- Heavy investment in capacity, dependence on the fans segment, late solar entry, and integration challenges create execution and margin risks amid intensifying competition and shifting consumer trends.

Catalysts

About Crompton Greaves Consumer Electricals- Manufactures and markets consumer electrical products in India.

- Ongoing investments in next-generation motor technologies (BLDC and advanced induction motor platforms), along with a platform-first product strategy, position Crompton to capitalize on the accelerating shift toward energy-efficient and durable electrical appliances, supporting long-term revenue growth and higher net margins as premium mix increases.

- Foray into the solar rooftop segment, following demonstrated execution success in solar pumps, leverages Crompton's trusted brand and wide distribution, directly addressing the expanding market from rural electrification efforts and government-backed initiatives—potentially driving substantial new recurring revenues and accretive earnings.

- The near-term launch of a greenfield, state-of-the-art manufacturing facility will upgrade supply chain agility, product quality, and innovation speed—enabling Crompton to more effectively serve growing demand tied to urbanization and rising middle-class consumption, while improving operating leverage and return metrics.

- Strategic expansion into adjacent product categories (kitchen appliances, water heaters, panels) diversifies revenue streams and supports topline CAGR, while operational focus on premiumization and margin optimization is already showing results—increasing both EBITDA and net margins, as seen in lighting and Butterfly segments.

- Strengthened channel management and brand investments (especially in premium and differentiated offerings) set the company up to benefit disproportionately from the market shift to organized, branded players amid rising regulatory stringency, enhancing pricing power and long-term margin stability.

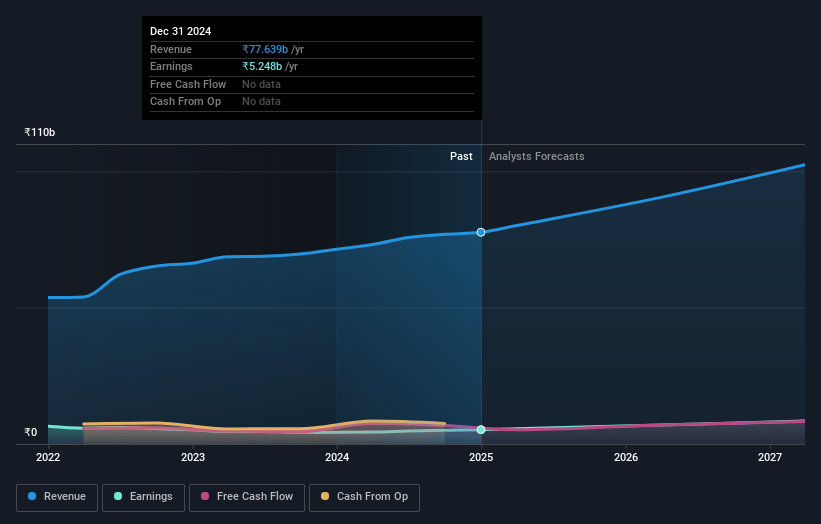

Crompton Greaves Consumer Electricals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Crompton Greaves Consumer Electricals's revenue will grow by 11.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.0% today to 8.5% in 3 years time.

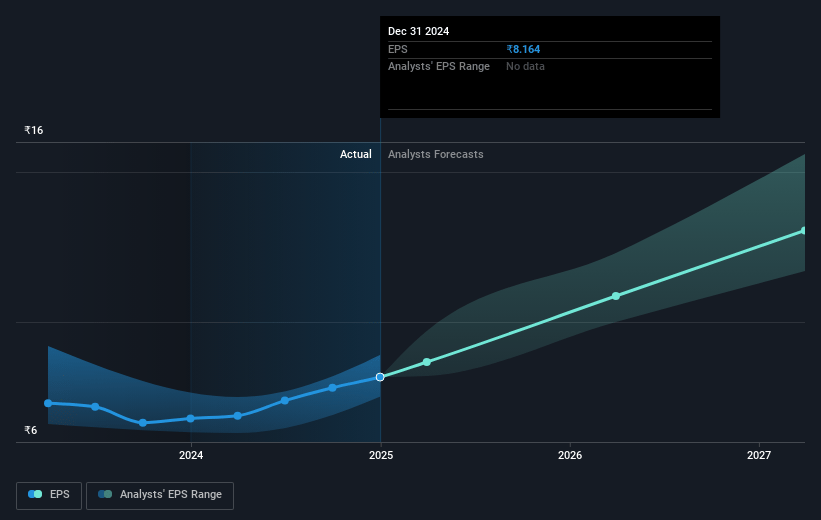

- Analysts expect earnings to reach ₹9.3 billion (and earnings per share of ₹14.47) by about May 2028, up from ₹5.6 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹10.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.2x on those 2028 earnings, up from 40.7x today. This future PE is greater than the current PE for the IN Consumer Durables industry at 42.1x.

- Analysts expect the number of shares outstanding to grow by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.81%, as per the Simply Wall St company report.

Crompton Greaves Consumer Electricals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s significant ₹350 crore CapEx in greenfield manufacturing, while intended to future-proof supply chain and elevate quality, brings elevated execution and absorption risk; if the expected demand growth in fans or other product lines fails to materialize due to long-term shifts in consumer preferences or industry commoditization, the returns on this investment could lag projections, pressuring future ROCE and net margins.

- Despite optimism about new product platforms (BLDC/induction fans, solar rooftops), Crompton Greaves’ legacy reliance on the fans segment, which saw modest volume growth this year and faces weather-linked cyclicality and shifting residential demand patterns (e.g., urbanization leading to smaller homes), raises the risk of revenue stagnation if technology adoption or category expansion underperforms expectations.

- Entry into the rooftop solar market is occurring as a “slightly late entrant” into a highly competitive, subsidy-driven sector; with large, established competitors (e.g., Havells and its Goldi Solar stake) and a business model initially dependent on government support, there is structural margin risk if subsidies taper or customer acquisition costs escalate, affecting both the topline and profitability.

- The ongoing turnaround of the Butterfly Gandhimathi acquisition, though seeing improvement, is not yet achieving sustained revenue growth and continues to post negative EBITDA in the larger appliance segment; integration risks, delayed brand repositioning, and difficult expansion beyond core Southern markets could dilute consolidated net margins and ROI if synergies fall short.

- The company’s growth and margin guidance assumes sustained consumer demand and strong brand-driven execution, but long-term sectoral threats—including increased competition from multinational and digital-first startups, rapid consumer shifts to smart/IoT-enabled appliances, and continued raw material cost inflation—pose downside risk to both revenue growth and operating margin expansion if Crompton is unable to continue premiumizing or innovate at pace.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹429.406 for Crompton Greaves Consumer Electricals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹491.0, and the most bearish reporting a price target of just ₹317.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹110.0 billion, earnings will come to ₹9.3 billion, and it would be trading on a PE ratio of 45.2x, assuming you use a discount rate of 14.8%.

- Given the current share price of ₹351.25, the analyst price target of ₹429.41 is 18.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.