Catalysts

About Ganesha Ecosphere

Ganesha Ecosphere converts post consumer PET waste into recycled polyester staple fibre, yarn and food grade rPET granules for textile and beverage packaging applications.

What are the underlying business or industry changes driving this perspective?

- Mandatory recycled plastic content in packaging is rising from 30 percent to 40 percent next year and further thereafter, which should structurally increase offtake for rPET granules and support higher, more stable revenue visibility as compliance becomes non deferrable.

- FSSAI approved rPET capacity in India has already expanded from 70,000 tonnes to about 210,000 tonnes, while Ganesha’s own approved capacity has tripled to 42,000 tonnes, positioning the company as a scaled, credible supplier that can win share as brand owners consolidate their vendor base and uplift earnings.

- The brownfield expansion at Warangal adding 22,500 tonnes of rPET capacity by March 2026, with revenue potential of INR 225 crore to INR 250 crore annually, provides a clear volume growth lever that can accelerate topline and operating leverage once utilization exceeds 80 percent.

- A growing global and domestic push for circularity in textiles, supported by resilient PSF demand, GST rationalization and strong order flows in the legacy fibre and yarn business, can restore EBITDA margins toward and above the historical 7 percent to 9 percent band, improving overall profitability and net margins.

- Mix shift towards higher value rPET chips and specialty premium fibres over the next few years, combined with normalization of inventory costs after the one off loss in Q2, should lift blended realizations and margin profile, translating into stronger EBITDA and earnings growth relative to the depressed current base.

Assumptions

How have these above catalysts been quantified?

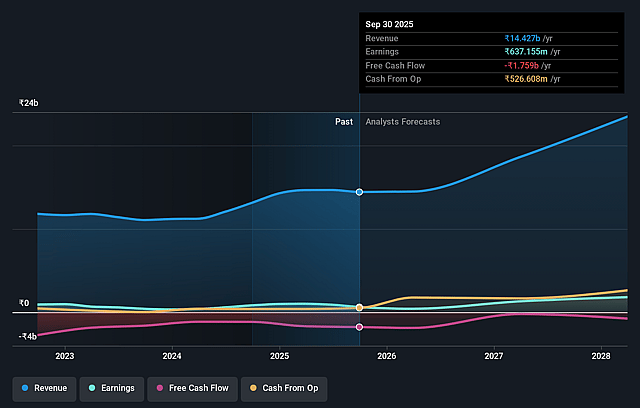

- Analysts are assuming Ganesha Ecosphere's revenue will grow by 20.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.4% today to 8.2% in 3 years time.

- Analysts expect earnings to reach ₹2.0 billion (and earnings per share of ₹75.9) by about December 2028, up from ₹637.2 million today.

- In order for the above numbers to justify the price target of the analysts, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, down from 37.9x today. This future PE is lower than the current PE for the IN Luxury industry at 20.3x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.32%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Regulatory uncertainty around the MoEF draft notification and the ability of brand owners to carry forward recycled content shortfalls over three years could prolong demand deferrals for rPET granules beyond the current year, leading to structurally lower utilization of new Warangal and greenfield capacities and weaker revenue growth.

- The business remains highly exposed to sharp swings in PET scrap prices with no available hedging mechanism, so another episode of rapid raw material inflation followed by price collapse, similar to the recent INR 55 per kg to INR 43 per kg move, could again compress gross margins and push EBITDA and net margins below management’s targeted 7 percent to 9 percent band.

- Industry wide capacity in FSSAI approved food grade rPET has already tripled from 70,000 tonnes to 210,000 tonnes while Ganesha is committing around INR 630 crores of CapEx, so if demand for bottle to bottle applications ramps more slowly than expected, the sector could face overcapacity, price pressure and lower earnings than implied by current expansion plans.

- Approximately 35 percent of revenue is tied to the higher volatility bottle to bottle rPET segment and is concentrated in a few large bottler customers, so any prolonged slowdown in beverage demand, changes in their sourcing strategy or shift toward alternative materials could materially reduce volumes and depress consolidated revenue and profitability.

- The planned long term mix shift toward higher margin rPET chips and specialty premium fibers depends on niche industrial adoption that is currently growing slowly, so if these products fail to scale or are displaced by competing materials or technologies, the anticipated margin uplift and earnings improvement from product mix enhancement may not materialize.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of ₹1782.5 for Ganesha Ecosphere based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analysts, you'd need to believe that by 2028, revenues will be ₹25.0 billion, earnings will come to ₹2.0 billion, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 16.3%.

- Given the current share price of ₹900.9, the analyst price target of ₹1782.5 is 49.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ganesha Ecosphere?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.