Key Takeaways

- Expansion of Floatz and Power brands with innovative, high-margin products is expected to drive significant revenue growth.

- Scaling zero-based merchandising and franchise expansion aims to enhance net margins and improve consumer experience efficiently.

- Execution delays in strategies and supply disruptions could impact revenue growth and margin improvements, while strategic expansion remains crucial amidst cost-cutting measures.

Catalysts

About Bata India- Manufactures and trades in footwear and accessories through its retail and wholesale network in India and internationally.

- Zero-based merchandising is being scaled to improve consumer experience and store efficiency, expected to increase revenue per square foot and enhance net margins by reducing inventory clutter and improving NPS scores.

- The launch and scaling of Floatz and Power brands with innovative products is expected to drive significant revenue growth, as they are contributing a higher margin compared to other product lines.

- Simplification of pricing in core categories, such as the women's category, is expected to enhance gross margins by consolidating price points and improving sales efficiency.

- Continued expansion of franchise stores, surpassing the 600-store milestone, should drive revenue growth and improve overall margins due to the lower cost structure of franchises.

- Improved inventory management and reduction in complexity are expected to enhance net margins by optimizing supply chain efficiencies and reducing inventory holding costs.

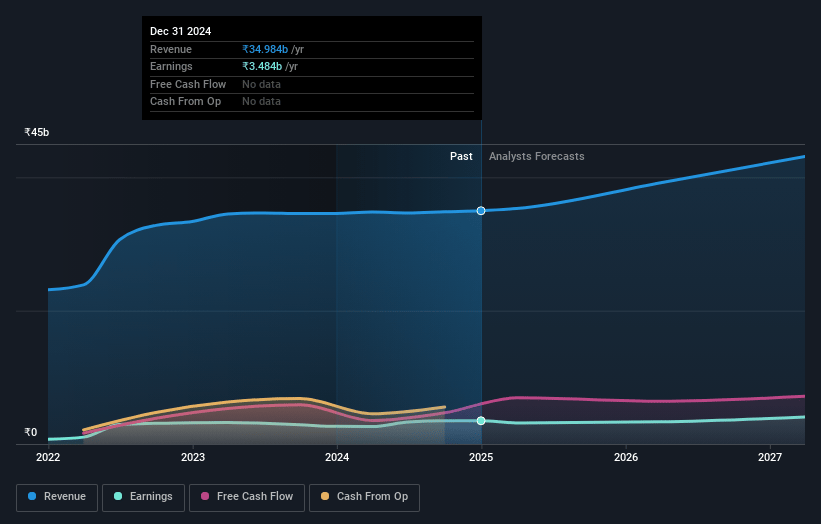

Bata India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bata India's revenue will grow by 9.6% annually over the next 3 years.

- Analysts are assuming Bata India's profit margins will remain the same at 10.0% over the next 3 years.

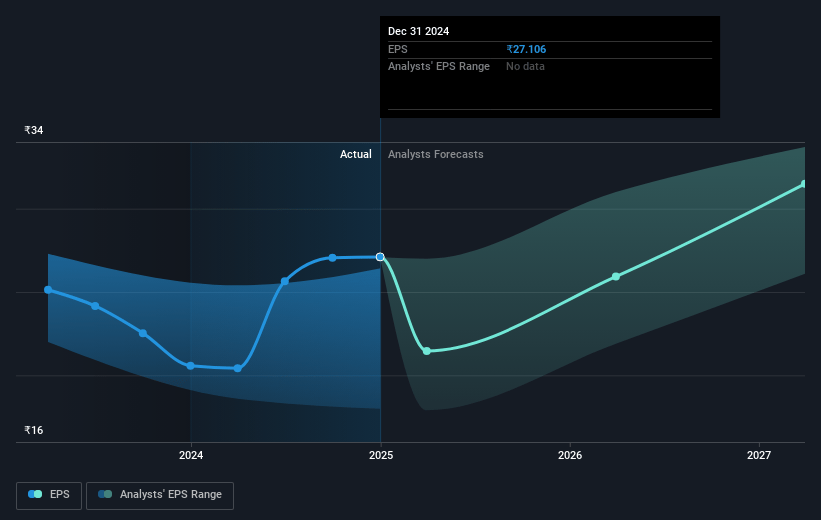

- Analysts expect earnings to reach ₹4.6 billion (and earnings per share of ₹35.63) by about February 2028, up from ₹3.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 57.3x on those 2028 earnings, up from 47.9x today. This future PE is greater than the current PE for the IN Luxury industry at 23.4x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.96%, as per the Simply Wall St company report.

Bata India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced slower-than-anticipated execution of zero-based merchandising, which may hinder planned efficiency and revenue improvements if delays continue.

- Supply disruptions were noted for the Floatz product line, impacting volumes, though the situation was mitigated by the end of the quarter, showing a potential risk to consistent revenue from this high-margin product line.

- The complexity of strategies such as store decluttering and consumer pricing adjustments may not be rapidly scalable, potentially delaying expected improvements in net margins and turnover.

- Stagnant store net additions, due to the closure of unprofitable stores, could slow overall revenue growth unless followed by consistent and strategic expansion.

- The impact of cost-cutting measures, such as VRS and factory closures, may not immediately translate to improved profitability, potentially affecting PAT margins and long-term financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1361.895 for Bata India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1689.0, and the most bearish reporting a price target of just ₹1050.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹46.1 billion, earnings will come to ₹4.6 billion, and it would be trading on a PE ratio of 57.3x, assuming you use a discount rate of 15.0%.

- Given the current share price of ₹1297.65, the analyst price target of ₹1361.89 is 4.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives