Last Update03 Oct 25Fair value Decreased 12%

Analysts have revised their price target for CMS Info Systems downward from ₹577.67 to ₹506.25. They cite a more cautious outlook on revenue growth and slight pressures on profit margins as reasons for the adjustment.

What's in the News

- Analyst and investor day hosted by CMS Info Systems Limited (Key Developments)

- Board meeting scheduled for July 23, 2025, to approve unaudited financial results and consider the acquisition of up to 100% of Securens Systems Private Limited (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has decreased significantly, from ₹577.67 to ₹506.25.

- Discount Rate has risen slightly, from 12.89% to 12.99%.

- Revenue Growth expectations have fallen considerably, from 13.45% to 10.91%.

- Net Profit Margin is marginally lower, declining from 15.70% to 15.36%.

- Future P/E ratio expectation has decreased slightly, from 25.0x to 24.0x.

Key Takeaways

- Market share gains, industry consolidation, and new value-added services are strengthening CMS's core business, improving revenue growth, pricing power, and order book quality.

- Technology-driven transformation and strong client relationships support recurring revenues, enhanced margins, and sustained outperformance despite cyclical or cost pressures.

- Structural decline in ATM usage and rising industry pressures are threatening revenue growth, margin stability, and contract profitability for CMS Info Systems.

Catalysts

About CMS Info Systems- Operates as a cash management company in India.

- Continued strength in cash usage for key segments-including government disbursements, rural financial inclusion, and semi-urban/rural banking-together with CMS's expanding logistics footprint (up 9% YoY to 153,000 touchpoints) and market share gains (now 58–60% in ATM cash) signal a persistent demand backdrop for CMS's core business, supporting medium-term revenue growth and earnings visibility.

- Accelerating industry consolidation following the exit of major competitors (e.g., AGS) and stressed smaller players is shifting market structure in favor of established, compliant firms like CMS, increasing pricing power and the ability to win high-quality, fixed-price contracts, which should benefit both revenue stability and net margins over time.

- Ongoing expansion into value-added adjacencies such as AI-based remote monitoring (via Securens acquisition), digital payments software, and direct-to-retail cash management is translating into a more diversified, higher quality order book (recent ₹500 cr in multi-year wins), enabling margin resilience and faster earnings growth even if core ATM transactions see cyclical softness.

- Enhanced automation, technology investment, and platform-centric business transformation ("unified platform limitless possibilities" repositioning) create operating leverage, driving long-term improvements in productivity and net margins as wage, compliance, and security costs rise.

- Long-duration, expanding relationships with major banks and corporates (ICICI Bank now CMS's #2 customer, major public sector software contract wins), together with a healthy forward order book (~₹1400 cr pending execution), underpin recurring revenues and support an above-market medium-term revenue growth trajectory relative to near-term investor concerns.

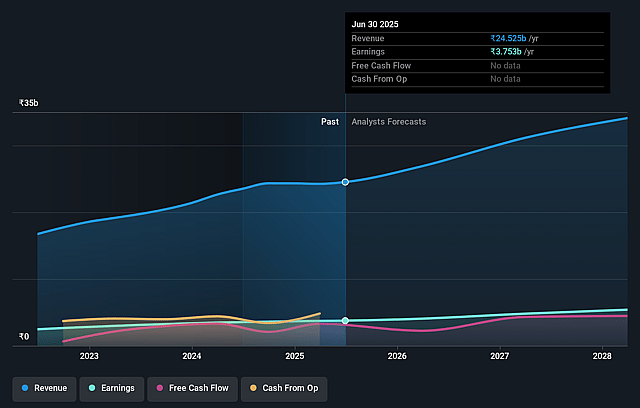

CMS Info Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CMS Info Systems's revenue will grow by 13.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.3% today to 15.7% in 3 years time.

- Analysts expect earnings to reach ₹5.6 billion (and earnings per share of ₹31.12) by about September 2028, up from ₹3.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.0x on those 2028 earnings, up from 18.2x today. This future PE is greater than the current PE for the IN Commercial Services industry at 22.3x.

- Analysts expect the number of shares outstanding to grow by 0.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.89%, as per the Simply Wall St company report.

CMS Info Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent decline in ATM transactions, a key revenue driver for CMS Info Systems, was attributed not only to muted consumption but also to broader secular trends such as digital payments adoption and potential plateauing ATM density; if this continues, it could materially impact long-term revenue growth.

- Significant margin compression in both cash and managed services segments, driven by wage inflation, higher compliance costs, and delays in revenue accruals from new investments, signals lasting pressure on net margins if costs continue to rise faster than revenue or if automation/value-added services fail to scale quickly enough.

- Delay and uncertainty in executing and ramping large contracts, often tied to complex regulatory, technological, and integration hurdles (e.g., device certifications, client onboarding timelines), introduce volatility in earnings and pose ongoing execution risk to future revenue streams.

- Increasing shift by banks from transaction-linked to fixed-price ATM management contracts is occurring alongside an overall decline in ATM transactions and selective bank outsourcing-this could limit upside for CMS if the overall addressable market declines due to secular shifts away from cash and toward digital payments, pressuring both revenue and margin stability.

- Industry consolidation and asset churn following distress in peer companies (e.g., AGS shutdowns) highlight systemic risks such as difficult asset recovery, working capital strain, and aggressive competition for fixed-price contracts, which could compress pricing power and further squeeze future earnings for CMS Info Systems.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹577.667 for CMS Info Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹620.0, and the most bearish reporting a price target of just ₹510.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹35.8 billion, earnings will come to ₹5.6 billion, and it would be trading on a PE ratio of 25.0x, assuming you use a discount rate of 12.9%.

- Given the current share price of ₹414.85, the analyst price target of ₹577.67 is 28.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.