Key Takeaways

- Reliance on timely government payments, regulatory scrutiny, and elevated finance costs may suppress margins, earnings, and limit the ability to capitalize on growth opportunities.

- Geographic concentration and rising competition expose the company to localized risks and potential loss of market share, impacting order inflow and long-term revenue growth.

- Strong government support, geographic diversification, and operational efficiencies position the company for sustained growth, stable margins, and long-term earnings visibility.

Catalysts

About Vishnu Prakash R Punglia- Operates as an engineering, procurement, and construction company in India.

- Extended delays in receivables and dependency on timely government payments are likely to increase working capital requirements and borrowing costs, which could suppress net margins and earnings over the next several quarters.

- Intensifying regulatory scrutiny and potential future requirements for environmental and social compliance may result in project delays, increased compliance costs, and operational inefficiencies, pressuring margins and affecting profitability.

- Rising competition in the infrastructure space-highlighted by other listed peers winning significant new orders-could force VPRPL into more aggressive bidding or loss of market share, impacting order inflow and future revenue growth.

- Continued concentration in a handful of geographies, despite gradual diversification efforts, exposes revenues and earnings to localized disruptions or policy changes that could hinder growth targets.

- Exposure to volatile funding environments and higher finance costs due to elevated debt levels may limit the company's ability to capitalize on government infrastructure programs, ultimately constraining revenue growth and putting pressure on net earnings.

Vishnu Prakash R Punglia Future Earnings and Revenue Growth

Assumptions

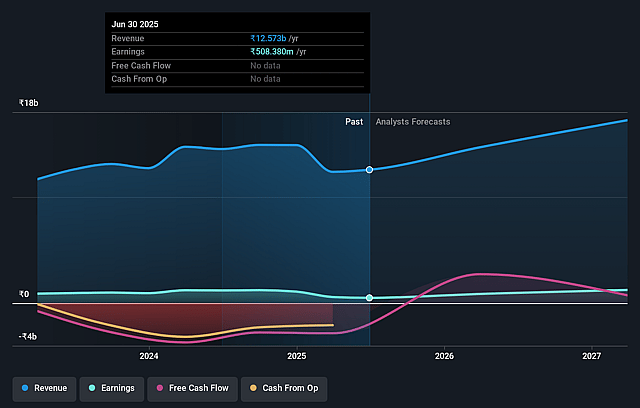

How have these above catalysts been quantified?- Analysts are assuming Vishnu Prakash R Punglia's revenue will grow by 19.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.0% today to 10.0% in 3 years time.

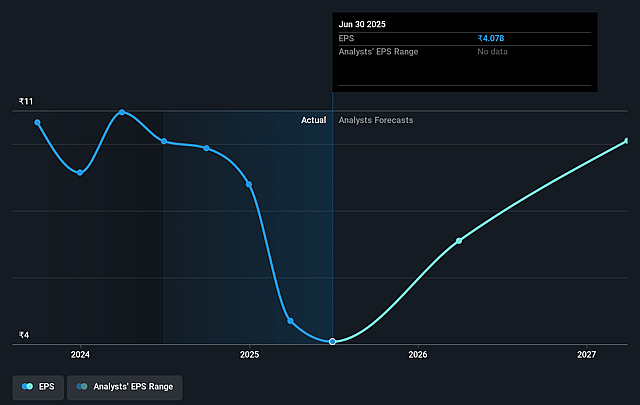

- Analysts expect earnings to reach ₹2.1 billion (and earnings per share of ₹17.24) by about August 2028, up from ₹508.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, down from 35.9x today. This future PE is lower than the current PE for the IN Construction industry at 20.5x.

- Analysts expect the number of shares outstanding to grow by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.45%, as per the Simply Wall St company report.

Vishnu Prakash R Punglia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained government focus on infrastructure and water projects, evidenced by timely release of funds from state governments (MP, UP, Rajasthan) and a robust pipeline of government-backed tenders, underpins recurring revenue streams and reduces the risk of long-term revenue decline.

- The company's expanding bidding pipeline (₹10,000–12,000 crores/year) and targeted geographic diversification into high-growth regions increase its addressable market and lower dependence on any single region, supporting future topline and earnings growth.

- Efficient project execution (90%+ on-time delivery rate) and ongoing investments in backward integration, in-house manufacturing, and machinery are likely to drive operational efficiencies and gradually improve EBITDA margins over the long run.

- Management's confidence in achieving 20–25% annual revenue growth and normalization of EBITDA margins back to historical levels (13–13.5%), once government payment cycles normalize, points toward earnings recovery and margin stability.

- The industry-wide sector tailwinds-such as continued government infrastructure spending, upcoming railway project phases, and rising urbanization-provide secular, multi-year demand visibility that can help maintain a strong order book and underpin long-term revenue and profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹131.0 for Vishnu Prakash R Punglia based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹21.3 billion, earnings will come to ₹2.1 billion, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 16.4%.

- Given the current share price of ₹146.61, the analyst price target of ₹131.0 is 11.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.