Last Update 15 Dec 25

TEGA: Planned Equity Placement And Board Actions Will Shape Balanced Risk Outlook

Analysts have slightly reaffirmed their outlook on Tega Industries, keeping the fair value estimate effectively unchanged at ₹2,034, as modest improvements in the assumed discount rate and stable long term growth and profitability expectations support the existing price target.

What's in the News

- Closed a private placement on November 28, 2025, issuing 8,592,206 equity shares at INR 1,994 each, raising about INR 17.13 billion in gross proceeds (Key Developments).

- Announced on September 18, 2025, a planned private placement of 10,033,090 equity shares at INR 1,994 each, targeting roughly INR 20.01 billion in gross proceeds, subject to regulatory and shareholder approvals (Key Developments).

- Scheduled an extraordinary shareholders meeting for October 10, 2025, in Kolkata to approve higher investment and borrowing limits, create security over company assets, and clear additional fund raising via equity or debt securities (Key Developments).

- Held a board meeting on September 26, 2025, to consider a change in the name of a proposed allottee and to discuss the annual general meeting (Key Developments).

- Set a board meeting for November 13, 2025, to review and approve unaudited standalone and consolidated financial results for the quarter and half year ended September 30, 2025 (Key Developments).

Valuation Changes

- The Fair Value Estimate is maintained at ₹2,034 per share, with no change from the prior assessment.

- The Discount Rate edged down slightly from 15.01 percent to about 14.96 percent, reflecting a marginally lower perceived risk profile.

- The Revenue Growth Assumption is effectively unchanged at around 18.34 percent, indicating stable top line expectations.

- The Net Profit Margin is steady at roughly 16.10 percent, signaling no material shift in profitability assumptions.

- The Future P/E Multiple eased slightly from about 44.83x to 44.78x, implying a marginally lower valuation multiple applied to future earnings.

Key Takeaways

- Expanding global footprint and product innovation in sustainability-oriented consumables position Tega to benefit from rising mining activity and evolving ESG requirements.

- Recurring aftermarket demand and strong operational efficiencies enhance earnings resilience, supporting stable margins and improved long-term revenue visibility.

- Global uncertainties, volatile input costs, tough competition, and stricter regulations threaten margins, cash flow stability, and growth prospects for Tega Industries.

Catalysts

About Tega Industries- Designs, manufactures, and installs process equipment and accessories for the mineral processing, mining, and material handling industries.

- The rising demand for copper and gold, driven by global electrification, EVs, infrastructure expansion, and the energy transition, is leading to increased mining activity and related capital expenditure, directly fueling Tega's order book and underpinning multi-year revenue growth.

- Tega's ongoing investments in capacity expansion and global footprint-especially the on-track Chile plant and ramp-up in Latin America and Africa-are set to unlock access to high-growth mining regions, supporting sustained export revenue growth and improved earnings visibility.

- The surge in environmental and ESG compliance requirements is pushing mining customers to favor innovative, wear-resistant, and sustainability-focused consumables, areas where Tega's product development and operational strategy are strongly aligned, potentially supporting premium pricing and margin expansion.

- Recurring aftermarket demand for consumable products, notably for high-growth platforms like DynaPrime, provides a stable, annuity-like revenue stream, enhancing earnings resilience and predictability even through cyclical industry downturns.

- Operational efficiencies, strong gross margins despite raw material volatility, and the ability to flexibly pass on supply chain and freight costs to customers support ongoing EBITDA margin stability and potential expansion as volumes increase over the next several quarters.

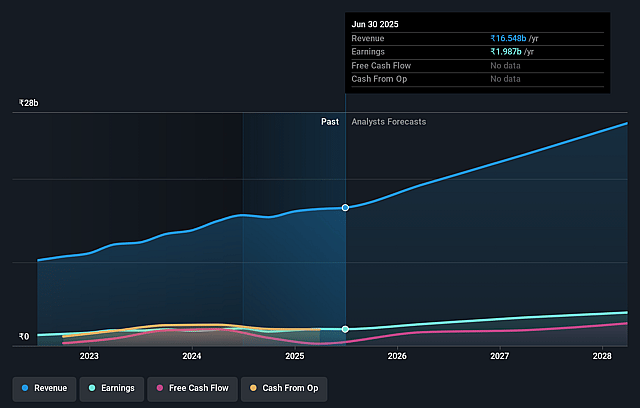

Tega Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tega Industries's revenue will grow by 19.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.0% today to 15.7% in 3 years time.

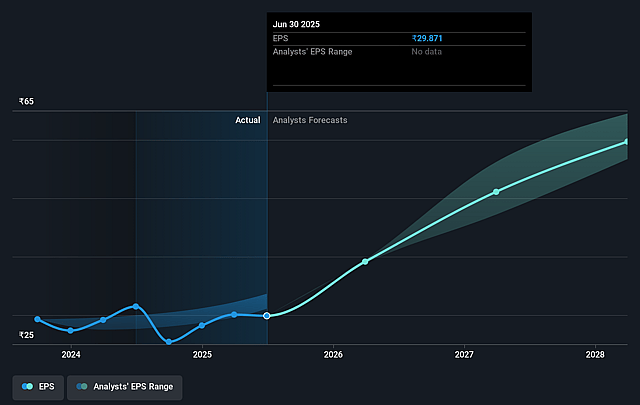

- Analysts expect earnings to reach ₹4.4 billion (and earnings per share of ₹57.54) by about September 2028, up from ₹2.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.9x on those 2028 earnings, down from 66.5x today. This future PE is greater than the current PE for the IN Machinery industry at 32.3x.

- Analysts expect the number of shares outstanding to decline by 0.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.62%, as per the Simply Wall St company report.

Tega Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged or worsening global macroeconomic and political uncertainties (such as wars, logistics bottlenecks, supply chain disruptions, and sanctions) could disrupt Tega's ability to serve international markets, which contribute approximately 90% of the company's revenues, directly impacting top-line growth and earnings visibility.

- Rising raw material price volatility (especially for rubber, steel, etc.) amid global supply chain pressures could squeeze gross margins and compress net profitability if Tega cannot pass on costs fully or faces delays in doing so, leading to potential margin erosion over time.

- Declining year-on-year revenues and margins in the key consumables business, combined with customer-driven order deferments and uncertainties in shipping schedules, introduce risks of uneven cash flows and reduced predictability of quarterly earnings.

- Intensifying competition from established global OEMs such as FLSmidth (actively expanding and lowering costs via contract manufacturing and acquisitions) and ongoing presence of Chinese players increase pricing pressure and pose risks to Tega's ability to retain or grow its market share, potentially reducing pricing power and impacting revenues and margins in the long term.

- Heightened ESG and regulatory pressures, particularly in developed markets (e.g., new US tariffs, tougher environmental regulations), could increase compliance costs and create barriers to entry, leading to higher operational expenses and limiting expansion opportunities, negatively affecting both future revenues and bottom-line performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1928.0 for Tega Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2035.0, and the most bearish reporting a price target of just ₹1725.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹27.9 billion, earnings will come to ₹4.4 billion, and it would be trading on a PE ratio of 42.9x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹1987.4, the analyst price target of ₹1928.0 is 3.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Tega Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.