Last Update 05 Sep 25

Indian Nuclear, Clean Energy And Defense Will Unlock New Markets

As key valuation metrics such as the discount rate and future P/E ratio have remained virtually unchanged, the consensus analyst price target for MTAR Technologies is also unchanged at ₹1979.

What's in the News

- Company reaffirms FY26 guidance: 25% revenue growth and 21% EBITDA margin (+/- 100 bps), driven by scale-up in clean energy and aerospace products.

- Board to review Q1 FY26 unaudited financial results and other matters.

- Secured a 10-year contract with Weatherford Products GMBH; expects to execute INR 100 million in FY26 and INR 900 million annually from FY27 via new Adibatla facility operational by June 2026.

- Received INR 192 million worth of new orders in clean energy and aerospace; successful development could yield recurring revenue of INR 100 million annually.

Valuation Changes

Summary of Valuation Changes for MTAR Technologies

- The Consensus Analyst Price Target remained effectively unchanged, at ₹1979.

- The Discount Rate for MTAR Technologies remained effectively unchanged, moving only marginally from 14.67% to 14.65%.

- The Future P/E for MTAR Technologies remained effectively unchanged, moving only marginally from 42.03x to 42.00x.

Key Takeaways

- Government and private sector investments in nuclear, clean energy, and defense position MTAR for long-term growth, expanding its addressable market and recurring revenue streams.

- Ongoing automation and facility upgrades are set to boost operational efficiency and margins, enhancing profitability as demand scales across strategic sectors.

- High working capital needs, customer concentration, debt-funded expansion, diversification risks, and regulatory changes threaten profitability, cash flow, growth, and long-term competitiveness.

Catalysts

About MTAR Technologies- A precision engineering solutions company, develops, manufactures, and sells high precision, heavy equipment, components, and machines in India and internationally.

- MTAR is poised to benefit from accelerating multi-year investments in India's civil nuclear power sector, with large orders (~₹1,000 crore expected in 3–6 months) for new and refurbishment reactor projects, a dedicated facility being set up to address growing demand, and an order pipeline extending over several years; this will structurally raise revenue visibility and support long-term earnings growth.

- Sharply rising global data center energy needs and the shift to low-carbon power are driving higher demand for Bloom Energy's fuel cells, with MTAR set to capture a higher wallet share (25–35% growth in order forecasts from Bloom for FY'27, broader product assembly mandates), leading to step-jump expansion in clean energy revenues and a likely improvement in blended net margins due to operating leverage.

- Geopolitical tensions and defense capacity constraints in Europe and Israel are unlocking strong export opportunities for MTAR in high-value aerospace and defense components, with management guiding for 80% segment growth in FY'26; recurring contracts and expanding relationships (ISRO, DRDO, leading global OEMs) will enhance long-term revenue predictability.

- The company's continued investment in automation, specialized facilities (dedicated for oil & gas, nuclear), and process innovation is expected to lift operational efficiency and support margin expansion, favorably impacting EBITDA and ROCE as revenue scales.

- The ongoing shift towards indigenous manufacturing for strategic sectors under India's self-reliance initiative is driving higher domestic capex for defense, nuclear, and space, positioning MTAR as a preferred supplier for critical components and broadening its long-term addressable market, which supports sustained revenue growth and earnings resilience.

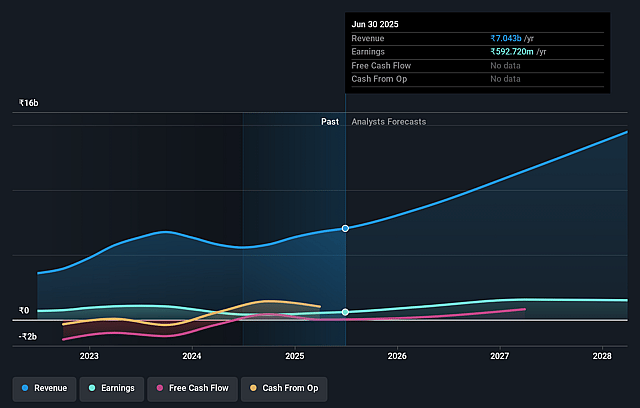

MTAR Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MTAR Technologies's revenue will grow by 30.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.4% today to 13.8% in 3 years time.

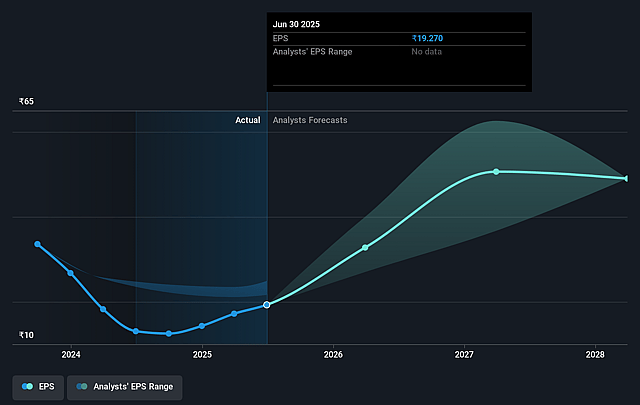

- Analysts expect earnings to reach ₹2.1 billion (and earnings per share of ₹50.14) by about September 2028, up from ₹592.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.0x on those 2028 earnings, down from 75.4x today. This future PE is greater than the current PE for the IN Machinery industry at 32.3x.

- Analysts expect the number of shares outstanding to decline by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.67%, as per the Simply Wall St company report.

MTAR Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent high working capital intensity (currently 267 days, with a target to reduce to 200 days) poses risks to free cash flow generation, especially as order execution in nuclear and aerospace ramps up; failure to manage this could pressure net margins and stretch the balance sheet.

- Heavy dependence on a few large customers, such as Bloom Energy and Indian government-linked defense/nuclear agencies, exposes MTAR to revenue volatility in the event of order delays, policy changes, or shifts in customer procurement strategies, risking future revenue and earnings visibility.

- Ambitious capacity expansions and new dedicated facilities (for nuclear and oil & gas) require substantial debt-funded capex (predominantly funded by term loans), adding leverage risk and heightening sensitivity to execution challenges; delays or underutilization can erode profitability and returns on capital.

- MTAR's strategy to diversify into new segments (clean energy, battery storage, oil & gas) and scale new product development increases operational and project execution risks; any failures in timely commercialization, technology scaling, or customer onboarding may result in cost overruns or delayed revenue realization, impacting EBITDA margins.

- Increases in global protectionist measures or regulatory changes (e.g., tariffs, local content requirements in export markets), combined with risk of technological obsolescence (such as shifts toward software-based solutions in automation/energy), may constrain MTAR's export growth potential or necessitate costly upgrades, thereby affecting both topline growth and long-term competitiveness.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1979.333 for MTAR Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2190.0, and the most bearish reporting a price target of just ₹1848.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹15.5 billion, earnings will come to ₹2.1 billion, and it would be trading on a PE ratio of 42.0x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹1453.8, the analyst price target of ₹1979.33 is 26.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.