Last Update 02 Nov 25

Fair value Increased 2.40%Analysts have revised their price target for Kalpataru Projects International upward from ₹1,408.31 to ₹1,442.18, reflecting adjustments to profit margin and valuation forecasts.

What's in the News

- KPIL and its international subsidiaries secured new orders and notifications of awards worth approximately INR 23,320 million in Power Transmission & Distribution (T&D) overseas and Buildings and Factories (B&F) business in India (Client Announcements).

- KPIL announced new orders totaling about INR 27,200 million for T&D projects in India and abroad, as well as B&F business within India. The fiscal year 2026 total order intake has reached around INR 1,26,200 million, which strengthens KPIL's position in the T&D and B&F sectors (Client Announcements).

- A board meeting is scheduled for October 31, 2025, to consider and approve unaudited standalone and consolidated financial results for the quarter and half year ending September 30, 2025 (Board Meeting).

- On August 5, 2025, a board meeting was conducted to consider a share sale agreement involving Kalpataru Power Transmission Sweden AB's equity in LMG to identified employees and a director, subject to necessary approvals regarding share splitting (Board Meeting).

Valuation Changes

- The Fair Value Estimate has risen slightly, increasing from ₹1,408.31 to ₹1,442.18.

- The Discount Rate has grown marginally from 15.69% to 15.81%.

- Revenue Growth Expectations have fallen from 9.55% to 8.78%.

- The Net Profit Margin is up slightly, moving from 4.57% to 4.64%.

- The Future P/E has declined from 30.08x to 29.16x.

Key Takeaways

- Robust order book growth, diversification into high-margin sectors, and international expansion are enhancing revenue visibility, margin profiles, and future earnings resilience.

- Effective working capital management and debt reduction are lowering financial risk and bolstering free cash flow and profitability.

- Delays in receivables, dependence on key segments, labor shortages, commodity price volatility, and rising global exposure collectively heighten risks to margins, cash flow, and earnings stability.

Catalysts

About Kalpataru Projects International- Provides engineering, procurement, and construction (EPC) services for power transmission and distribution, buildings and factories, water, railways, oil and gas, and urban infrastructure sectors in India and internationally.

- Substantial multi-year infrastructure and urbanization programs, both in India and internationally, are driving a large and growing EPC project pipeline; Kalpataru's record order book (up 14% YoY to ₹65,475 crores as of June 2025) and 20–25% guided revenue growth reflect underappreciated visibility in future revenues and earnings.

- Major expansion and investment in grid modernization and energy transition (including renewables, grid expansion, and HVDC projects) are resulting in strong order inflows and execution in the high-margin T&D segment (30% YoY growth in order book), likely supporting top-line acceleration and EBITDA margin expansion.

- Deepening capabilities in design-build and smart infrastructure projects (such as large-scale residential and data center orders) are set to diversify revenue streams, improve project complexity, and raise overall margin profiles, leading to resilient earnings growth.

- Strong improvements in working capital days and a 26% YoY reduction in net debt (consolidated) are decreasing financial risk and interest costs, directly supporting higher net earnings and free cash flow generation in future periods.

- Increasing penetration in international markets (Nordics, Middle East, Africa) and a strategic approach to value unlocking (e.g., LMG Sweden IPO) are reducing geographic concentration risk and providing new growth levers that may not be fully reflected in current valuations, potentially boosting both revenue and margin visibility.

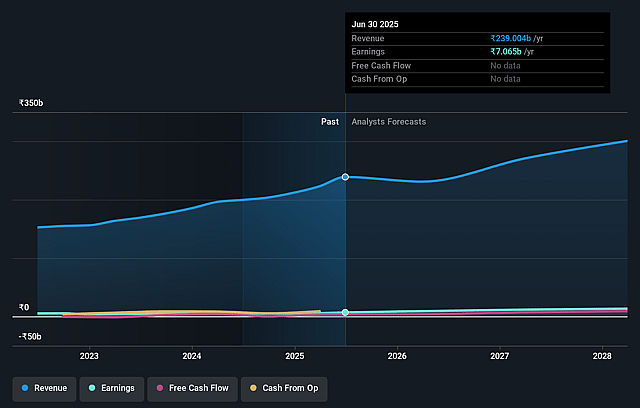

Kalpataru Projects International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kalpataru Projects International's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 4.6% in 3 years time.

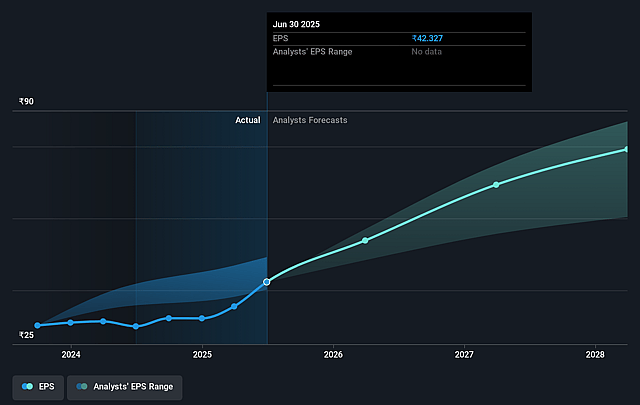

- Analysts expect earnings to reach ₹14.4 billion (and earnings per share of ₹84.05) by about September 2028, up from ₹7.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹10.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.1x on those 2028 earnings, down from 30.8x today. This future PE is greater than the current PE for the IN Construction industry at 20.9x.

- Analysts expect the number of shares outstanding to grow by 5.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.69%, as per the Simply Wall St company report.

Kalpataru Projects International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent delays in receivables collection from certain state government-funded Water projects, particularly in UP and Jharkhand, create risk of elevated working capital, reduced cash flow, and uncertainty in collecting over ₹1,000 crores of outstanding payments, which could negatively impact net margins and liquidity.

- Continued subdued performance and breakeven/negative margins in lower-margin segments like Water, Railways, and Fasttel, combined with concentrated growth and profitability in T&D and B&F, heighten the risk that any slowdown or execution challenge in the higher-margin segments could have an outsized negative impact on consolidated earnings.

- The company's ability to maintain high growth depends on continued labor availability and productivity improvements; labor shortages in India remain the primary operational challenge and, if unresolved, could constrain project execution pace, increase costs, and impact revenue growth projections.

- 35% of the order book is subject to variable commodity price risk (primarily steel), and while hedging is implemented, a sudden sharp increase (e.g., a doubling as seen post-COVID) could not be fully mitigated, potentially compressing project margins and reducing EBITDA.

- Aggressive international expansion and growing exposure to new geographies and large projects (including potential LMG IPO and Middle East Oil & Gas ventures) increase execution and geopolitical risks; unfamiliar regulatory and operating environments could lead to cost overruns, delays, or lower-than-expected margins, impacting long-term earnings stability and return on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1408.312 for Kalpataru Projects International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1572.0, and the most bearish reporting a price target of just ₹1235.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹314.3 billion, earnings will come to ₹14.4 billion, and it would be trading on a PE ratio of 30.1x, assuming you use a discount rate of 15.7%.

- Given the current share price of ₹1272.4, the analyst price target of ₹1408.31 is 9.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.