Last Update19 Aug 25Fair value Decreased 13%

The consensus price target for Inox Wind has been lowered to ₹206.00, primarily reflecting concerns about declining net profit margins, despite strengthened revenue growth forecasts.

What's in the News

- Inox Wind announced a 51 MW order from First Energy Private Limited for 3 MW turbines in Tamil Nadu, including EPC and multi-year O&M services.

- The board is considering and proceeding with a rights issue, including determining record date, issue price, rights entitlement ratio, and related matters.

- Inox Wind filed a follow-on equity offering totaling INR 12.5 billion through a rights offering under Regulation S.

- Appointment of Shri Sanjeev Aganval as CEO, replacing Kailash Lal Tarachandani.

- Upcoming board meetings to approve unaudited Q1 FY26 results, appoint secretarial auditors, and consider ESOP grants.

Valuation Changes

Summary of Valuation Changes for Inox Wind

- The Consensus Analyst Price Target has significantly fallen from ₹235.57 to ₹206.00.

- The Net Profit Margin for Inox Wind has significantly fallen from 13.29% to 11.30%.

- The Consensus Revenue Growth forecasts for Inox Wind has significantly risen from 46.4% per annum to 51.5% per annum.

Key Takeaways

- Expansion into solar and ambitious infrastructure plans are anticipated to drive significant revenue growth and open new revenue streams.

- Improved credit ratings are expected to lower financing costs, enhancing net earnings and financial stability.

- Challenges in land acquisition, grid connectivity, and project approvals may delay revenue, while competitive and scaling risks threaten profitability and financial predictability.

Catalysts

About Inox Wind- Engages in the manufacture and sale of wind turbine generators and components for independent power producers, utilities, public sector undertakings, businesses, and private investors in India.

- The commissioning of Inox Wind's nacelle manufacturing unit, operationalization of cranes, and commencement of transformer manufacturing lines within Q4 FY '25 are expected to enhance operational efficiency and reduce costs, potentially leading to improved net margins.

- Inox Wind's focus on expanding its project infrastructure for ambitious execution plans is anticipated to significantly accelerate revenue growth starting in FY '26.

- The synergistic venture into solar manufacturing through Inox Solar, allowing for comprehensive hybrid contracts, is likely to open new revenue streams and potentially improve overall earnings.

- India's awarding of 15.5 gigawatts of wind-related tenders and the growth in the C&I segment present substantial future demand, which can markedly increase Inox Wind's order book and revenues.

- The recent upgrades in Inox Wind's credit ratings for both short-term and long-term facilities are expected to reduce financing costs, thereby positively impacting net earnings and financial stability.

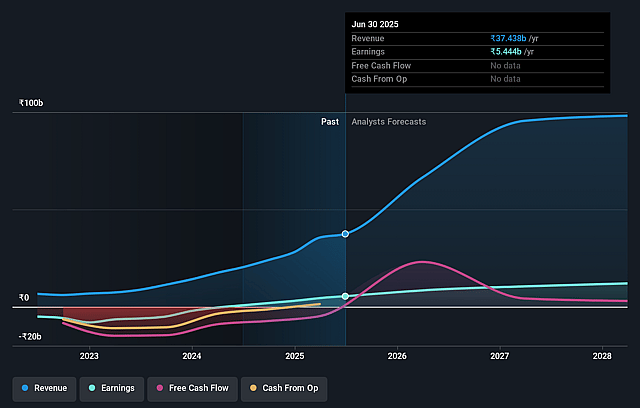

Inox Wind Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Inox Wind's revenue will grow by 51.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.5% today to 10.6% in 3 years time.

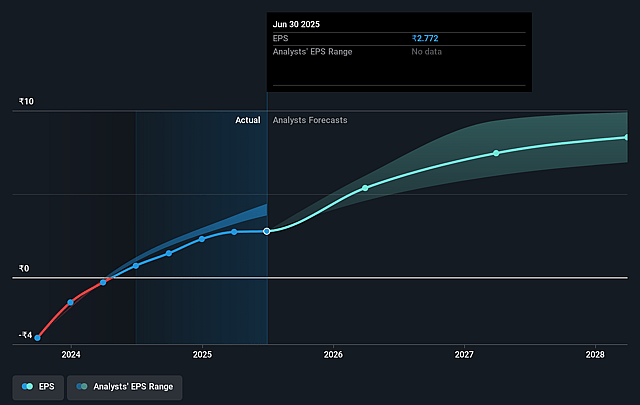

- Analysts expect earnings to reach ₹13.9 billion (and earnings per share of ₹8.16) by about August 2028, up from ₹5.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.9x on those 2028 earnings, up from 45.1x today. This future PE is greater than the current PE for the IN Electrical industry at 37.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.92%, as per the Simply Wall St company report.

Inox Wind Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Challenges related to on-ground project execution, such as land acquisition and grid connectivity issues, could impact Inox Wind's ability to meet its output goals, potentially affecting revenue and delaying project completion.

- Dependence on receiving the necessary approvals for commissioning turbines, with 200 MW awaiting such permissions, could delay revenue recognition and impact cash flows.

- As competitors, including MNCs and Chinese companies, operate in the market with potentially different dynamics and cost structures, Inox Wind's competitive position and margin sustainability might be challenged, affecting profitability.

- Execution risks associated with rapidly scaling new manufacturing initiatives like crane and transformer manufacturing could affect profit margins and cost structures if inefficiently managed, influencing net margins.

- Variability in order intake from both external markets and affiliated group companies adds uncertainty to future revenue projections, which may impact financial predictability and investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹206.0 for Inox Wind based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹281.0, and the most bearish reporting a price target of just ₹154.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹130.7 billion, earnings will come to ₹13.9 billion, and it would be trading on a PE ratio of 48.9x, assuming you use a discount rate of 15.9%.

- Given the current share price of ₹142.03, the analyst price target of ₹206.0 is 31.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.