Key Takeaways

- Completion of the e-beam facility and auto cable expansion could enhance revenue and net margins through higher capacity utilization and economies of scale.

- Strategic initiatives in 5G infrastructure, fiber production expansion, and improved procurement methods may bolster revenue growth and profitability despite recent margin pressures.

- Falling raw material prices and price erosion in core segments threaten Finolex Cables' margins and profitability, despite increased volumes and project sales.

Catalysts

About Finolex Cables- Engages in the manufacture and sale of electrical and communication cables, and other electrical appliances in India and internationally.

- Finolex Cables has completed its e-beam facility, which is expected to begin generating revenue soon, potentially increasing operational capacity and overall revenue.

- The completion and production commencement of the auto cable expansion and the e-beam facility are anticipated by the end of the fiscal year, which could lead to increased revenue and improved net margins due to higher capacity utilization and economies of scale.

- The procurement of BSNL tenders in collaboration with partners and the ongoing rollout of 5G infrastructure and data centers present significant growth opportunities, which could positively impact revenue and earnings in the medium to long term.

- The volatility in copper prices has pressured margins recently, but stabilization and strategic procurement could prevent further margin erosion and offer potential margin improvement.

- The expansion of fiber draw capacity and backward integration in optic fiber production are expected to reduce costs and increase margins, improving profitability in the communication cables segment.

Finolex Cables Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Finolex Cables's revenue will grow by 12.2% annually over the next 3 years.

- Analysts are assuming Finolex Cables's profit margins will remain the same at 11.3% over the next 3 years.

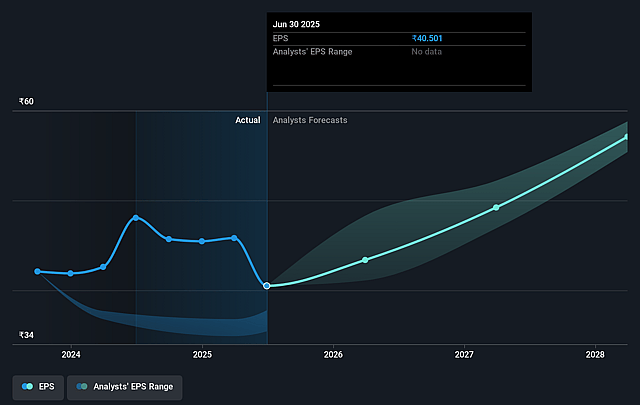

- Analysts expect earnings to reach ₹8.8 billion (and earnings per share of ₹55.12) by about August 2028, up from ₹6.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.8x on those 2028 earnings, up from 20.5x today. This future PE is lower than the current PE for the IN Electrical industry at 39.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.63%, as per the Simply Wall St company report.

Finolex Cables Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Finolex Cables faced a difficult quarter due to high inventories and the need to cut prices as copper prices fell sharply, impacting margins negatively. This volatility in raw material prices could continue to pressure net margins.

- The company is experiencing lower realizations in communication cables, despite higher volumes, due to falling copper prices and reduced fiber prices. This could negatively impact overall revenue and earnings if downward price trends persist.

- Execution and demand normalization are uncertain as recent destocking of electrical wires due to speculative purchasing behavior amid sharp commodity price fluctuations has contributed to muted volume growth. This volatility introduces risks to stable revenue generation.

- The competitive market and price erosion in the Lighting segment present risks, particularly as price erosion erodes realized revenue, putting pressure on earnings growth despite potential volume increases.

- Financial results and cash flow are further pressured by project-based selling when compared to pure retail, where project sales often have finer pricing, impacting overall margins and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1215.286 for Finolex Cables based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹77.7 billion, earnings will come to ₹8.8 billion, and it would be trading on a PE ratio of 32.8x, assuming you use a discount rate of 15.6%.

- Given the current share price of ₹829.15, the analyst price target of ₹1215.29 is 31.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.