Last Update 27 Aug 25

Fair value Decreased 4.63%The slight reduction in Finolex Cables’ future P/E multiple, alongside stable net profit margins, has prompted a downward revision in the consensus analyst price target from ₹1215 to ₹1159.

What's in the News

- Board meeting scheduled to consider and approve unaudited standalone and consolidated financial results for the quarter ended June 30, 2025.

Valuation Changes

Summary of Valuation Changes for Finolex Cables

- The Consensus Analyst Price Target has fallen slightly from ₹1215 to ₹1159.

- The Future P/E for Finolex Cables has fallen slightly from 32.75x to 31.59x.

- The Net Profit Margin for Finolex Cables remained effectively unchanged, moving only marginally from 11.30% to 11.21%.

Key Takeaways

- Strong demand from infrastructure and digitalization projects, capacity headroom, and product mix enhancements are set to drive both revenue and margin growth.

- Expanded focus on higher-margin cables and FMEG segments, improved retail reach, and reduced import reliance should strengthen earnings as operating leverage kicks in.

- Reliance on low-margin, project-based sales, slow diversification, fierce competition, and high costs are restraining profit growth and increasing revenue volatility.

Catalysts

About Finolex Cables- Engages in the manufacture and sale of electrical and communication cables, and other electrical appliances in India and internationally.

- Accelerating completion of real estate and infrastructure projects in India is expected to trigger a strong demand cycle for wires and cables over the next several quarters; this aligns with an uptick in retail and project sales, potentially boosting Finolex Cables' volume growth and revenue from both housing and large-scale government electrification initiatives.

- The company's ramp-up in its optical fiber and communication cables business, supported by backward integration (in-house preform manufacturing) and anticipated order flows from large government digitalization/5G projects (e.g., BharatNet Phase 3), should lead to higher-margin sales and reduce import dependence, enhancing both top-line growth and segment margins over the medium term.

- Substantial unutilized capacity (30-40% headroom) in electrical cables and recently established e-beam facility provide operating leverage opportunities; as demand recovers and capacity utilization rises, fixed costs will be better absorbed and margins are likely to normalize back to targeted 12%+ over the next few quarters, benefiting company-wide earnings.

- Ongoing investments in brand building and expansion of retail distribution, especially in the FMEG (Fast-Moving Electrical Goods) segment, are expected to support premiumization and drive higher-margin growth channels, potentially leading to a more favorable revenue mix and improved net margins as new product lines and expanded reach take effect.

- Strategic shift to participate more actively in power cable projects-without major capex-positions Finolex to capitalize on growing utility, data center, and infrastructure orders in India, directly leveraging long-term government infrastructure trends to drive both revenue and EBIT, provided project execution and payment risks remain controlled.

Finolex Cables Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Finolex Cables's revenue will grow by 12.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 11.3% today to 11.2% in 3 years time.

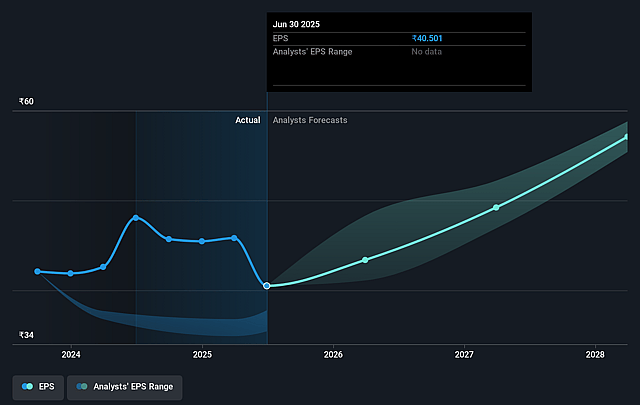

- Analysts expect earnings to reach ₹8.7 billion (and earnings per share of ₹54.24) by about September 2028, up from ₹6.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.6x on those 2028 earnings, up from 21.2x today. This future PE is lower than the current PE for the IN Electrical industry at 36.8x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.64%, as per the Simply Wall St company report.

Finolex Cables Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent margin pressure due to a shift in sales mix toward project-based business (where competition is fierce, and pricing is discounted), as opposed to higher-margin retail sales, is eroding EBITDA and net margins, limiting the company's ability to improve profitability even as volumes grow.

- Underperformance relative to peers in both top-line growth and margin improvement over a multi-year period (as noted in comparison to market leaders) suggests rising industry competition and possible loss of market share, which may constrain long-term revenue and earnings growth.

- Slow progress and margin drag in newer business segments like FMEG (Fast-Moving Electrical Goods) and communication cables – where Finolex remains reliant on third-party manufacturers and faces significant price erosion – indicates a lack of diversification and insufficient uptake of higher value-add segments, constraining future revenue and gross margin expansion.

- Delays in large government-driven infrastructure projects and dependence on execution of such projects (e.g., BharatNet, optical fiber rollouts) make communication cable and related business lines exposed to unpredictable demand and long cash cycles, increasing the risk of underutilization and revenue volatility.

- Ongoing requirement for high promotional and advertising spends (resulting in higher operating costs) combined with modest incremental capex in core electrical cable business, and only limited greenfield expansion, may limit the company's ability to drive volume growth or meaningfully enhance net margin and earnings in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1159.0 for Finolex Cables based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1250.0, and the most bearish reporting a price target of just ₹1031.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹77.4 billion, earnings will come to ₹8.7 billion, and it would be trading on a PE ratio of 31.6x, assuming you use a discount rate of 15.6%.

- Given the current share price of ₹856.85, the analyst price target of ₹1159.0 is 26.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.