Key Takeaways

- Expansion across products, electric vehicles, and global markets positions Ashok Leyland for diversified growth and reduced exposure to domestic market shifts.

- Operational focus on premiumization, digitalization, and industry tailwinds supports margin expansion, stronger cash flows, and resilience to regulatory changes.

- Heavy capital investment amid tepid domestic growth and industry transitions could pressure margins, with profitability and expansion hinging on demand recovery, cost control, and successful EV execution.

Catalysts

About Ashok Leyland- Engages in the manufacture and sale of commercial vehicles in India and internationally.

- Significant expansion of bus and truck capacity, new product launches (including LNG and bi-fuel vehicles), and network additions position Ashok Leyland to capture rising demand driven by infrastructure investment, urbanization, and the transition to fully-built vehicles. This is expected to drive volume growth and higher revenue realization.

- Accelerated progress and traction in electric vehicles (e-trucks and buses via Switch and OHM), with growing order books, increasing fleet size, and expansion of E-MaaS offerings, align with government incentives and demand for clean mobility. This should progressively diversify the revenue mix, capture higher-margin business, and improve long-term earnings visibility.

- Robust growth in international markets (notably GCC, Africa, and SAARC), supported by local presence, tailor-made products, and capacity ramp-up, reduces dependency on the domestic cycle and provides a buffer to top-line and margin volatility.

- Ongoing focus on premiumization, digitalization, and operational efficiency (e.g., cost controls, better product mix, higher-margin offerings, and price realization) supports margin expansion, contributing to stronger EBITDA and net profit growth over time.

- Benefiting from industry formalization and regulatory tailwinds (e.g., increasing fleet replacement, stricter emission norms, scrappage policy, and payment security on government tenders), Ashok Leyland stands to capture increased market share, recurring revenue streams, and resilient future cash flows as an established domestic manufacturer.

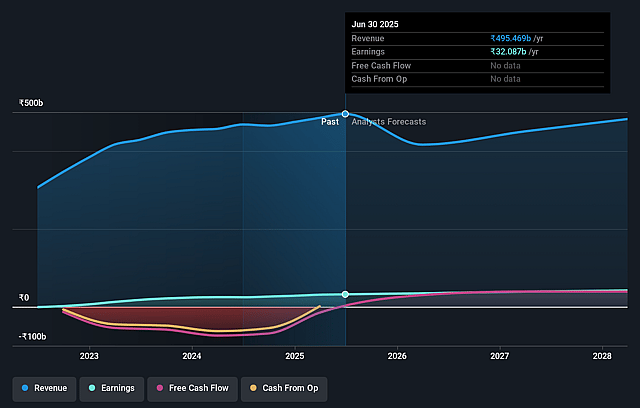

Ashok Leyland Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ashok Leyland's revenue will decrease by 0.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.5% today to 8.9% in 3 years time.

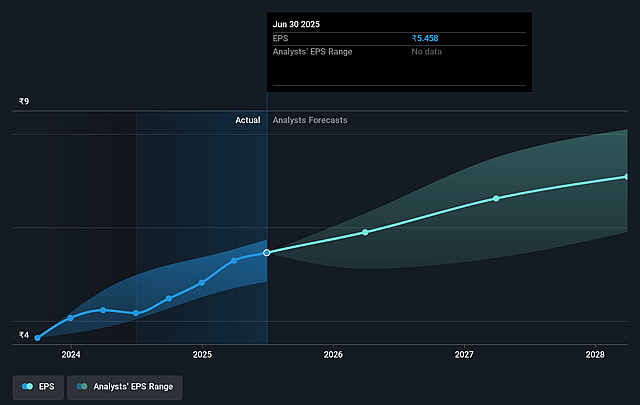

- Analysts expect earnings to reach ₹44.0 billion (and earnings per share of ₹7.86) by about August 2028, up from ₹32.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹35.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.3x on those 2028 earnings, up from 24.4x today. This future PE is lower than the current PE for the IN Machinery industry at 30.8x.

- Analysts expect the number of shares outstanding to decline by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.91%, as per the Simply Wall St company report.

Ashok Leyland Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite strong recent financial performance, Ashok Leyland's domestic MHCV industry volumes have remained flattish or declined for several years, with the management acknowledging that replacement demand is slow to recover and that growth in FY '26 is only expected to be mid-single-digit-indicating long-term growth headwinds and possible pressure on revenue expansion.

- The company is undertaking significant capital expenditure for bus plant expansion and investments in subsidiaries like OHM, while simultaneously relying on expectations of demand growth and higher capacity utilization; if that demand does not materialize as projected, this could result in underutilized assets, working capital strain, and margin pressure.

- Ashok Leyland's growing focus on premiumization, new product launches (including fully built buses and high-horsepower tippers), and passing regulatory costs (such as mandatory AC cabins) has so far supported profitability, but persistent input cost volatility (especially steel prices and commodities) as well as challenges in consistently passing costs to customers could squeeze net margins over time.

- In the strategic area of electric vehicles (EVs) and E-MaaS (Electric-Mobility-as-a-Service), the company highlights ramp-up in Switch India and OHM, but continued capital infusions are required and the path to long-term profitability is unproven, especially as market competition intensifies and the scale shift from ICE to EVs could create topline and margin risks if execution lags sector trends.

- International growth, though strong in GCC and selected markets, remains limited by capacity bottlenecks and is still a relatively small contributor overall; with persistent reliance on the Indian market, Ashok Leyland's revenues and earnings are vulnerable to domestic policy changes, financing landscape instability, and any shocks to domestic CapEx or transportation demand cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹137.778 for Ashok Leyland based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹155.0, and the most bearish reporting a price target of just ₹100.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹494.4 billion, earnings will come to ₹44.0 billion, and it would be trading on a PE ratio of 29.3x, assuming you use a discount rate of 16.9%.

- Given the current share price of ₹133.1, the analyst price target of ₹137.78 is 3.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.