Key Takeaways

- Skipper's strategic shifts into substation EPC projects and renewable energy position the company for sustained revenue and margin growth.

- Enhancing operational efficiencies through SAP implementation and capacity expansion supports Skipper's ability to meet rising demand and improve profitability.

- Capacity constraints and reliance on T&D projects may limit revenue growth, while new ventures and commodity volatility pose risks to profitability and diversification.

Catalysts

About Skipper- Manufactures and sells transmission and distribution structures, telecom towers, and fasteners in India.

- Skipper's strategic expansion into substation EPC projects, which offer significant margin potential, could drive higher earnings due to increased revenue from more diverse project offerings.

- The implementation of SAP S/4HANA RISE is expected to enhance operational efficiencies, potentially leading to improved net margins by optimizing resource utilization and enabling real-time decision-making.

- The planned 75,000-tonne capacity expansion is expected to increase production capabilities, allowing Skipper to meet rising demand, particularly in the T&D sector, contributing to future revenue growth.

- Skipper's strong order book and growing presence in international markets, backed by a robust pipeline and key contract wins, provide visibility for sustained revenue growth in the coming years.

- The ongoing global transition towards renewable energy and electrification presents long-term opportunities, aligning with Skipper's strategic focus and potentially boosting revenues and net margins.

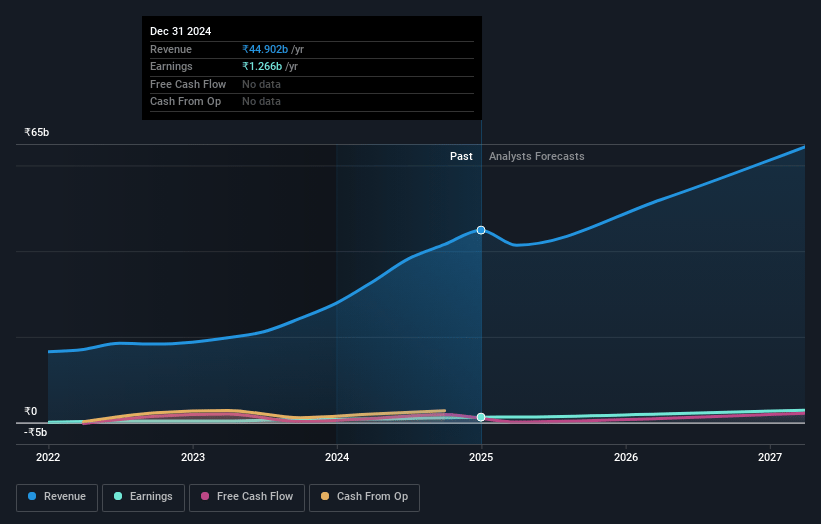

Skipper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Skipper's revenue will grow by 17.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.8% today to 5.1% in 3 years time.

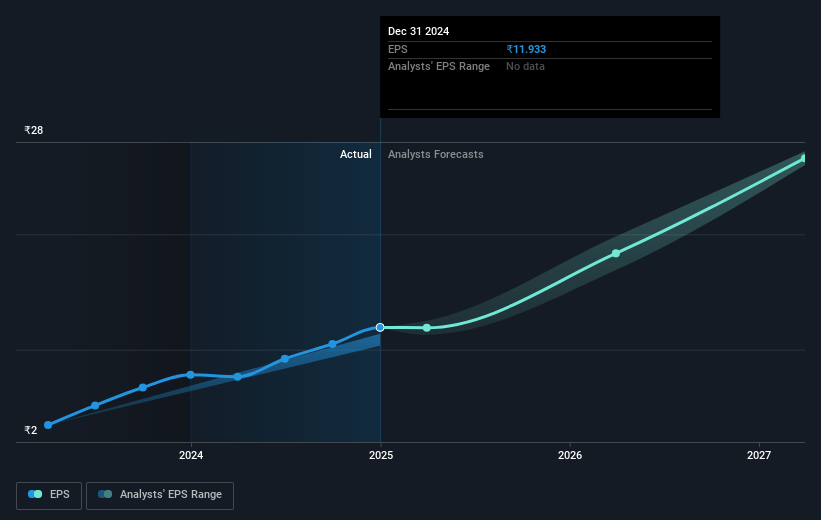

- Analysts expect earnings to reach ₹3.7 billion (and earnings per share of ₹34.17) by about February 2028, up from ₹1.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.0x on those 2028 earnings, down from 46.6x today. This future PE is greater than the current PE for the IN Construction industry at 24.1x.

- Analysts expect the number of shares outstanding to grow by 4.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.18%, as per the Simply Wall St company report.

Skipper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is facing capacity constraints, which may limit its ability to take on more orders and expand revenues in the near term. This could impact overall revenue growth.

- There is a heavy reliance on executing Transmission & Distribution (T&D) projects, which tend to yield higher margins. A shift or slowdown in demand away from T&D projects could affect net margins as non-T&D projects reportedly involve lower margins.

- While the polymer segment has potential for growth, it has been experiencing headwinds due to volatile commodity prices and lower government allocation to related projects, which could negatively affect earnings from this segment.

- The company is exploring entry into the substation sector to capture margin potential, but being new to this area, there is a risk of execution challenges, which could impact profitability and margins if not successfully managed.

- Export revenues currently constitute a smaller percentage of total revenues and are limited by ongoing capacity constraints. Without significant capacity expansions, the potential growth in export revenues may be restricted, affecting overall revenue diversification.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹642.5 for Skipper based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹72.8 billion, earnings will come to ₹3.7 billion, and it would be trading on a PE ratio of 36.0x, assuming you use a discount rate of 14.2%.

- Given the current share price of ₹478.9, the analyst price target of ₹642.5 is 25.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives