Key Takeaways

- Capacity expansion and innovation in renewable energy cables position KEI to capture growing infrastructure and green power demand, boosting revenue and margins.

- Export growth, geographic diversification, and a strengthened distribution network will stabilize earnings and enhance pricing power.

- Increasing competition, capacity risks, volatile exports, and rising operational demands threaten KEI Industries' pricing power, margin growth, and overall financial stability.

Catalysts

About KEI Industries- Manufactures, sells, and markets wires and cables in India and internationally.

- Large ongoing investments in new manufacturing capacity (Sanand plant) will significantly increase production of LT/HT and extra high-voltage cables in the next 12–24 months, positioning KEI to benefit from accelerating urban infrastructure, smart cities, and electrification demand; this will drive strong volume-led revenue growth and eventual operating leverage on net margins.

- Accelerated transition to renewable energy, with KEI investing in new processes (such as electron beam/radiation for solar cables) and targeting solar, wind, and HVDC cable markets, positions the company to capitalize on surging capex in green power, translating this sector's secular growth into top-line and margin expansion.

- Sustained robust export growth strategy, with diversification into new geographies (e.g., U.S., Europe) and sectors (utility/EPC), will reduce domestic cyclicality and stabilize earnings, while higher export mix is expected to lift EBITDA margins as scale is achieved.

- Ongoing expansion of the dealer/distribution network in underpenetrated regions (South and East India) and rising B2C cable/wire sales will enable KEI to further tap rising per capita wire/cable consumption, increasing both revenue and potential pricing power over time.

- Strong pipeline in extra high-voltage and infrastructure cables-supported by government push for power reforms, transmission upgrades, and data center investment-provides visibility for future institutional order flow and supports blended margin improvement as higher-value products scale.

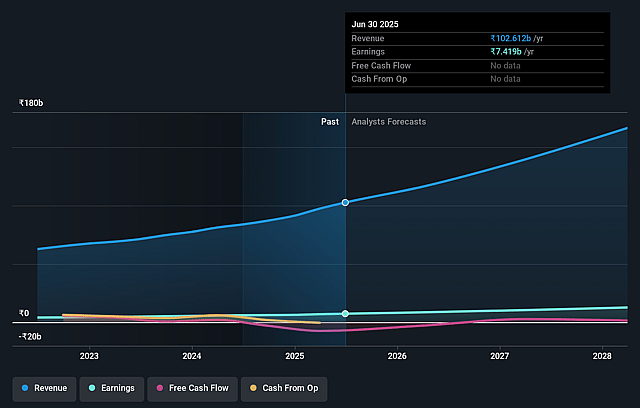

KEI Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming KEI Industries's revenue will grow by 18.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.2% today to 7.7% in 3 years time.

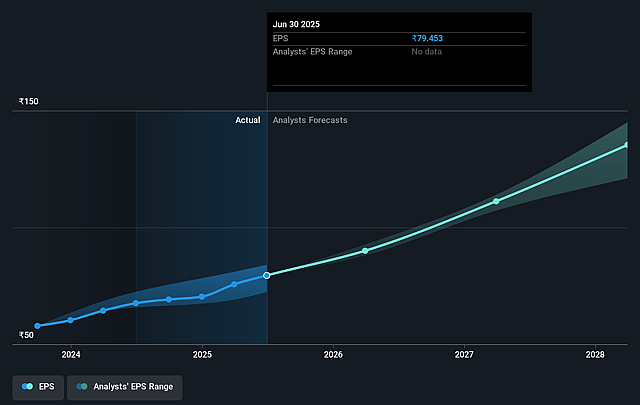

- Analysts expect earnings to reach ₹13.3 billion (and earnings per share of ₹129.27) by about August 2028, up from ₹7.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹11.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 57.2x on those 2028 earnings, up from 49.1x today. This future PE is greater than the current PE for the IN Electrical industry at 40.7x.

- Analysts expect the number of shares outstanding to grow by 5.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.65%, as per the Simply Wall St company report.

KEI Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition, including both new domestic entrants and established global players (e.g., in Australia and other exports markets), could lead to persistent price pressure, affecting KEI Industries' long-term pricing power and potentially compressing net margins.

- Rapid capacity additions and aggressive CapEx at Sanand and other sites carry the risk of underutilization if market demand, particularly in export or high-voltage segments, fails to meet expectations, which may weigh on revenue growth and return on assets.

- Export growth is largely dependent on securing short-term project contracts; the absence of long-term agreements, evolving tariff uncertainty (particularly with the U.S.), and exposure to shifting global trade dynamics could lead to volatility in export revenues and earnings.

- Despite historical margin stability, greater mix shift towards lower-margin cable segments, limited quantifiable logistics cost savings from new plants, and normalization of high-growth B2C housing wires may curb future operating margin expansion.

- Recurring high working capital needs, ongoing CapEx requirements, and the dependency on rapid order execution (typically within 3–5 months) expose KEI Industries to elongated receivables cycles or project delays, which could impact cash flow stability and ultimately earnings consistency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹4340.048 for KEI Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5100.0, and the most bearish reporting a price target of just ₹3035.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹171.9 billion, earnings will come to ₹13.3 billion, and it would be trading on a PE ratio of 57.2x, assuming you use a discount rate of 15.6%.

- Given the current share price of ₹3809.75, the analyst price target of ₹4340.05 is 12.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.