Last Update05 Sep 25

The Consensus Analyst Price Target for Pitti Engineering remained unchanged at ₹1126, with a slight decrease in the forward P/E ratio reflecting marginally lower growth expectations.

What's in the News

- Board meeting scheduled to consider and approve unaudited financial results for the quarter ended June 30, 2025.

Valuation Changes

Summary of Valuation Changes for Pitti Engineering

- The Consensus Analyst Price Target remained effectively unchanged, at ₹1126.

- The Future P/E for Pitti Engineering has fallen slightly from 30.55x to 29.92x.

- The Discount Rate for Pitti Engineering remained effectively unchanged, moving only marginally from 16.53% to 16.57%.

Key Takeaways

- Rising demand from electrification, renewables, and supply chain shifts is expanding Pitti Engineering's customer base and supporting strong, diversified growth prospects.

- Strategic integration, automation, and capacity investments are enabling margin expansion and positioning the company for sustained earnings growth across high-value segments.

- Execution risks, supply chain disruptions, rising debt, and customer concentration threaten liquidity, revenue growth, and earnings stability amid changing market and regulatory conditions.

Catalysts

About Pitti Engineering- Manufactures and sells iron and steel engineering products in India.

- The ongoing electrification of industrial and consumer sectors, along with increasing investments in renewable energy and grid modernization, is driving robust demand for Pitti Engineering's products, evidenced by strong order visibility and a broadening customer base across sectors like data centers, wind power, railways, and mining. This is expected to support double-digit revenue growth and higher operating leverage.

- Nearshoring and supply chain diversification trends, especially as global OEMs diversify away from China, continue to favor Indian manufacturers. Pitti Engineering is capitalizing on this through long-term export agreements, increased RFQs from US and EU clients, and a growing share of export revenues, which is likely to compound topline growth and diversify revenue streams.

- Backward integration via recent acquisitions and investments in automation are enabling the company to expand into higher-margin, value-added product categories (such as machined castings and integrated assemblies), boosting EBITDA margins and improving return on capital employed over time.

- The strategic ₹150 crore brownfield CapEx being deployed over the next 18 months will meaningfully expand capacity in core verticals, positioning Pitti Engineering to fully capitalize on visible demand, increase capacity utilization, and lift both revenues and margins starting from FY27.

- The acceleration of electric transport (such as railways, metros, and electric mobility), as well as growing penetration in renewable energy, data centers, and high-margin railway components, is expanding the addressable market for Pitti's integrated solutions and supporting a multiyear runway of earnings and margin expansion.

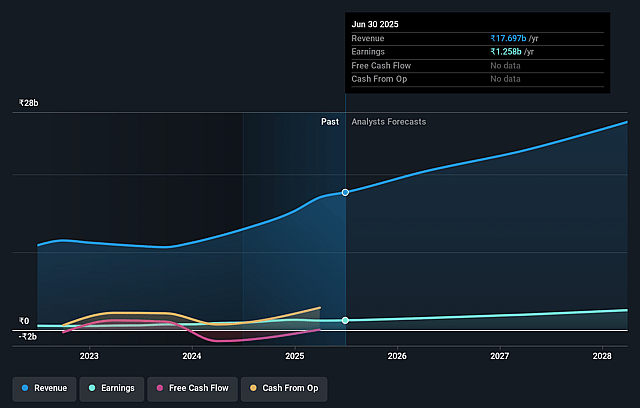

Pitti Engineering Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pitti Engineering's revenue will grow by 15.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.1% today to 9.7% in 3 years time.

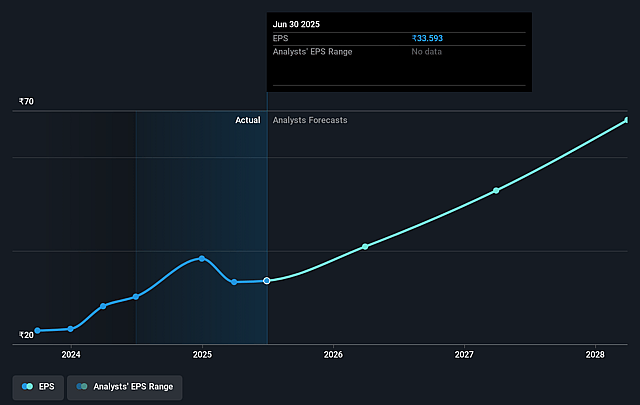

- Analysts expect earnings to reach ₹2.7 billion (and earnings per share of ₹64.2) by about September 2028, up from ₹1.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.6x on those 2028 earnings, up from 27.5x today. This future PE is lower than the current PE for the IN Electrical industry at 36.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.53%, as per the Simply Wall St company report.

Pitti Engineering Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising working capital requirements, particularly due to elevated inventory levels driven by raw material shortages and changes in export financing, could continue to put pressure on liquidity and increase net debt, leading to higher interest expenses and compressing net margins and earnings.

- Exposure to evolving U.S. tariffs presents a structural risk for exports (especially mining-related components), which could result in the loss of 3–10% of revenues if customers shift sourcing to other regions or if indirect demand softens, directly impacting revenue stability and growth.

- Prolonged or recurring disruptions in electrical steel imports-stemming from regulatory and quality control shifts impacting both Chinese and non-Chinese suppliers-may constrain input availability, disrupt production schedules, and limit the company's ability to meet demand, affecting revenue realization and operating margins over time.

- The announced expansion through brownfield CapEx, largely debt-funded, creates execution risk if demand fails to ramp as projected due to sector cyclicality or unforeseen industry slowdowns (e.g., softer industrial/EV demand), potentially depressing return on capital employed (ROCE) and delaying earnings accretion.

- Continued customer and end-market concentration in sectors like railways, mining, or specific geographies (e.g., U.S., Mexico) heightens vulnerability to order volatility, supply chain realignment, or major client shifts, increasing risk to ongoing topline growth and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1126.0 for Pitti Engineering based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹27.5 billion, earnings will come to ₹2.7 billion, and it would be trading on a PE ratio of 30.6x, assuming you use a discount rate of 16.5%.

- Given the current share price of ₹918.0, the analyst price target of ₹1126.0 is 18.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.