Catalysts

About Man Industries (India)

Man Industries (India) manufactures and supplies large diameter line pipes and value added tubular solutions for global oil and gas and water infrastructure projects.

What are the underlying business or industry changes driving this perspective?

- Although the multiyear build out of global energy transport networks and hydrogen ready gas corridors supports a healthy bid pipeline above INR 15,000 crores, any slowdown or deferral of these capital projects could limit conversion of orders into revenue and curb the targeted 20% annual top line growth.

- While the company is expanding capacity with new facilities in Saudi Arabia and Jammu to address rising demand from GCC and export markets, execution delays or a slower than planned ramp up from roughly 50% utilization in initial years would pressure operating leverage and EBITDA, constraining earnings growth.

- Although stainless steel seamless tubes from the Jammu plant are expected to command higher EBITDA margins in the 18% to 22% range, weaker offtake in premium segments or adverse product mix could dilute blended profitability and keep net margins closer to current 5% levels.

- While the shift toward long distance water transmission projects in India and large scale desalination infrastructure in GCC offers strong volume visibility, intensified competition and aggressive bidding for these projects could cap realisations and erode the recently achieved 11% to 12% EBITDA margin band.

- Although a net cash position and hedging of steel and freight costs currently support stable profitability, the move toward peak borrowings of INR 1,150 crores to INR 1,200 crores and annual interest outgo near INR 120 crores raises the risk that any shortfall versus the INR 7,000 crores revenue ambition will disproportionately compress earnings and return ratios.

Assumptions

This narrative explores a more pessimistic perspective on Man Industries (India) compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

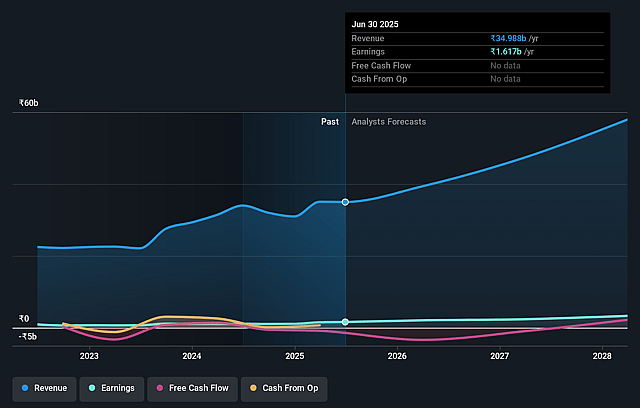

- The bearish analysts are assuming Man Industries (India)'s revenue will grow by 20.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.7% today to 5.6% in 3 years time.

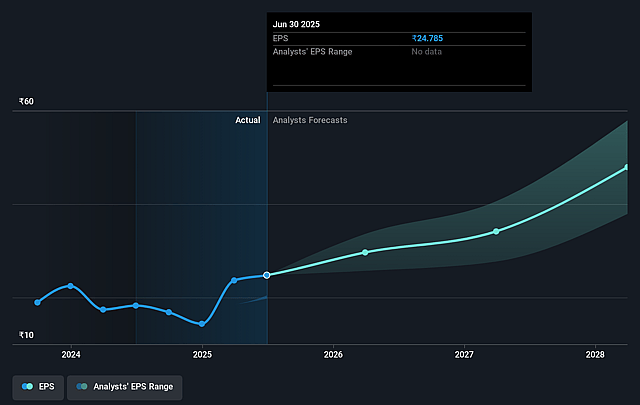

- The bearish analysts expect earnings to reach ₹3.4 billion (and earnings per share of ₹46.64) by about December 2028, up from ₹1.7 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹9.8 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 19.2x on those 2028 earnings, down from 19.9x today. This future PE is greater than the current PE for the IN Construction industry at 18.0x.

- The bearish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.82%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The multiyear global capex cycle in energy transition, hydrogen transportation and GCC water infrastructure could remain strong for longer than expected, allowing Man Industries to sustain or exceed the guided 20% annual growth and push revenue meaningfully above INR 7,000 crores, which would likely drive a structurally higher earnings base and share price over time through stronger revenue and EBITDA.

- The new Saudi and Jammu facilities, initially expected to operate at around 50% and 40% utilization respectively, may ramp up faster than planned in a tight supply environment, leading to higher than guided volumes and realization of the 12% to 15% and 18% to 22% EBITDA margin profiles sooner, which would materially lift consolidated EBITDA and net profit margins.

- If the company executes its INR 15,000 crores plus bid pipeline with a healthy win ratio while maintaining its policy of hedging steel and freight costs, Man Industries could enjoy sustained double digit EBITDA margins in the 11% to 12% range or higher despite raw material volatility, supporting faster compounding of earnings and return ratios.

- Successful monetization of the Andheri real estate project with around INR 700 crores of largely expense free inflows over the next 5 years, combined with disciplined capex and working capital, could offset higher interest costs from peak borrowings near INR 1,200 crores and leave the company in a stronger net cash or low leverage position, improving earnings and de risking the balance sheet.

- As Man Industries deepens its presence in export markets where 80% to 90% of the current order book already resides, any move into additional high value regions or segments similar to GCC and stainless seamless tubes could boost the long term mix of value added products, resulting in structurally higher realizations, improved net margins and upward re rating of the stock’s earnings multiple.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Man Industries (India) is ₹450.0, which represents up to two standard deviations below the consensus price target of ₹525.0. This valuation is based on what can be assumed as the expectations of Man Industries (India)'s future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹600.0, and the most bearish reporting a price target of just ₹450.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be ₹61.2 billion, earnings will come to ₹3.4 billion, and it would be trading on a PE ratio of 19.2x, assuming you use a discount rate of 15.8%.

- Given the current share price of ₹443.3, the analyst price target of ₹450.0 is 1.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Man Industries (India)?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.