Last Update 11 Nov 25

Fair value Increased 48%501423: Future Earnings And Profit Margins Will Drive Substantial Upside

Analysts have raised their price target for Shaily Engineering Plastics significantly, increasing it from ₹2,142 to ₹3,180. They anticipate improved profit margins and robust future earnings, even though revenue growth expectations are moderating.

What's in the News

- A board meeting is scheduled for November 8, 2025, to consider and approve unaudited standalone and consolidated financial results for the quarter and half year ended September 30, 2025. (Key Developments)

- The agenda will also include other business items to be addressed by the company. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has increased significantly from ₹2,142 to ₹3,180.

- The discount rate has risen slightly from 14.57% to 14.94%.

- Revenue growth expectation has fallen substantially from 40.82% to 24.82%.

- Net profit margin is projected to improve markedly, increasing from 17.20% to 25.77%.

- The future P/E multiple is expected to rise from 36.12x to 48.10x.

Key Takeaways

- Expansion in healthcare plastics and exports, alongside multinational partnerships, strengthens revenue growth and diversification amid rising global outsourcing and demand trends.

- Investments in automation, product innovation, and sustainability initiatives enhance operational efficiency, support higher margins, and secure long-term earnings quality.

- Heavy reliance on uncertain healthcare demand, global market risks, high fixed costs, and regulatory headwinds challenge revenue growth, utilization, and long-term market share.

Catalysts

About Shaily Engineering Plastics- Engages in the manufacture and sale of precision injection moulded plastic components/products in India.

- Large-scale capacity expansion in the healthcare segment-especially for GLP-1 semaglutide and other pen devices-positions Shaily to capitalize on accelerating demand for high-performance engineered plastics in healthcare globally, with visibility from customer commitments suggesting continued robust revenue growth and improved operating leverage.

- High mix of exports (76% of revenue) and deepening collaboration with multinational clients in pharma, FMCG, and consumer products supports diversification and the ability to gain wallet share as emerging market middle-class expansion and global outsourcing trends drive rising demand for contract-manufactured plastic components, underpinning sustainable top-line growth.

- Capex investment and ongoing automation initiatives (e.g., new assembly and molding lines) coupled with rising machine utilization rates point to improved operational efficiency and expanding EBITDA margins, with further upside as scale accelerates and healthcare (a higher-margin segment) becomes an increasing proportion of the business.

- Significant pipeline of IP-led products, innovation in next-generation drug delivery (e.g., new GLP-1 pen platforms), and focus on sustainability (targeting device advancements to incorporate eco-friendly features) allow Shaily to participate in new, expanding applications of advanced plastics, supporting long-term pricing power and earnings quality.

- Expanding product portfolio into mixed-material consumer goods and success in winning business from marquee FMCG and healthcare customers create additional optionality for future revenue streams and margin expansion, as these segments align with broad industry shift toward lightweighting and sustainability, directly impacting recurring earnings and margin resilience.

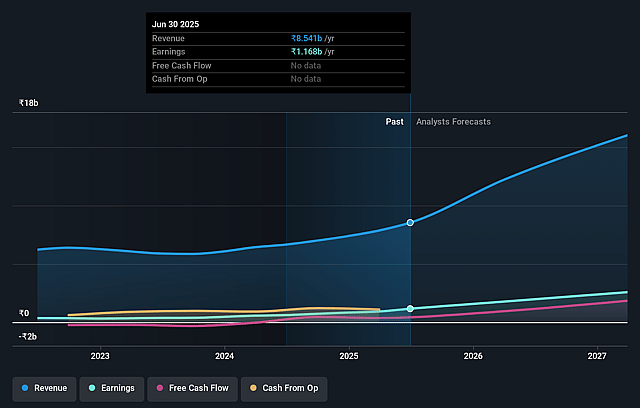

Shaily Engineering Plastics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Shaily Engineering Plastics's revenue will grow by 40.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.7% today to 17.2% in 3 years time.

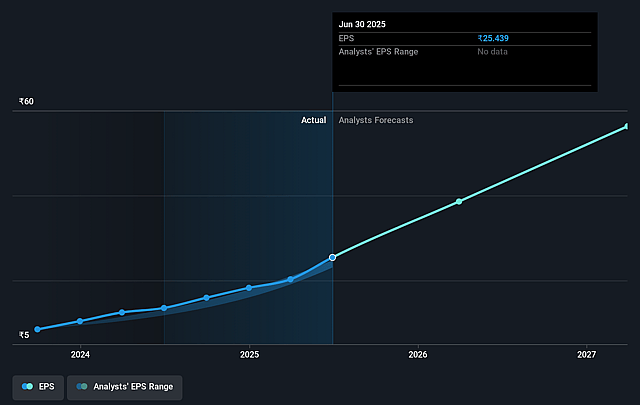

- Analysts expect earnings to reach ₹4.1 billion (and earnings per share of ₹89.17) by about September 2028, up from ₹1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.1x on those 2028 earnings, down from 86.6x today. This future PE is greater than the current PE for the IN Machinery industry at 32.3x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.59%, as per the Simply Wall St company report.

Shaily Engineering Plastics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's aggressive capacity expansion in the Healthcare segment relies heavily on uptake of GLP-1 and related pen devices, but management repeatedly emphasized that actual demand and capacity utilization remain uncertain until post-launch, which could lead to significant under-absorption if market adoption falls short, negatively impacting revenues and margins.

- Only about 50%–60% of the new pen manufacturing capacity is backed by customer commitments, and many such contracts depend on customers securing regulatory approvals; delayed or failed approvals could result in lower-than-expected order volumes and oversupplied capacity, impacting revenue growth and earnings visibility.

- Management acknowledges that a significant portion of exports (76% of total revenue) are tied to international markets, including the US and Europe, which are subject to global economic slowdowns, trade uncertainties, tariff risks, and protectionist measures, all of which could disrupt shipments and revenue growth over the long term.

- The business is investing heavily in automation and R&D, leading to a higher fixed cost base (e.g., increased employee costs and capital expenditure of ₹125 crores with limited external funding), which may pressure margins if volume growth or margin expansion from innovation does not materialize as quickly as projected.

- The broader regulatory and secular trend of anti-plastic sentiment and a global push towards sustainable, recyclable, and green materials could result in tighter regulations, customer preferences shifting to bioplastics or alternative materials, and reduced market share for traditional engineering plastics-potentially compressing long-term addressable markets and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2142.0 for Shaily Engineering Plastics based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹23.8 billion, earnings will come to ₹4.1 billion, and it would be trading on a PE ratio of 36.1x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹2200.7, the analyst price target of ₹2142.0 is 2.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.