Key Takeaways

- Expanding infrastructure projects, clean energy initiatives, and export diversification drive sustained sales growth and enhance revenue resilience across multiple segments.

- Advanced emission-compliant products, service offerings, and operational improvements support higher margins, recurring revenues, and stability as new market opportunities emerge.

- Increasing competition, technology shifts, and external risks threaten Cummins India's market position, revenue stability, and margins as industry dynamics and customer needs rapidly evolve.

Catalysts

About Cummins India- Engages in the design, manufacture, distribution, and service of engines, generator sets, and related technologies in India, Nepal, and Bhutan.

- Sustained and broad-based demand from India's infrastructure development (roads, rail, airports, data centers, and quick commerce) continues to drive robust sales in Cummins India's Powergen and Industrial segments, directly supporting long-term revenue and earnings growth.

- The company's rapid adoption and stabilization of CPCB IV+ emission-compliant products, along with higher technological content and advanced aftermarket requirements, increases the addressable market for branded players, underpinning higher-margin and recurring service revenues, which boosts net margins and revenue stability.

- Ongoing and recent product launches such as Battery Energy Storage Systems (BESS) and dual-fuel kits position Cummins India to capture new opportunities driven by the shift towards clean, reliable, and hybrid energy solutions, potentially expanding both topline and margin profiles as adoption increases.

- Strong export growth, notably with diversification into Europe and Latin America and opportunities for new product acceptance in markets like the US and UK, increases the resilience of the revenue base and offers significant upside for revenue growth if global macro or trade conditions become more favorable.

- Continued investment in cost optimization, automation, and capacity expansion, along with disciplined capital allocation, provides room for improved operational leverage-helping sustain or enhance net margins as volumes scale and new market segments (such as railways and marine) ramp up.

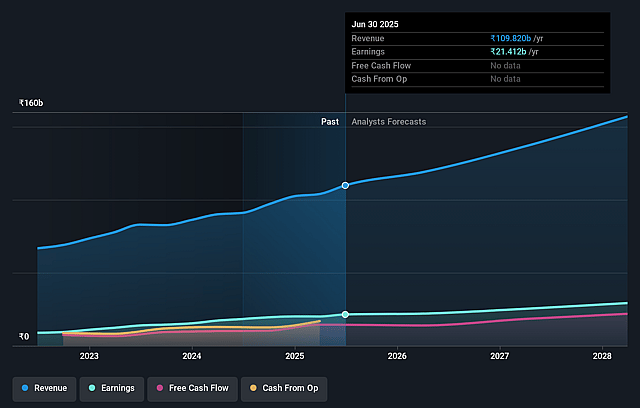

Cummins India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cummins India's revenue will grow by 12.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 19.5% today to 18.6% in 3 years time.

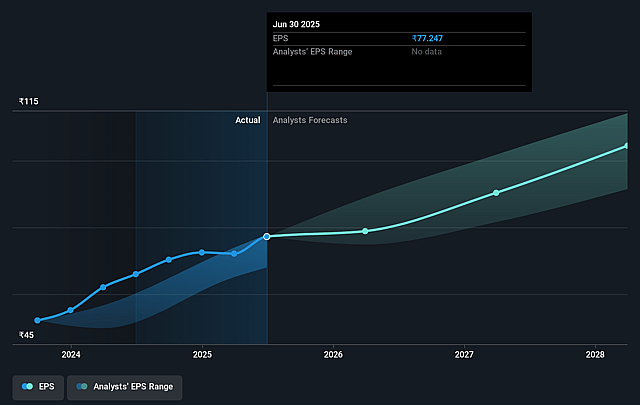

- Analysts expect earnings to reach ₹29.0 billion (and earnings per share of ₹104.05) by about August 2028, up from ₹21.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹25.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 54.4x on those 2028 earnings, up from 49.4x today. This future PE is greater than the current PE for the IN Machinery industry at 30.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.53%, as per the Simply Wall St company report.

Cummins India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from both domestic and foreign players, especially in high horsepower diesel gensets, is leading to increased pricing pressure and potential declines in market share, which could negatively impact Cummins India's revenue growth and margins over time.

- Failure to rapidly scale new technologies like Battery Energy Storage Systems (BESS) and flexible/alternative fuel engines-while primary segments remain heavily dependent on traditional diesel and gas-risks technological obsolescence as the global transition to renewables and electrification accelerates, jeopardizing long-term top-line and product mix.

- High exposure to government and infrastructure spending introduces volatility, as prolonged downturns, capex delays, or policy shifts could severely reduce domestic demand, directly pressuring revenues and net earnings.

- Export growth, while strong this quarter, remains vulnerable to shifting geopolitical risks, tariffs (especially in the U.S.), and varying regulatory requirements; the company's cautious view on export sustainability highlights persistent risks to earnings stability from external factors.

- Commoditization of engine and generator technologies-with increasing standardization and local manufacturing capability-could erode Cummins India's pricing power and gross margins, especially as differentiated technology advantages diminish across the industry.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹3808.818 for Cummins India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5075.0, and the most bearish reporting a price target of just ₹2621.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹155.7 billion, earnings will come to ₹29.0 billion, and it would be trading on a PE ratio of 54.4x, assuming you use a discount rate of 14.5%.

- Given the current share price of ₹3818.9, the analyst price target of ₹3808.82 is 0.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.