Key Takeaways

- Heavy dependence on diesel products risks obsolescence and revenue decline as cleaner energy and tighter regulations accelerate across key markets.

- Struggles to pivot toward new technologies and rising competition in low-emission solutions threaten margins, profitability, and long-term market positioning.

- Rising domestic and export demand, localization strategies, and early adoption of clean technologies are strengthening Cummins India's margins, revenue visibility, and long-term earnings stability.

Catalysts

About Cummins India- Engages in the design, manufacture, distribution, and service of engines, generator sets, and related technologies in India, Nepal, and Bhutan.

- The rapid global transition to clean and renewable energy is likely to undercut the long-term demand for Cummins India's core diesel engines and generator sets, particularly as India and export markets accelerate efforts to curb emissions; this threatens to erode revenue as legacy products become obsolete.

- Increasingly stringent environmental regulations and emission norms are expected to continue, raising compliance and retrofit costs for older product lines while exposing Cummins India to the risk of stranded assets; this will put sustained pressure on net margins over the next several years.

- Heavy reliance on conventional diesel technologies means Cummins India may face major operational and R&D challenges in pivoting quickly to new propulsion systems such as electric and hydrogen, especially as the company signals its primary capital expenditure will remain focused on sustenance rather than transformative growth; this increases the risk of future revenue stagnation and diminishing pricing power.

- Intensifying global and domestic competition in emerging low-emission powertrains and energy solutions is likely to compress margins further, as price wars and product commoditization take hold in key end markets such as data centers and industrial power; profitability and long-term earnings stability could deteriorate as new entrants and digital-native competitors gain ground.

- Ongoing geopolitical uncertainties, volatile trade policies, and escalating raw material costs are likely to cause persistent supply chain disruptions and cost inflation, threatening both top-line growth forecasts and the company's ability to sustain current gross margins in the medium to long term.

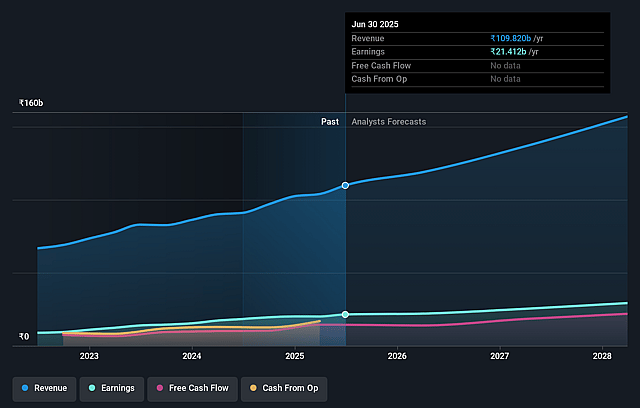

Cummins India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Cummins India compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Cummins India's revenue will grow by 10.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 19.2% today to 17.6% in 3 years time.

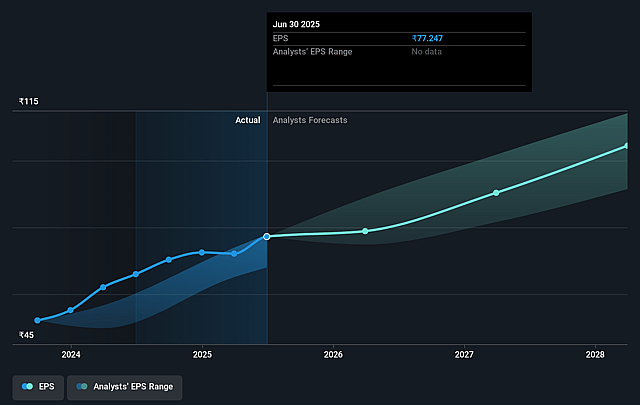

- The bearish analysts expect earnings to reach ₹24.4 billion (and earnings per share of ₹87.84) by about June 2028, up from ₹20.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 39.8x on those 2028 earnings, down from 45.4x today. This future PE is greater than the current PE for the IN Machinery industry at 33.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.22%, as per the Simply Wall St company report.

Cummins India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained growth in India's infrastructure, commercial real estate, and data center investments are fueling robust demand for power generation and industrial engines, which supports rising revenues and order book visibility for Cummins India.

- Strong focus on localization and ongoing cost optimization efforts have helped the company improve and sustain gross margins, indicating potential for stable or even higher net margins if these initiatives continue delivering results.

- Export markets, especially Latin America and Europe, have shown consistent growth, and Cummins India has tailored its product and pricing strategies market-by-market, which could drive continued export revenue growth and further diversification of earnings.

- The company's expansion of its aftermarket and service network, alongside introduction of value-added offerings like extended warranties and retrofit solutions, is building recurring revenue streams that strengthen long-term earnings stability.

- Demand for emission-compliant and advanced technology engines is increasing, and Cummins India's early positioning with CPCB IV+ and alternative fuel solutions could give it a competitive edge, supporting both top line growth and healthy profit margins in the shift to clean energy.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Cummins India is ₹2348.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cummins India's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹4558.0, and the most bearish reporting a price target of just ₹2348.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹138.1 billion, earnings will come to ₹24.4 billion, and it would be trading on a PE ratio of 39.8x, assuming you use a discount rate of 14.2%.

- Given the current share price of ₹3276.9, the bearish analyst price target of ₹2348.0 is 39.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Cummins India?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.