Key Takeaways

- Growing digital competition and regulatory demands are expected to erode DCB Bank's profitability, raising costs and compressing margins.

- Dependence on high-risk lending and limited scale may weaken DCB's asset quality, revenue growth, and long-term market share against larger or digital-native rivals.

- Strong growth in lending, operational efficiency gains, controlled risk with steady asset quality, and diversified income streams position the bank for sustainable profitability and capital strength.

Catalysts

About DCB Bank- Provides various banking and financial products and services in India.

- Intensifying digital banking adoption and fintech disruption are expected to erode DCB Bank's ability to retain and grow its core CASA franchise, resulting in increased pressure on low-cost deposits and a decline in both net interest margins and fee-based income over time, putting structural pressure on long-term profitability.

- Heightened regulatory scrutiny and the ongoing tightening of compliance requirements-such as stricter guidelines around co-lending, KYC, and capital adequacy-are likely to escalate compliance and operational costs for DCB Bank, shrinking net margins and potentially constraining earnings growth over the medium to long term.

- DCB's reliance on high-yield MSME, agri, and retail lending exposes it to elevated asset quality risks, particularly during economic downturns, which could cause a sharp increase in non-performing assets and credit costs and thereby significantly impair bottom-line growth in future economic cycles.

- As the banking sector continues to consolidate and larger banks leverage their scale and digital prowess, DCB's limited size and brand recognition are expected to make it harder to compete for new customers, gain low-cost funding, and protect its market share, leading to slower revenue growth and margin compression.

- The continued rise of digital-native, large private banks and fintechs catering to India's young, tech-savvy demographic is anticipated to accelerate market share loss for DCB, reducing its ability to expand its retail and MSME loan books, thereby stalling long-term advances growth and eroding the sustainability of its earnings.

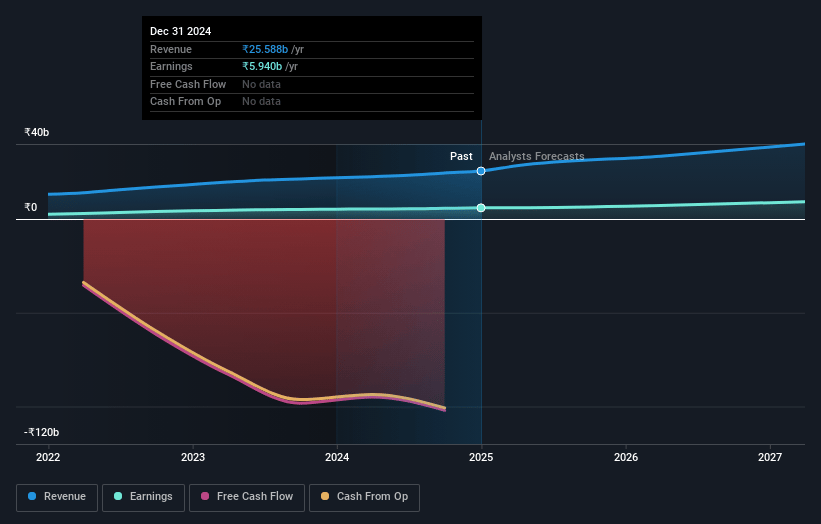

DCB Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on DCB Bank compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming DCB Bank's revenue will grow by 25.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 23.2% today to 22.6% in 3 years time.

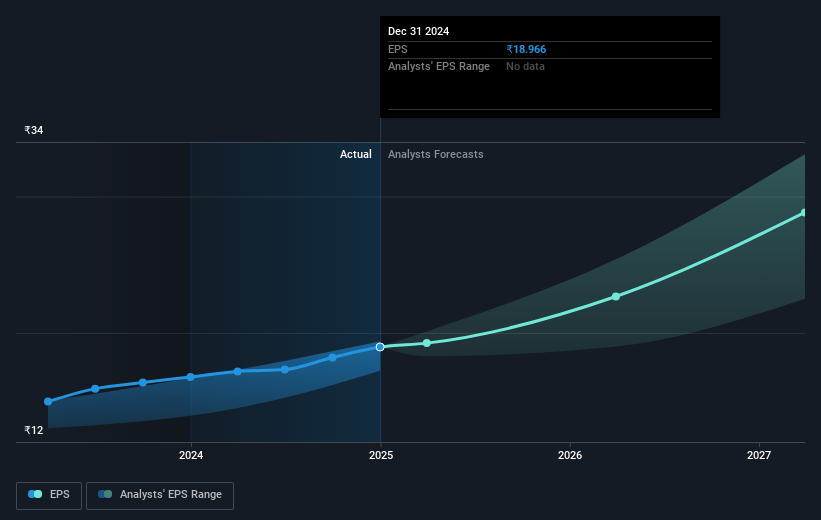

- The bearish analysts expect earnings to reach ₹11.7 billion (and earnings per share of ₹37.18) by about July 2028, up from ₹6.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.0x on those 2028 earnings, down from 7.5x today. This future PE is lower than the current PE for the IN Banks industry at 13.0x.

- Analysts expect the number of shares outstanding to grow by 0.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.57%, as per the Simply Wall St company report.

DCB Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The bank is demonstrating strong deposit, loan, and balance sheet growth with healthy metrics like a 25 percent loans growth rate and stable net interest margin, suggesting that long-term revenue, earnings, and profitability could be resilient if this momentum continues.

- Continued strategic investment and efficiency gains from digitalization and technology upgrades, including automation and core banking enhancements, are reducing both staff count and operational expenses, indicating that cost-to-income and cost-to-average-assets ratios may improve and support long-term margin expansion.

- The focus on granular, secured lending with controlled risk appetite, combined with robust underwriting and recovery practices, has resulted in consistently low net non-performing assets and healthy provision coverage ratios, which bodes well for long-term asset quality and stable net profits.

- DCB Bank's expanding core fee income, aided by increased customer engagement and cross-selling, and its potential to grow third-party distribution and transaction-driven revenue, indicate new earnings levers beyond traditional interest income, providing upside to overall earnings and return on equity over the long term.

- With a well-capitalized balance sheet, disciplined capital usage even at high loan growth, and prudent plans to raise capital only at more favorable valuations, the bank is positioned to self-fund growth without near-term equity dilution, supporting intrinsic book value and potentially strengthening share price performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for DCB Bank is ₹147.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of DCB Bank's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹260.0, and the most bearish reporting a price target of just ₹147.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹51.8 billion, earnings will come to ₹11.7 billion, and it would be trading on a PE ratio of 6.0x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹146.21, the bearish analyst price target of ₹147.0 is 0.5% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.