Last Update 05 Sep 25

Electric Vehicles And Indian Green Mobility Will Drive Future Opportunity

As key valuation metrics such as the discount rate and future P/E remained virtually unchanged, the consensus analyst price target for Tube Investments of India also held steady at ₹3554.

What's in the News

- Board meeting scheduled to consider and approve unaudited financial results for the quarter ended 30 June 2025.

Valuation Changes

Summary of Valuation Changes for Tube Investments of India

- The Consensus Analyst Price Target remained effectively unchanged, at ₹3554.

- The Discount Rate for Tube Investments of India remained effectively unchanged, moving only marginally from 14.41% to 14.42%.

- The Future P/E for Tube Investments of India remained effectively unchanged, moving only marginally from 89.06x to 89.07x.

Key Takeaways

- Expansion into electric vehicles, automation, and value-added products is expected to drive margin improvement and support top-line growth amid rising industry demand.

- Diversification into exports, medical devices, and premium market segments should enhance revenue stability and leverage evolving trends in global mobility and manufacturing.

- Intensifying EV segment competition, export uncertainties, customer concentration, high capital spending, and raw material cost pressures threaten growth, profitability, and earnings stability.

Catalysts

About Tube Investments of India- Engages in the manufacture and sale of precision engineered and metal formed products to automotive, railway, construction, agriculture, etc.

- The company's strategic expansion into electric vehicles, including three-wheelers, e-trucks, and upcoming launches in new subsegments, aligns with the rising demand for green mobility solutions and government incentives (such as the PLI scheme). As volumes scale, benefits from cost reduction, local sourcing (indigenization), and upcoming battery pack manufacturing are likely to drive top-line growth and improve gross/operating margins over time.

- Rapid urbanization and higher disposable incomes in India are fueling demand for automobiles and mobility products; Tube Investments is capitalizing on this with strong double-digit volume growth in its core Engineering and Mobility divisions, which should support continued revenue expansion and sustainable margin recovery as input cost pass-throughs stabilize.

- The company's increased focus on process automation, value-added product lines (e.g., fitness-focused bicycles, spare parts, premium precision tubes), and operating efficiencies positions it to enhance net margins even as raw material price volatility and competitive intensity persist.

- Growth in export-oriented product categories, supported by ongoing CE certifications and customer approvals at new manufacturing facilities, provides incremental revenue diversification; this offsets near-term protectionist risks and positions the company to capture increased share as global infrastructure and manufacturing investment cycles accelerate.

- Prudent deployment of capital-doubling down on emerging areas like medical devices, clean mobility, and advanced CDMO manufacturing-combined with targeted inorganic expansion, is expected to compound future earnings and market share, capitalizing on industry trends of premiumization, consolidation, and preference for technologically advanced and reliable suppliers.

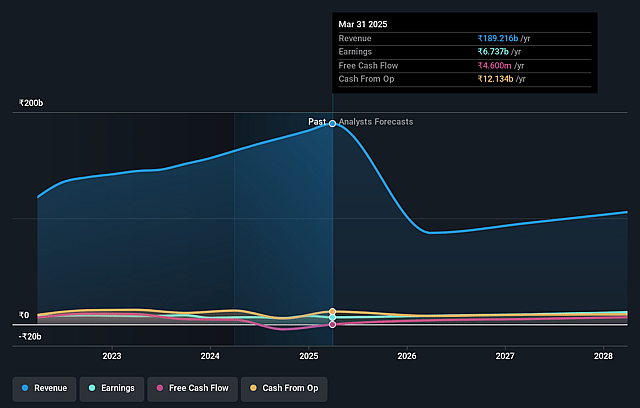

Tube Investments of India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tube Investments of India's revenue will decrease by 18.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.3% today to 10.9% in 3 years time.

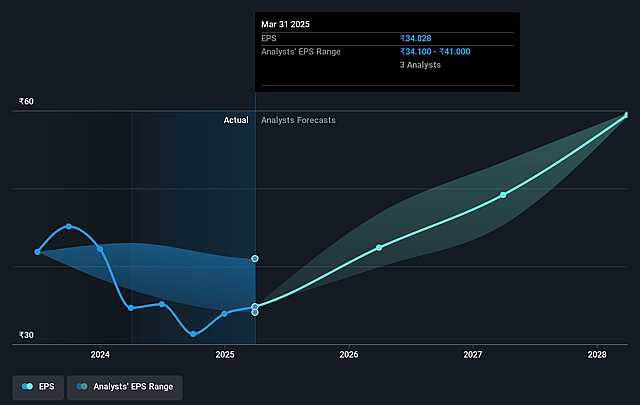

- Analysts expect earnings to reach ₹11.5 billion (and earnings per share of ₹59.63) by about September 2028, up from ₹6.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 89.1x on those 2028 earnings, down from 91.2x today. This future PE is greater than the current PE for the IN Auto Components industry at 29.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.41%, as per the Simply Wall St company report.

Tube Investments of India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in the electric vehicle (EV) segment, particularly in 3-wheelers, is resulting in lower-than-expected volumes, limited pricing power, delayed achievement of operational breakeven, and potential margin pressure, which could impact net profitability and long-term earnings quality.

- Uncertainty around export growth due to rising global protectionism and tariffs (e.g., in the US), along with delays in new product development for international markets, increases the risk of missed revenue targets and can erode top-line growth from exports.

- Customer concentration, especially notable in the automotive segments, may lead to significant fluctuations in revenue and earnings if major clients reduce orders or switch to alternative suppliers, negatively affecting revenue stability.

- High ongoing capital expenditure requirements (e.g., ₹350 crores planned for this year), coupled with investments in new divisions like EVs, TI Medical, and CDMO, could constrain free cash flow, delay return on investment, and pressure bottom-line margins if targeted volume growth or profitability is not achieved.

- Delay in cost recovery and margin normalization due to lag in passing through raw material (steel) price changes to customers, combined with sectoral input cost volatility and slow take-up of process automation or indigenization strategies, can result in compressed or unpredictable net margins over multiple quarters.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹3554.333 for Tube Investments of India based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹105.8 billion, earnings will come to ₹11.5 billion, and it would be trading on a PE ratio of 89.1x, assuming you use a discount rate of 14.4%.

- Given the current share price of ₹3043.8, the analyst price target of ₹3554.33 is 14.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.