Last Update 09 Dec 25

SJS: Upcoming Board Meeting Will Support Bullish Long Term Earnings Outlook

Analysts have nudged their price target for S.J.S. Enterprises slightly higher to ₹2,091. This reflects modest improvements in model assumptions around the discount rate and long term earnings multiples, despite broadly unchanged growth and margin expectations.

What's in the News

- Board meeting scheduled for November 3, 2025 at 13:30 IST to review unaudited standalone and consolidated financial results for the quarter and half year ended September 30, 2025 (Key Developments)

- Board to consider allotment of 562,000 equity shares upon exercise of vested employee stock options under the SJS Enterprises Employee Stock Option Plan 2021 (Key Developments)

Valuation Changes

- Fair Value Estimate remains unchanged at ₹2,091 per share, indicating no revision to the fundamental valuation outcome.

- Discount Rate has fallen slightly from 14.76 percent to 14.66 percent, reflecting a modest reduction in perceived risk or cost of capital.

- Revenue Growth Assumption is virtually unchanged at about 20.93 percent, suggesting stable expectations for top line expansion.

- Net Profit Margin Assumption is effectively steady at about 18.37 percent, indicating no material change in anticipated profitability levels.

- Future P/E Multiple has eased slightly from 36.30x to 36.20x, implying a marginally lower valuation multiple applied to future earnings.

Key Takeaways

- Expansion into automotive and non-automotive segments, along with new technologies, is driving sustained growth, margin improvement, and diversifying revenue streams.

- Increased production capacity and export market focus position the company to benefit from global demand for premium, high-value components.

- Overdependence on a few customers, lagging export growth, and risks in new segments threaten revenue stability, margin expansion, and long-term diversification.

Catalysts

About S.J.S. Enterprises- Designs, develops, manufactures, sells, and exports decorative aesthetics primarily to automotive and consumer appliance industries in India and internationally.

- The ramp-up of supplies to new marquee customers like Hero MotoCorp and additional share gains with existing OEMs are expected to sustain above-industry growth in automotive revenues over the coming quarters, supporting both topline and margin expansion.

- Ongoing capacity expansions (at Pune, Bangalore, Exotech/Decoplast) are designed to address surging demand from both domestic and export customers (e.g., Stellantis, Whirlpool), positioning S.J.S. Enterprises to benefit from rising global demand for aesthetic and premium components, which should drive future revenue and asset turnover growth.

- The launch and scaling of next-generation, higher-value technologies-such as cover glass for digital displays and advanced decorative components-align with the increased consumer focus on premiumization and personalization in vehicles, boosting kit value per vehicle and supporting long-term increases in average selling prices and EBITDA margins.

- Diversification into non-automotive segments (consumer appliances, electronics, medical devices) and cross-selling of advanced products to new international customers are both accelerating, creating multiple growth avenues and reducing cyclicality, thus supporting steadier revenue and earnings growth.

- Export market expansion, with a medium-term target to increase export contribution to 14–15% of revenues by FY28, leverages global trends in vehicle electrification and rising regulatory quality standards, expected to deliver higher-margin revenues and enhance the company's long-term profitability and ROCE.

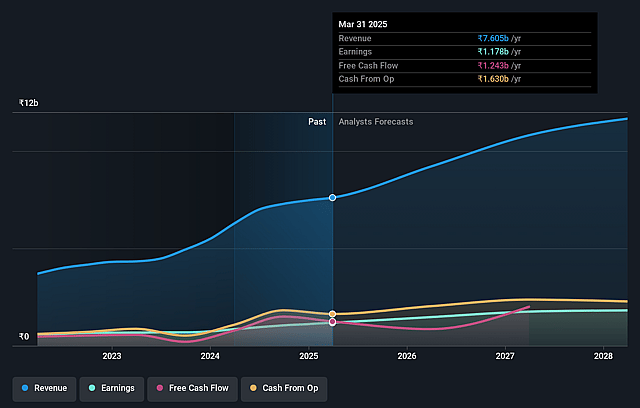

S.J.S. Enterprises Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming S.J.S. Enterprises's revenue will grow by 17.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.9% today to 16.3% in 3 years time.

- Analysts expect earnings to reach ₹2.1 billion (and earnings per share of ₹60.91) by about September 2028, up from ₹1.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.6x on those 2028 earnings, down from 35.6x today. This future PE is greater than the current PE for the IN Auto Components industry at 29.3x.

- Analysts expect the number of shares outstanding to grow by 0.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.25%, as per the Simply Wall St company report.

S.J.S. Enterprises Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant revenue concentration and underperformance in Walter Pack (WPI) due to dependence on a few legacy customers and limited product diversification exposes SJS to earnings volatility and ongoing revenue stagnation if new business or models are delayed or fail to ramp up, which threatens overall consolidated top-line growth.

- Margin compression risk remains in the chrome plating and related decorative businesses (such as Exotech), where even after process improvements, target EBITDA margins are structurally low (historically 12–19%), and global ESG trends or shifts in design preferences could depress demand or squeeze margins further, risking long-term profitability.

- While exports are a strategic growth focus, current export revenues contribute only ~6–7% of the total and management expects scaled ramp only by FY28; any setbacks in export client ramp-up, global trade protectionism, tariffs, or delays in plant upgrades (as with Exotech), may prevent diversification and increase cyclicality, impacting long-term revenue and earnings stability.

- Entry into cover glass and advanced display segments is not de-risked yet, with no commercial orders secured and technology/investment requirements still under evaluation; execution risk and high initial capex could delay earnings contribution, make R&D returns uncertain, and expose the firm to technological obsolescence or stronger competition, thus impacting future revenue streams.

- Heavy dependence on premiumization and wallet share gains in cyclical automotive and consumer durables end-markets, with only moderate penetration in higher-margin international and non-automotive verticals, means an industry slowdown, OEM insourcing, or digitalization (reducing demand for physical aesthetic parts) could compress margins and cap long-term topline growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1506.0 for S.J.S. Enterprises based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹12.8 billion, earnings will come to ₹2.1 billion, and it would be trading on a PE ratio of 34.6x, assuming you use a discount rate of 14.3%.

- Given the current share price of ₹1416.0, the analyst price target of ₹1506.0 is 6.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on S.J.S. Enterprises?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.