Narratives are currently in beta

Key Takeaways

- Pricol's strategic acquisition and shift towards engineered products could double business and enhance revenue and earnings significantly over three years.

- Expanding in electric vehicles and high-margin products, alongside improving operational efficiencies, aims to boost revenue growth and net margins.

- Concentration risk and persistent supply chain challenges could hinder Pricol's revenue diversification and growth, especially with the low-margin acquisition of Sundaram Auto Components.

Catalysts

About Pricol- Manufactures and sells instrument clusters and other allied automobile components to original equipment manufacturers and replacement markets in India and internationally.

- Pricol's acquisition of a company in the plastics sector, with plans to move from a component supplier to an engineered product provider, can potentially double the business to ₹1,600-1,700 crores over the next three years, boosting overall revenue and earnings.

- The anticipated growth rate of 13% to 15% in the next couple of quarters due to new product launches and market growth, excluding the newly acquired entity, suggests an increase in revenues.

- Pricol is expanding its presence in the electric vehicle segment, with ramping up of the Battery Management System expected to contribute to revenue growth starting H2 of the current financial year and primarily in the next financial year.

- The company is enhancing its operational efficiencies and productivity, potentially increasing margins by around 200 basis points post-acquisition.

- Increasing the penetration of high-margin products like TFT clusters in two-wheelers, where Pricol holds a significant market share, could improve revenue and net margins.

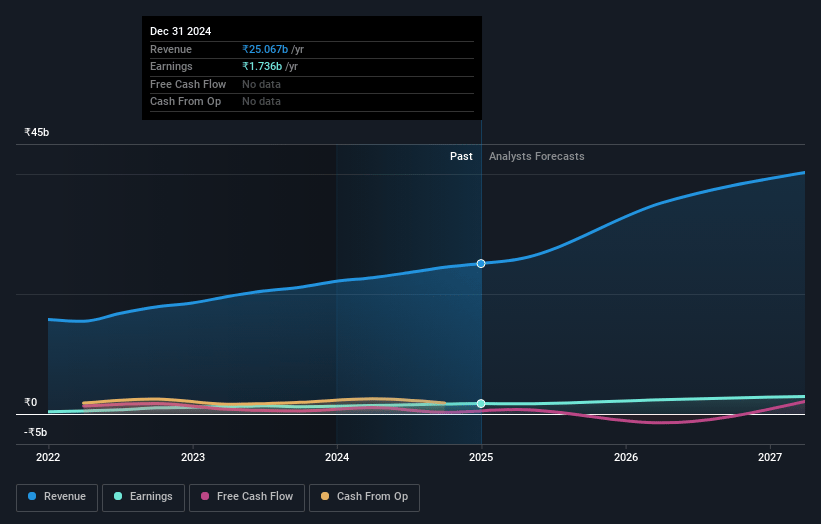

Pricol Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pricol's revenue will grow by 23.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.9% today to 7.4% in 3 years time.

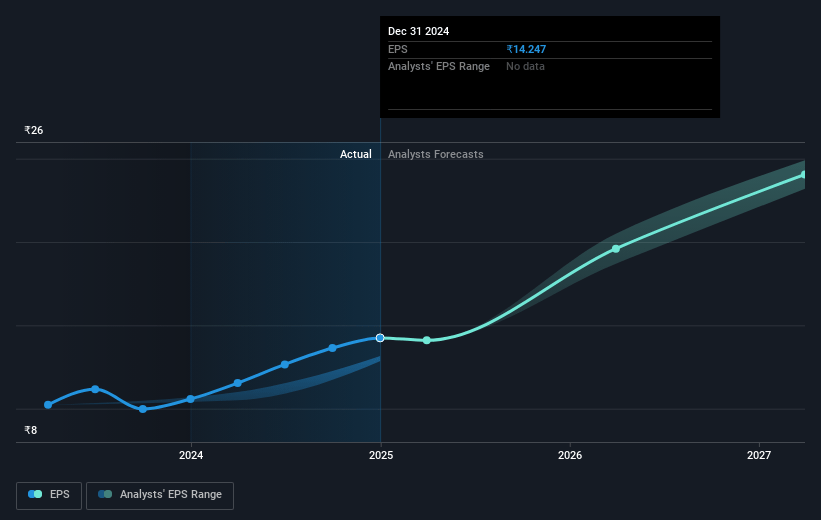

- Analysts expect earnings to reach ₹3.5 billion (and earnings per share of ₹28.72) by about February 2028, up from ₹1.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.9x on those 2028 earnings, down from 36.5x today. This future PE is greater than the current PE for the IN Auto Components industry at 28.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.38%, as per the Simply Wall St company report.

Pricol Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's growth in the current quarter and projected growth rate of 13% to 15% suggests a potentially slower pace than previous quarters, which could impact revenue growth expectations.

- Supply chain issues have led to lower sales in the current quarter, and while they are being mitigated, persistent supply chain disruptions could affect revenue and earnings.

- The newly acquired Sundaram Auto Components is currently a low-margin business, which could dilute overall margins unless successfully improved, impacting net profit margins.

- Export business faces significant headwinds with expected prolonged challenges for the next 8 quarters, potentially affecting revenue from international markets.

- Heavy reliance on the domestic market, with limited export revenue from both Pricol and Sundaram, indicates a concentration risk that could impact revenue diversification.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹590.0 for Pricol based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹47.6 billion, earnings will come to ₹3.5 billion, and it would be trading on a PE ratio of 29.9x, assuming you use a discount rate of 13.4%.

- Given the current share price of ₹519.8, the analyst's price target of ₹590.0 is 11.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives