Last Update 10 Nov 25

Fair value Increased 6.67%MARUTI: Revenue Expansion And Lower Discount Rate Will Balance Potential Risks

Analysts have raised their price target for Maruti Suzuki India, updating their estimate from ₹16,047 to ₹17,117. They cited improved revenue growth forecasts and a lower discount rate as key drivers for the change.

What's in the News

- Board meeting scheduled for October 31, 2025, to consider and approve unaudited financial results for the quarter ended September 30, 2025, and to review the Limited Review Report (Board Meeting).

- Launch of Maruti Suzuki's latest SUV, the VICTORIS, featuring advanced technology, safety enhancements, and a range of powertrain options including Strong Hybrid and eco-friendly S-CNG. (Product-Related Announcements)

- Shareholders approved changes to the Object Clause of the company's Memorandum of Association at the annual general meeting held on August 28, 2025. (Changes in Company Bylaws/Rules)

- Appointment of Price Waterhouse Chartered Accountants LLP as Statutory Auditors confirmed at the company's annual general meeting on August 28, 2025. (Auditor Changes)

- Popular Vehicles and Services Limited received approval to acquire an existing authorized Maruti Suzuki dealership in Telangana, dramatically expanding its regional footprint. (Client Announcements)

Valuation Changes

- Consensus Analyst Price Target has increased from ₹16,047 to ₹17,117, reflecting updated expectations for the company's value.

- Discount Rate has fallen from 18.80% to 17.78%, which indicates a more favorable risk assessment and contributes to a higher valuation.

- Revenue Growth Forecast has risen from 13.67% to 15.78%, representing improved growth prospects for the company.

- Net Profit Margin has decreased slightly from 9.31% to 9.05%.

- Future P/E Ratio estimates have dipped marginally from 39.64x to 38.94x, suggesting modest changes in expected earnings multiples.

Key Takeaways

- Strong export growth, new launches, and rural market expansion diversify revenue sources and mitigate domestic market fluctuations for sustained long-term growth.

- Focus on SUVs, alternative powertrains, and operational efficiencies drives improved margins, while proactive regulatory compliance reduces risk and supports profitability.

- Dependence on entry-level cars, slow EV progress, and rising compliance costs threaten Maruti Suzuki's growth, margins, and resilience amid shifting consumer and regulatory landscapes.

Catalysts

About Maruti Suzuki India- Manufactures, purchases, and sells motor vehicles, components, and spare parts in India.

- Robust export growth-partly driven by significant market share gains in both emerging and developed markets like Japan and pending launches in over 100 countries, including Europe, positions Maruti Suzuki to offset domestic demand softness and deliver sustained revenue growth.

- Rising consumer preference for SUVs and alternative powertrains (especially CNG and hybrids), together with an expanding product pipeline (multiple upcoming launches, including an EV SUV), supports higher average selling prices and improves mix, benefiting both revenue and net margins.

- Expanding penetration in rural and non-metro markets-with rural sales outperforming urban and improved monsoon-related sentiment-taps into a large, underpenetrated buyer base, underlining long-term volume growth potential and revenue stability.

- Increased investment in production capacity (e.g., new Kharkhoda plant), solar energy deployment, and supply chain/logistics resilience are expected to improve scalability, reduce operating costs, and enhance net margins over time as utilization rises.

- Accelerated compliance with safety and emissions norms (e.g., 6 airbags standard across 97% of volumes, early moves in hybrids and CNG, and readiness for new CAFE norms) reduces regulatory risk and positions the company favorably as regulatory intensity increases, supporting future revenue and margin sustainability.

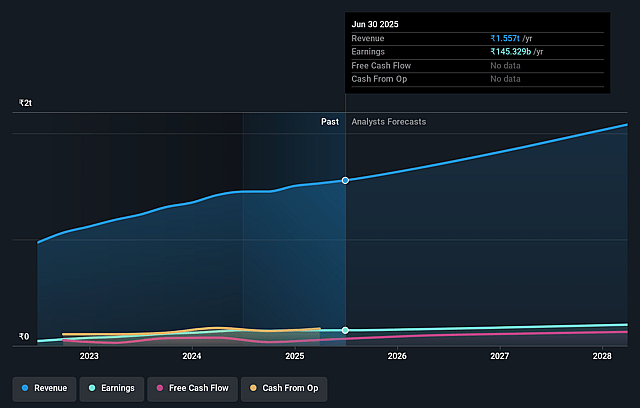

Maruti Suzuki India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Maruti Suzuki India's revenue will grow by 13.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.3% today to 9.1% in 3 years time.

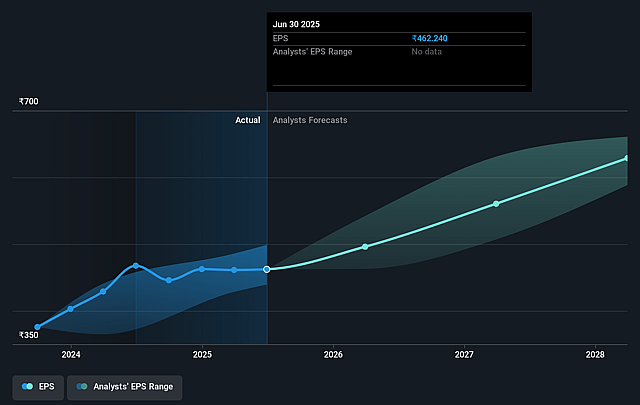

- Analysts expect earnings to reach ₹207.3 billion (and earnings per share of ₹659.08) by about September 2028, up from ₹145.3 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹185.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.7x on those 2028 earnings, up from 32.3x today. This future PE is greater than the current PE for the IN Auto industry at 33.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.63%, as per the Simply Wall St company report.

Maruti Suzuki India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Maruti Suzuki continues to face sluggish domestic demand and shrinking first-time buyer participation due to affordability issues, particularly in the entry and hatchback segments, which threatens core volume growth and long-term revenue sustainability.

- The company's traditionally strong focus on small/entry-level vehicles is challenged by rapidly shifting consumer preferences toward SUVs, MPVs, and higher-value vehicles; lagging innovation or inability to capture premiumization trends can limit future net margin expansion and overall earnings growth.

- Maruti Suzuki's electric vehicle (EV) strategy remains in early stages with management openly citing ongoing supply chain uncertainty, rare earth magnet and critical mineral challenges, and unproven resilience for an accelerated EV transition-potentially resulting in future capex, R&D spending pressures, and margin dilution if EV adoption outpaces Maruti Suzuki's pivot.

- Intensifying regulatory requirements on emissions, fuel efficiency (CAFE norms), and safety standards are driving up costs for technology upgrades and compliance, which can depress operating margins for price-sensitive portfolios and slow adaptation if clarity or action remains delayed.

- The company's export surge (notably to Japan and Europe) now constitutes a higher share of total volumes but exposes Maruti Suzuki to added competitive intensity, foreign exchange volatility, and external market risks that may create future revenue and margin instability if international demand or pricing pressure materializes.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹14139.725 for Maruti Suzuki India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹17500.0, and the most bearish reporting a price target of just ₹11300.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹2267.7 billion, earnings will come to ₹207.3 billion, and it would be trading on a PE ratio of 36.7x, assuming you use a discount rate of 19.6%.

- Given the current share price of ₹14927.0, the analyst price target of ₹14139.72 is 5.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.