Key Takeaways

- Strategic acquisitions, vertical integration, and proprietary technology are positioning Endurance as a premium, diversified global supplier with accelerated growth potential and margin expansion.

- Expansion into high-value automotive and non-auto markets, combined with innovative products and strong OEM partnerships, enhances revenue stability and supports higher long-term valuation.

- Heavy reliance on key clients, slow EV transition, regulatory pressures, capital spending risks, and intensifying competition threaten revenue growth, margins, and long-term financial stability.

Catalysts

About Endurance Technologies- Manufactures and supplies automotive components for original equipment manufacturers in India and internationally.

- Analyst consensus views the Stöferle acquisition as a revenue and margin accretive step, but this likely underestimates its transformative cross-selling potential and rapid integration into Endurance's global order book, supporting a scenario of sustained above-industry European revenue growth and significant long-term EBITDA expansion.

- Analysts broadly expect strong order flow from the new AURIC Shendra casting plant in the EV segment; however, faster-than-anticipated ramp-up, secured multi-year contracts with multiple global OEMs, and premium margin profiles on critical EV castings could sharply accelerate both revenue growth and structural profit margin uplift, far beyond current market expectations.

- The company's rapid vertical integration into lithium-ion battery pack manufacturing with proprietary, patentable wireless and thermal management IP positions Endurance as a differentiated supplier across not just automotive but high-growth non-auto sectors (such as energy storage and telecom), potentially unlocking entirely new, high-margin addressable markets and accelerating consolidated earnings growth.

- Strong, recurring value-added order wins from key global OEMs-including for mission-critical EV and hybrid components-combined with Endurance's expanding in-house innovation platforms and R&D in embedded electronics, set the stage for Endurance to become a top-tier solution partner with durable pricing power and improving net margins.

- Endurance's entry into premium non-auto segments (such as solar tracking systems), alongside rapid ₹500–1,000 crore business opportunities already pursued with global leaders, provides both immediate revenue diversification and long-term earnings stability, making the business materially less cyclical and potentially justifying a significant upward rerating of valuation multiples.

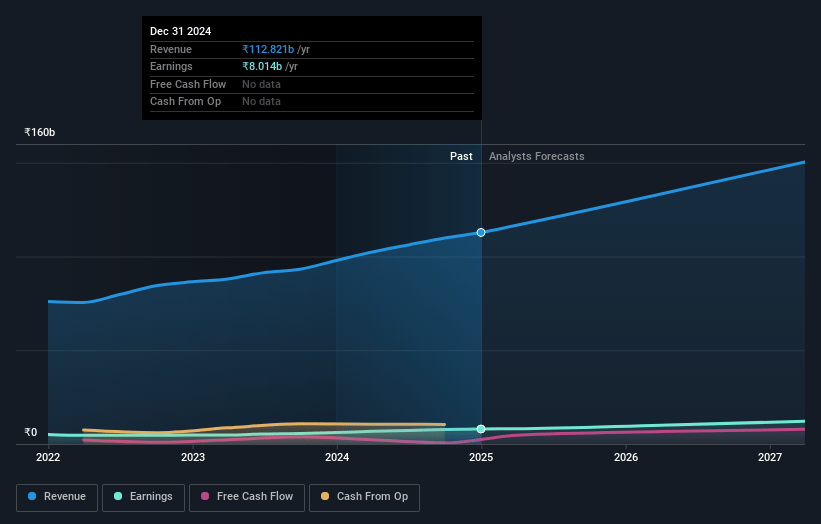

Endurance Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Endurance Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Endurance Technologies's revenue will grow by 19.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.2% today to 8.6% in 3 years time.

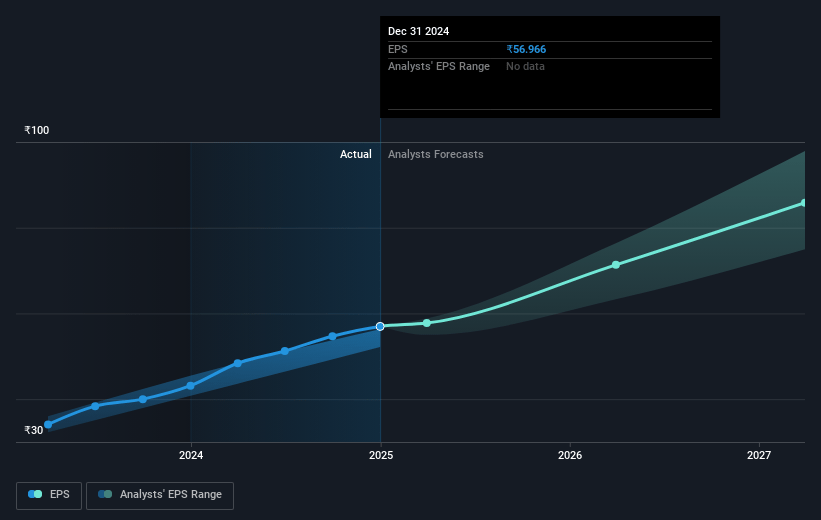

- The bullish analysts expect earnings to reach ₹17.0 billion (and earnings per share of ₹121.08) by about July 2028, up from ₹8.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.7x on those 2028 earnings, down from 44.1x today. This future PE is greater than the current PE for the IN Auto Components industry at 31.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.85%, as per the Simply Wall St company report.

Endurance Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Endurance Technologies remains heavily dependent on large clients such as Bajaj Auto, Royal Enfield, and, in Europe, the Volkswagen Group and its affiliates, creating significant client concentration risk; any reduction in orders or market share from these clients would directly depress revenues and earnings.

- The company's attempts to diversify into EV components, while visible, lag behind several industry peers; if EV adoption accelerates faster than Endurance's transition capabilities, there is a material risk of existing internal combustion engine product lines becoming rapidly obsolete, resulting in underutilised capacity and compression in both revenue and net margins.

- Increasing regulatory pressures, particularly ESG mandates and the rising cost of compliance with green manufacturing standards, could substantially raise operational and capital costs for Endurance Technologies, which may not be fully recouped via price increases, leading to deteriorating net margins over time.

- The high capital expenditure for new plants, automation, battery pack facilities, and overseas expansions-while stated as growth investments-places strain on the company's balance sheet; if these investments do not scale as anticipated or face market headwinds, rising debt and interest costs could weaken overall net margins and the company's credit profile.

- Competitive intensity is rising across both traditional and EV-specific auto component markets, with new domestic and global entrants challenging Endurance's pricing power; increased competition, especially in alloy wheels, aluminum castings, and battery packs, could suppress revenue growth and drive down profitability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Endurance Technologies is ₹3275.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Endurance Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹3275.0, and the most bearish reporting a price target of just ₹2050.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹198.6 billion, earnings will come to ₹17.0 billion, and it would be trading on a PE ratio of 39.7x, assuming you use a discount rate of 13.8%.

- Given the current share price of ₹2623.0, the bullish analyst price target of ₹3275.0 is 19.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.