Key Takeaways

- Early facility expansion and automation efforts are driving higher capacity utilization, operational leverage, and margin improvement, supporting future profitability.

- Product diversification and partnerships in advanced automotive solutions position the company to benefit from premiumization trends and rising vehicle content.

- Overreliance on two-wheeler customers, regulatory shifts, export challenges, and rising competition threaten revenue stability, calling for urgent diversification and innovation.

Catalysts

About ASK Automotive- Through its subsidiary, manufactures and sells auto components for the automobiles industry in India.

- The company is ramping up new manufacturing facilities (Bangalore and Karoli) ahead of schedule, driving higher capacity utilization and unlocking operating leverage, which is expected to lift both future revenue and net margins as fixed costs are spread over increased output.

- ASK Automotive is actively investing in product diversification, such as advanced aluminum lightweighting solutions and sunroof cables (in partnership with global players), positioning itself to capitalize on rising vehicle content per unit and the long-term shift towards premiumization and increased feature adoption, supporting top-line growth.

- Despite current headwinds in export markets due to geopolitical issues, management remains confident of achieving a 20% YoY export growth in FY '26, suggesting that ASK is poised to benefit as global OEMs increase localization and as global economic sentiment recovers-potentially boosting revenue and enhancing geographic diversification.

- Secular increases in middle-class incomes and urbanization in India are projected to result in sustainable two-wheeler and passenger vehicle demand growth, which directly supports ASK Automotive's dominant position as a tier-1 supplier and provides a favorable volume tailwind for future revenues.

- The company's focus on process automation, capacity expansion, and cost optimization (including strategic reduction of low-margin wheel assembly business) has resulted in a significant improvement in EBITDA margin (up 183 bps YoY), indicating potential for sustained or further improved net margins and profitability as these initiatives continue to scale.

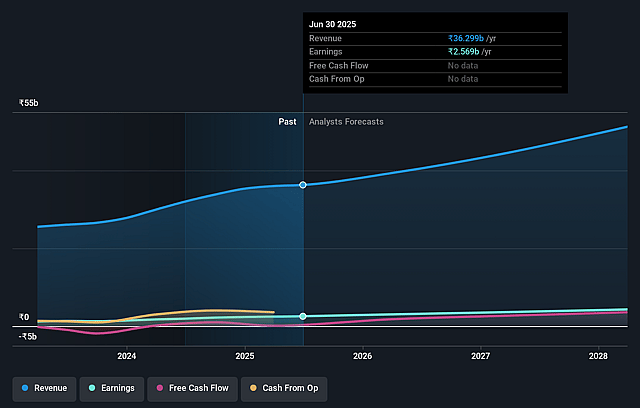

ASK Automotive Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ASK Automotive's revenue will grow by 12.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.1% today to 8.7% in 3 years time.

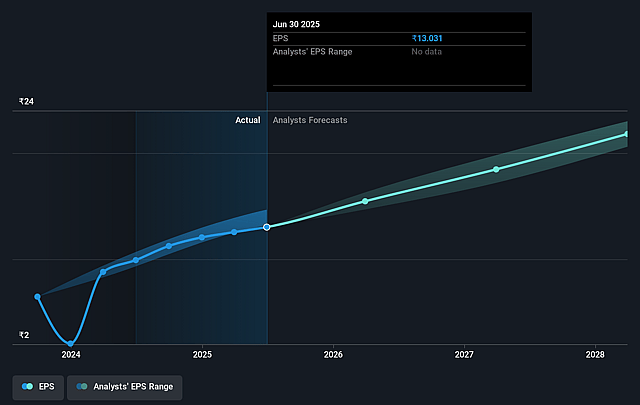

- Analysts expect earnings to reach ₹4.5 billion (and earnings per share of ₹20.96) by about September 2028, up from ₹2.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.9x on those 2028 earnings, down from 39.5x today. This future PE is greater than the current PE for the IN Auto Components industry at 29.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.37%, as per the Simply Wall St company report.

ASK Automotive Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy dependence on the 2-wheeler industry for revenue leaves ASK Automotive exposed to risk from long-term stagnation or decline in two-wheeler sales, particularly as the management expects industry growth to remain muted (3%-4%) rather than the earlier forecast of 6%-8%-threatening future revenue and earnings momentum.

- The company's top three customers (HMSI, TVS, and Hero MotoCorp) contribute over 70% of total sales, resulting in customer concentration risk, which could lead to sudden revenue volatility and margin pressure if any large OEM renegotiates contracts or shifts suppliers.

- Global geopolitical instability, trade tariffs (notably affecting U.S. exports), and stagnant export revenue in the latest quarter point to challenges in sustaining ambitious export growth targets-potentially limiting long-term revenue diversification and foreign currency earnings.

- The move toward regulatory-mandated adoption of ABS across 2-wheelers poses a structural threat to ASK's core brake shoe business, with management warning of up to ₹230 crores in annual revenue headwinds if fully implemented, thus pressuring revenue, margins, and requiring swift innovation or diversification.

- Despite substantial planned capex and plant expansions, increasing competitive intensity in advanced braking components-including from global majors-and ASK's limited new OEM additions in its established markets may compress future margin expansion and slow the realization of projected operating leverage benefits.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹565.0 for ASK Automotive based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹52.1 billion, earnings will come to ₹4.5 billion, and it would be trading on a PE ratio of 36.9x, assuming you use a discount rate of 14.4%.

- Given the current share price of ₹514.8, the analyst price target of ₹565.0 is 8.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.