Key Takeaways

- Strong order growth, product innovation, and operational initiatives are set to accelerate revenue and margin improvements while supporting expansion into global markets.

- A diversified customer and product portfolio ensures revenue stability, leveraging rising vehicle ownership, premiumization trends, and global supply chain shifts.

- Weakness in European operations, export constraints, limited product innovation, rising competition, and reliance on key customers threaten growth, margins, and revenue stability.

Catalysts

About CIE Automotive India- Produces and sells automotive components to original equipment manufacturers and other customers in India, Europe, and internationally.

- The combination of steady increases in new orders (₹6 billion in H1, the highest in company history) and successful ramp-up of delayed order books-especially at key plants like CIE Hosur-positions the company for revenue acceleration in coming quarters, as new products (including both ICE and EV-related components) move to full production.

- Ongoing product innovation and development of higher-complexity offerings (e.g., complex crankshafts and EV-specific gears) enable CIE Automotive India to capture the rising content per vehicle and premiumization trends in the auto industry, which can support both top-line growth and higher EBITDA margins.

- The company's diversified exposure across PVs, CVs, 2W, and tractors-paired with a broad customer base-reduces demand cyclicality and supports revenue stability, directly leveraging the structural trend of increasing vehicle ownership and expansion of India's middle class.

- The castings export order ramping up in early 2026, especially for US customers, signals a growing role for CIE India as a global manufacturing and export hub, positioning it to capitalize on the global supply chain localization initiative and "China+1" shifts; this is likely to drive export revenue and improved capacity utilization in India.

- Focused operational initiatives-such as appointment of dedicated business development leadership, closer customer engagement, ongoing automation, and cost controls-are expected to deliver incremental improvements in net margins and earnings, as margin accretive projects begin contributing and efficiency gains offset pressures in a competitive pricing environment.

CIE Automotive India Future Earnings and Revenue Growth

Assumptions

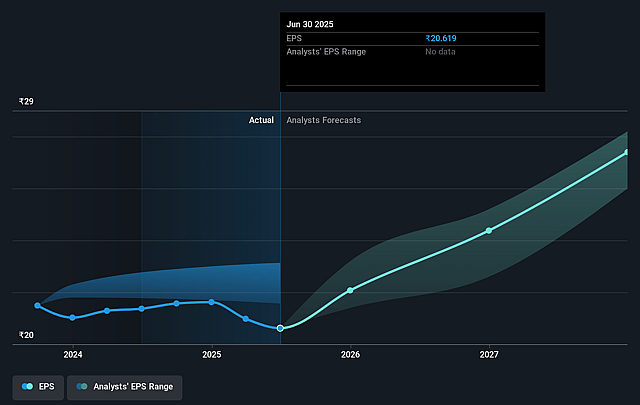

How have these above catalysts been quantified?- Analysts are assuming CIE Automotive India's revenue will grow by 6.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.8% today to 10.0% in 3 years time.

- Analysts expect earnings to reach ₹10.8 billion (and earnings per share of ₹27.39) by about September 2028, up from ₹7.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.9x on those 2028 earnings, up from 19.3x today. This future PE is lower than the current PE for the IN Auto Components industry at 29.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.34%, as per the Simply Wall St company report.

CIE Automotive India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent weakness and lack of visibility in the European business, with ongoing volume declines, high unused capacity (40–50%), and reliance on difficult market recovery, may continue to drag consolidated revenues and negatively impact net margins.

- Export growth from India remains constrained by unresolved global tariff issues and a 'local-to-local' supply strategy, limiting overseas revenue potential and making the company vulnerable to international trade barriers.

- New product development is mostly focused on incremental innovation within existing categories, with limited entry into truly new high-growth or EV-oriented segments, raising the risk of slower future revenue growth and technological obsolescence as OEM needs evolve.

- Increasing competitive pressure, especially in the magnets segment (due to lack of access to rare earths and Chinese competition), could further compress margins and impair earnings in businesses already showing profitability challenges.

- Heavy exposure to a concentrated customer base (such as Bajaj in the aluminum business and major OEMs in core segments) increases vulnerability to single-customer risk, potentially reducing revenue visibility and causing earnings volatility if key accounts are lost or renegotiated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹493.333 for CIE Automotive India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹574.0, and the most bearish reporting a price target of just ₹400.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹107.4 billion, earnings will come to ₹10.8 billion, and it would be trading on a PE ratio of 25.9x, assuming you use a discount rate of 14.3%.

- Given the current share price of ₹399.15, the analyst price target of ₹493.33 is 19.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.