Key Takeaways

- Expansion into consumer electronics and aerospace is driving diversification and future revenue growth.

- Strengthened balance sheet and operational efficiencies enhance financial flexibility and support potential earnings growth.

- Volatile production, rising costs, and geopolitical risks could strain liquidity, operational efficiency, and profitability, impacting revenue and working capital management.

Catalysts

About Samvardhana Motherson International- Engages in the development, manufacture, supply, and sale of components for automotive original equipment manufacturers in India, Germany, the United States, and internationally.

- The company’s large automotive book business of USD 88 billion provides visibility over future revenues, which is expected to be executed over the next 5 to 6 years. This should lead to steady revenue growth.

- Expansion into non-automotive businesses such as consumer electronics and aerospace is gaining traction, with the consumer electronics plant now operational and ramping up production. This diversification is anticipated to contribute to future revenue and earnings growth.

- Improved operating efficiencies and efforts to share costs with customers amid a challenging production environment are expected to enhance net margins in future quarters as the external environment stabilizes.

- The company’s significant deleveraging from 1.5x to 1x net debt to EBITDA ratio, alongside capital raising activities, strengthens the balance sheet, allowing for greater financial flexibility and potential for earnings growth through opportunistic acquisitions.

- The operationalization and ramp-up of 8 of 19 new greenfield projects in the second half of the fiscal year are anticipated to drive revenue growth and improve return on capital employed (ROCE) as new capacity comes online.

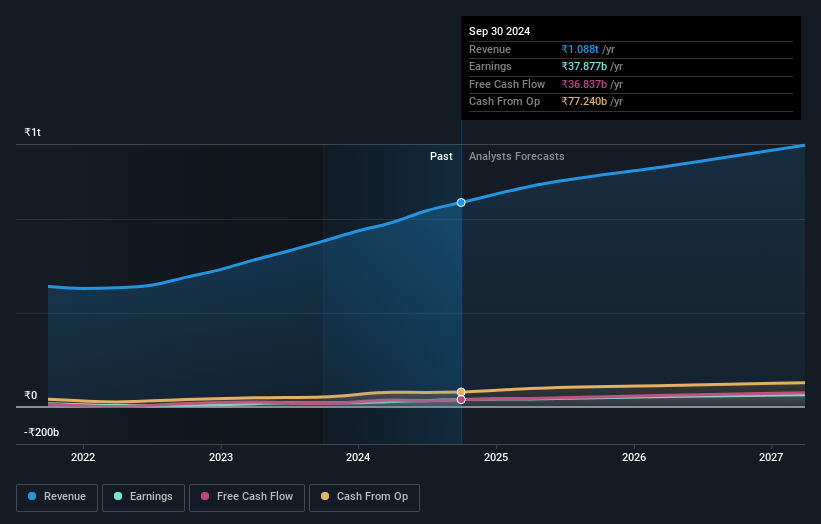

Samvardhana Motherson International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Samvardhana Motherson International's revenue will grow by 10.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.5% today to 4.7% in 3 years time.

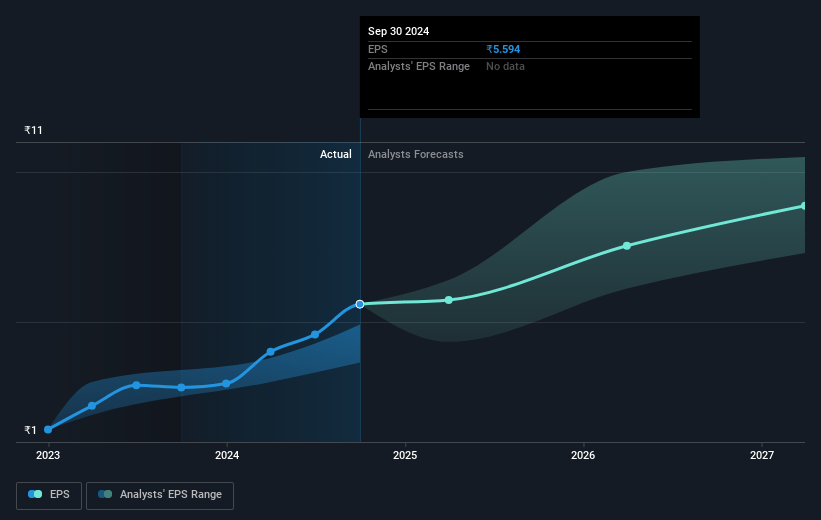

- Analysts expect earnings to reach ₹69.2 billion (and earnings per share of ₹8.82) by about January 2028, up from ₹37.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹51.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.2x on those 2028 earnings, up from 26.2x today. This future PE is greater than the current PE for the IN Auto Components industry at 27.5x.

- Analysts expect the number of shares outstanding to grow by 3.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.24%, as per the Simply Wall St company report.

Samvardhana Motherson International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The volatile production environment and erratic production schedules, including delays in EV launches, could impact the company's revenues and margins if manufacturers face reduced demand for certain automotive platforms.

- Rising energy prices in Europe, coupled with logistics and supply challenges, have increased inventory and working capital requirements, which could strain liquidity and affect net margins.

- Transitionary changes, such as platform evolution and shifts in the consumer mix in regions like China, introduce uncertainties that could impact revenue visibility and production planning.

- Seasonal fluctuations, such as the typical weakness in Q2 due to summer shutdowns in Europe, present a recurring challenge that may affect quarterly earnings.

- Increasing geopolitical risks and the need for conservative inventory strategies could further strain the company's operational efficiency, impacting profitability and working capital management.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹184.29 for Samvardhana Motherson International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹219.0, and the most bearish reporting a price target of just ₹125.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹1455.9 billion, earnings will come to ₹69.2 billion, and it would be trading on a PE ratio of 31.2x, assuming you use a discount rate of 14.2%.

- Given the current share price of ₹141.2, the analyst's price target of ₹184.29 is 23.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives