Narratives are currently in beta

Key Takeaways

- Strategic product mix optimization and investments in automation are expected to stabilize margins and enhance net earnings.

- Expansion in tire recycling and upcoming regulations will likely drive revenue growth and improve future margins.

- Elevated costs and competition in key sectors challenge margins and revenue, with investment in new ventures introducing execution risk and revenue unpredictability.

Catalysts

About GRP- Manufactures and sells reclaimed rubber products for tyre and non-tyre rubber goods in India and internationally.

- GRP Limited is focusing on strategic optimization of its product mix and revising customer pricing to offset rising raw material costs, which is expected to stabilize and return gross margins to normal levels impacting future earnings.

- The company's investment in automation and energy savings has optimized workforce utilization, reduced manpower costs, and improved energy efficiency, which is expected to enhance net margins.

- GRP's announced CapEx plan and receipt of additional financing is set to expand its tire recycling ecosystem, potentially increasing revenue through new product lines such as crumb rubber and continuous pyrolysis.

- Growing interest in recovered carbon black (RCB) from tire and carbon black manufacturers highlights future demand in sustainability, aligning with GRP’s exploration of new opportunities in the tire recycling ecosystem, potentially boosting future revenue.

- Regulation mandating the use of recycled materials from April 2025 in the plastics industry is expected to drive demand for GRP’s repurposed polyolefins business, improving future revenue and overall margins.

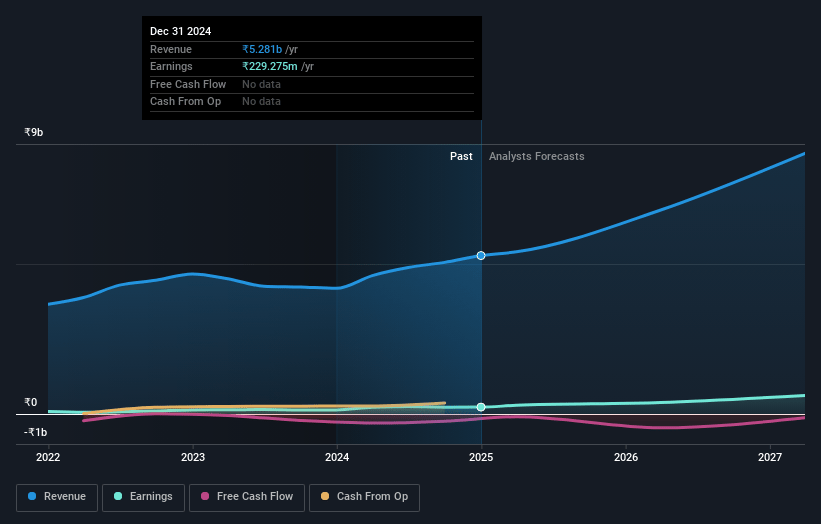

GRP Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GRP's revenue will grow by 23.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.3% today to 8.0% in 3 years time.

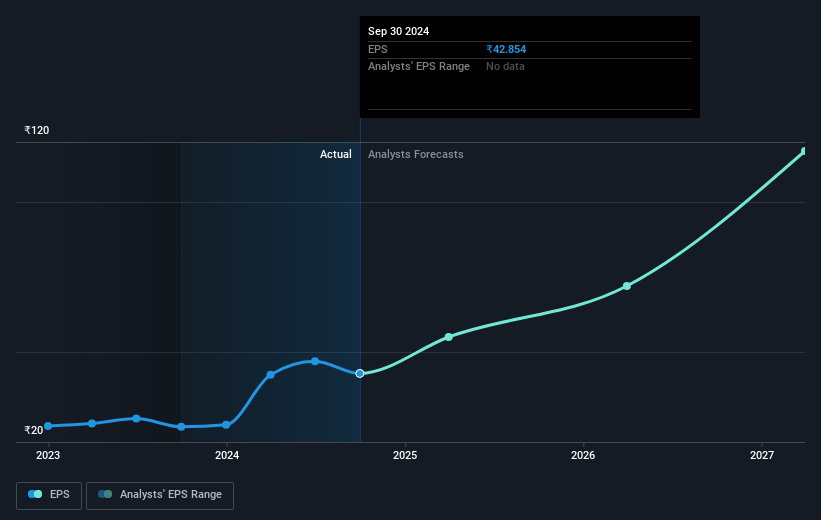

- Analysts expect earnings to reach ₹801.1 million (and earnings per share of ₹151.19) by about January 2028, up from ₹229.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 44.7x on those 2028 earnings, down from 65.6x today. This future PE is greater than the current PE for the IN Auto Components industry at 27.5x.

- Analysts expect the number of shares outstanding to decline by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.68%, as per the Simply Wall St company report.

GRP Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Elevated raw material prices and inability to pass costs on to customers due to fixed pricing contracts have resulted in reduced gross margins, impacting earnings.

- The company's reliance on outsourced materials for their non-reclaim business has increased raw material costs, further affecting overall gross margins and net margins.

- Competition and new product introductions in the recovered carbon black sector could shift market dynamics potentially affecting GRP’s revenue from this business line.

- While GRP is investing in the circularity space, the timeline for commercial operations, approvals, and achieving profitability in new ventures like the pyrolysis and RCB facilities could introduce execution risk, affecting future earnings.

- The EPR credit income is noted to fluctuate based on demand-supply dynamics in the tire industry, influencing revenue unpredictably.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹4874.0 for GRP based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹10.0 billion, earnings will come to ₹801.1 million, and it would be trading on a PE ratio of 44.7x, assuming you use a discount rate of 13.7%.

- Given the current share price of ₹2821.5, the analyst's price target of ₹4874.0 is 42.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives