Narratives are currently in beta

Key Takeaways

- Bosch's strategic shift toward electric vehicles and sustainable transportation can enhance revenue amid global electrification trends.

- Growth in Mobility Aftermarket and investments in R&D and emerging technologies position Bosch for increased profitability and market expansion.

- Geopolitical risks, declining domestic demand, and restructuring costs threaten Bosch's revenue and margins, despite solid aftermarket growth.

Catalysts

About Bosch- Engages in the manufacture and trading of automotive products in India and internationally.

- Bosch's focus on next-generation electric vehicles and sustainable transportation systems, including advancements in vehicle control units and accelerator pedal modules, positions it to capture growth in the electrification of mobility. This can significantly enhance revenue as electric vehicle adoption increases globally.

- Strong growth in Bosch's Mobility Aftermarket business, driven by an uptick in demand for diesel systems, automotive batteries, and lubricants, suggests potential for higher revenue and improved earnings as the segment continues to expand.

- Bosch's strategic investments in R&D, particularly with local collaborations for advanced engine control units and integration with international production networks, can improve product offerings and boost revenue and net margins by increasing operational efficiency.

- Ongoing developments in hydrogen and alternate fuel technologies indicate future opportunities for Bosch to leverage emerging markets and technologies, potentially driving both revenue and net earnings as these sectors mature.

- Bosch’s ongoing assessment and capacity buildup for manufacturing shifts to India amidst global movements could potentially optimize cost structures and improve net margins, thereby increasing overall profitability.

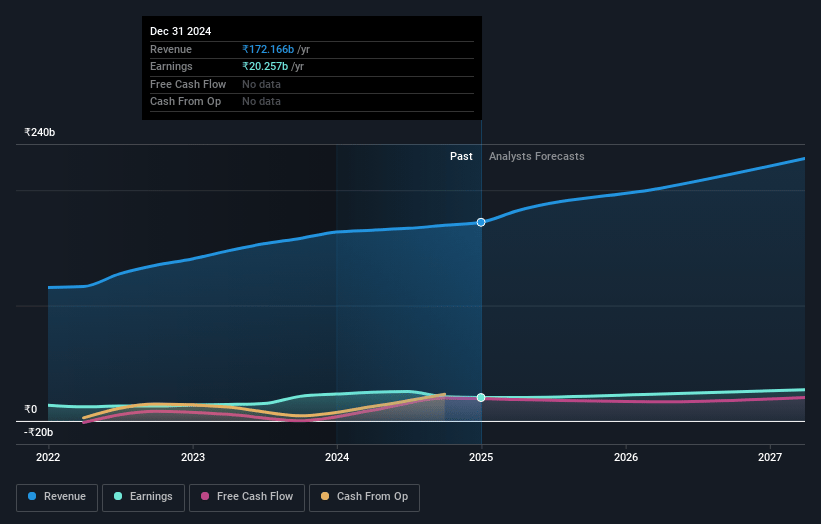

Bosch Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bosch's revenue will grow by 13.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.7% today to 12.5% in 3 years time.

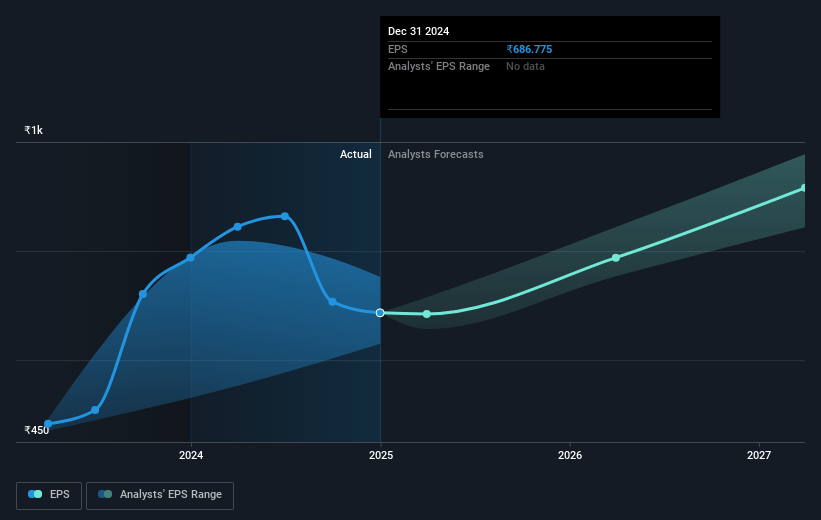

- Analysts expect earnings to reach ₹31.3 billion (and earnings per share of ₹1061.64) by about January 2028, up from ₹20.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 44.6x on those 2028 earnings, up from 41.0x today. This future PE is greater than the current PE for the IN Auto Components industry at 27.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.44%, as per the Simply Wall St company report.

Bosch Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical uncertainties and potential trade conflicts, as well as inflationary pressures, pose risks to global and local demand, which could negatively impact Bosch's revenue and profit margins.

- Domestically, weakening consumption and uncertain business sentiment due to proposed tariffs and China's export pressures could adversely affect Bosch's sales and earnings in India.

- Reduced profitability in the consumer goods segment, primarily due to seasonal effects and inventory adjustments, might continue affecting Bosch's overall net margins if not adequately addressed.

- Despite a robust aftermarket growth, the contribution to overall profitability is limited due to a decline in other divisions like Power Solutions, highlighting potential earnings volatility.

- Employee and restructuring costs, combined with a reliance on specific segments to drive growth, could pressure Bosch's net earnings and margins if these challenges are not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹32955.2 for Bosch based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹38348.0, and the most bearish reporting a price target of just ₹23600.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹250.2 billion, earnings will come to ₹31.3 billion, and it would be trading on a PE ratio of 44.6x, assuming you use a discount rate of 13.4%.

- Given the current share price of ₹28140.2, the analyst's price target of ₹32955.2 is 14.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives