Narratives are currently in beta

Key Takeaways

- Investments in EV and premium segments alongside strategic product launches are expected to drive revenue growth and boost market share.

- Expansion of premium models and store platforms aims to capture higher-value sales, improve customer experience, and enhance margins.

- Economic and financing challenges, coupled with competition and sustainability investment, could hinder Hero MotoCorp's revenue growth and profitability.

Catalysts

About Hero MotoCorp- Primarily engages in the manufacture and sale of motorized two wheelers in India, Asia, Central and Latin America, Africa, and the Middle East.

- Significant investments planned in brand building and new product launches, particularly in the EV and premium segments, are expected to drive future revenue growth.

- Continued expansion in the EV scooter market, with plans to cover multiple price segments, is expected to increase market share and improve earnings as cost efficiencies are realized.

- Upcoming product launches in the ICE scooter and premium motorcycle segments are targeted towards filling portfolio gaps and are likely to support revenue and margin growth.

- Efforts to bolster the premium motorcycle and scooter segments with models like Xpulse 210 and Xtreme 250R are aimed at capturing higher-value sales, potentially improving net margins.

- Expansion of Premia stores and Hero 2.0 platforms is expected to enhance customer experience and drive higher volumes in the premium segment, positively impacting revenue and margins.

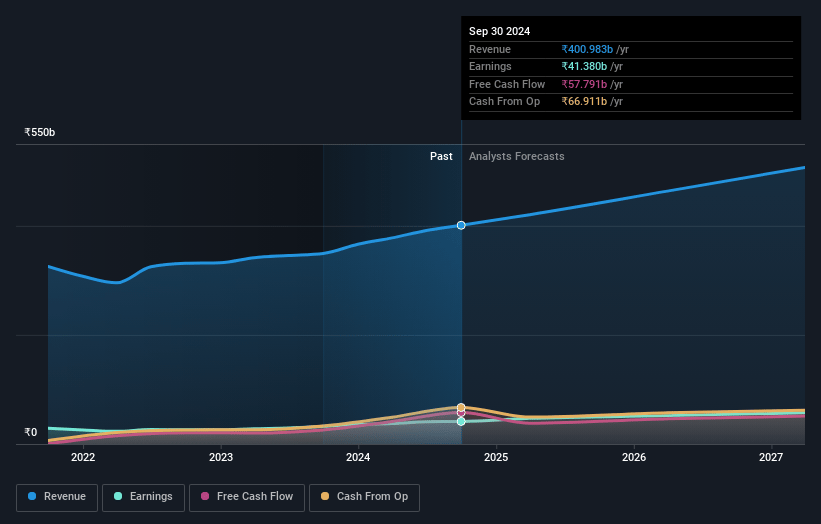

Hero MotoCorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hero MotoCorp's revenue will grow by 9.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.3% today to 12.3% in 3 years time.

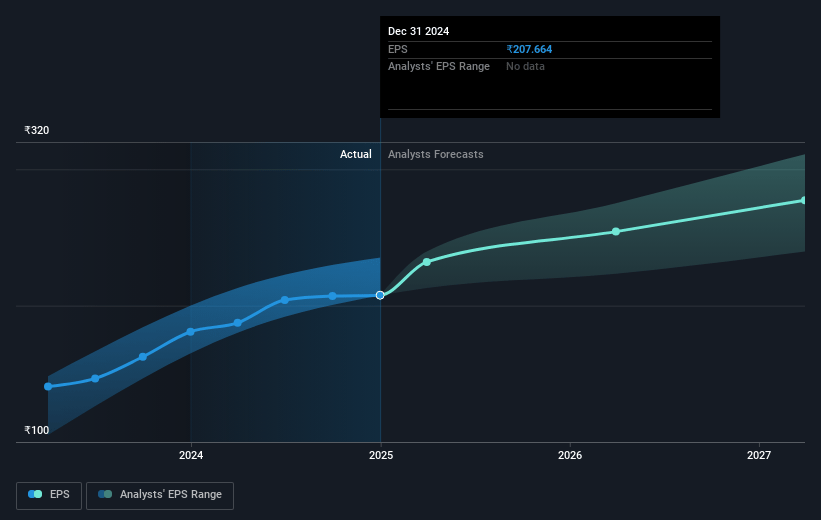

- Analysts expect earnings to reach ₹65.2 billion (and earnings per share of ₹324.53) by about January 2028, up from ₹41.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹50.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.4x on those 2028 earnings, up from 19.7x today. This future PE is lower than the current PE for the IN Auto industry at 29.5x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.35%, as per the Simply Wall St company report.

Hero MotoCorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global economic uncertainties, such as geopolitical issues in key markets like Bangladesh, Turkey, and Nigeria, could pose challenges to export growth, potentially impacting Hero MotoCorp's revenue diversification efforts.

- The increased credit costs and collection issues faced by Hero FinCorp, partly due to higher delinquencies, could impact financing availability and affordability for customers, thereby potentially affecting sales volumes and revenue.

- While Hero MotoCorp reports strong festive season sales, reliance on peak seasonality and potential post-festive demand volatility could lead to uneven revenue distribution throughout the year, impacting consistent earnings growth.

- Despite aggressive investments in EV and premium segments, high competition and changing consumer preferences could delay achieving the desired market share and affect planned revenue growth targets.

- The increasing focus on sustainability and transitions to EVs requires significant capital investment; any delay in realizing PLI (Production Linked Incentives) benefits or higher than expected costs could impact net margins and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹5163.92 for Hero MotoCorp based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹6664.0, and the most bearish reporting a price target of just ₹3430.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹532.6 billion, earnings will come to ₹65.2 billion, and it would be trading on a PE ratio of 26.4x, assuming you use a discount rate of 18.4%.

- Given the current share price of ₹4074.4, the analyst's price target of ₹5163.92 is 21.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives